Bull Of The Day: Devon Energy

Photo by Nicholas Cappello on Unsplash

Devon Energy (DVN) is cashing in on the rise in oil and natural gas. This Zacks Rank #1 (Strong Buy) is expected to grow earnings by 85% in 2022 as it pays out record dividends.

Devon Energy is an oil and gas producer in the United States with a focus on the Delaware Basin. It has a market cap of $41 billion.

Record Dividend Payout in Q4

On Feb 15, Devon announced that its board declared a fixed-plus-variable dividend of $1.00 per share based on the fourth-quarter performance which was a record high in the company's 50-year history.

It gives the stock a current yield of 6.5%.

The board also approved an increase in the fixed dividend, raising it 45%, or $0.05. After the fixed dividend is funded, up to 50% of the excess free cash flow each quarter is distributed to shareholders through the variable dividend.

The fourth quarter dividend payout of $1.00 will be paid on Mar 31, 2022 to shareholders of record at the close of business as of Mar 14, 2022. Therefore, since the deadline has passed, investors interested in Devon's big dividend payouts, will have to wait until the first quarter dividend to cash in.

Devon is also doing a share buyback program. In the fourth quarter, it repurchased 14 million shares at the cost of $589 million. The board expanded the share-repurchase authorization by 60% to $1.6 billion, or equivalent to 5% of Devon's market capitalization.

Another Beat in Q4

On Feb 15, Devon reported its fourth quarter results and beat the Zacks Consensus Estimate, reporting $1.39 versus the Zacks Consensus of $1.21.

It was the fourth earnings beat in a row.

Operating cash flow in the fourth quarter was $1.6 billion, a 173% increase year-over-year when the WPX merger closed. It resulted in $1.1 billion in free cash flow in the quarter.

For the year, Devon generated $2.9 billion of free cash flow, the highest in the company's 50-year history.

While much of the free cash flow went to shareholders, Devon also retired $1.2 billion of outstanding debt. As of Dec 31, 2021, the company had $2.3 billion of cash on hand and intends to retire low-premium debt of up to $1 billion in 2022 and 2023.

Analysts Raise Full Year Earnings Estimates

Devon reaffirmed its previously announced production plan in the range of 570,000 to 600,000 Boe per day for 2022, with an upstream capital investment of $1.9 billion to $2.2 billion.

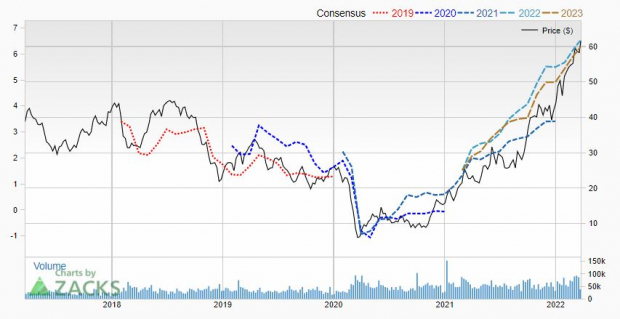

But the analysts are bullish on what will happen with earnings in 2022, especially with crude still moving higher.

5 estimates were revised higher in the last 30 days pushing up the Zacks Consensus Estimate to $6.52 from $5.90 over the last 30 days.

(Click on image to enlarge)

Image Source: Zacks Investment Research

This is 2022 earnings growth of 84.7% as the company only made $3.53 last year.

Shares Soar But Are Still Cheap

Energy was the best performing sector in 2021 and has started 2022 equally as hot. Devon is up 40% year-to-date.

But over the last 5 years, it still lags the S&P 500 with shares up just 44.7% compared to the SPY up 91.5%.

(Click on image to enlarge)

Image Source: Zacks Investment Research

Shares are still cheap, with a forward P/E of just 9.5.

It also has a PEG of just 0.2. A PEG under 1.0 indicates that a company is both a value and has growth. That's a rare combination.

Devon will report first quarter 2022 earnings on May 2, 2022 after the market closes. It's conference call will be the next morning, on May 3, 2022.

For investors looking for a big dividend payout in the hottest sector on Wall Street, Devon Energy is one to keep on the short list.

Disclaimer: Neither Zacks Investment Research, Inc. nor its Information Providers can guarantee the accuracy, completeness, timeliness, or correct sequencing of any of the Information on the Web ...

more