Bull Of The Day: DaVita

DaVita (DVA) is a leading provider of dialysis services in the US to patients suffering from chronic kidney failure, and an essential contributor to the healthcare system. DaVita also enjoys a near duopoly over the kidney care market, which it shares with Fresenius with each controlling ~36% and ~38% respectively.

Most anybody who works in healthcare is familiar with the company and its services which include 2,707 outpatient centers in 46 states, as well as 351 centers in 11 countries worldwide. It also performs treatments in hospitals and at home and has provided care to some 250,000 people.

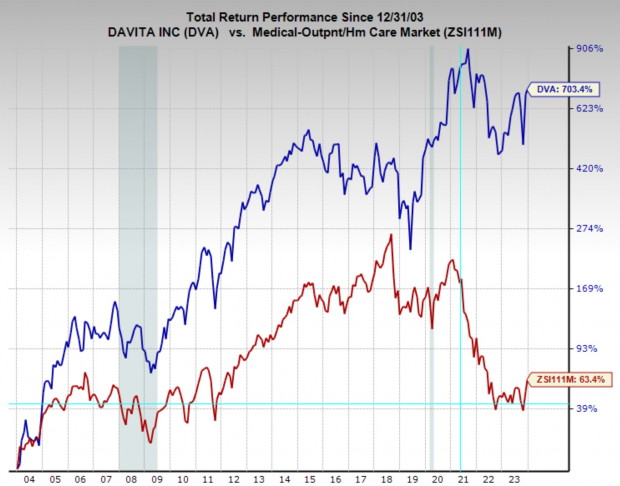

DaVita has been a steady performing stock, with compound annual returns of 10.8%, which is well above the industry average and broad market. The stock is also a favorite of legendary investor Warren Buffett and owns nearly 40% of outstanding shares.

Furthermore, DaVita has a Zacks Rank #1 (Strong Buy) rating, reflecting upward trending earnings revisions. All these factors together, among several others, make DVA stock an appealing investment in both the near and long-term.

(Click on image to enlarge)

Image Source: Zacks Investment Research

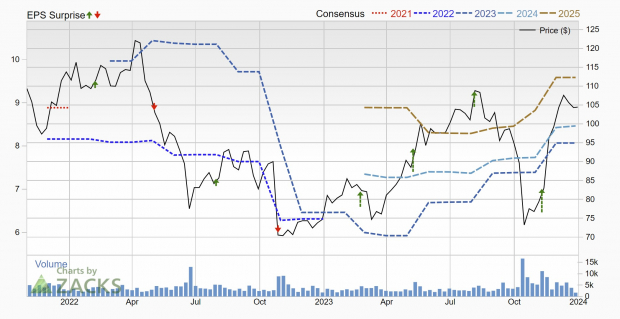

Earnings Estimates Climbing Higher

Analysts have been steadily raising earnings estimates over the last six months, with the last two months experiencing considerable upgrades. Even after the improved earnings estimates, Last quarter DVA EPS came in 48.4% above analysts' expectations.

FY23 earnings estimates have increased by 9.2% and are forecast to grow 22.3% YoY to $8.07 per share. FY24 earnings have been revised higher by 9.4% and are expected to climb 5% YoY to $8.46 per share.

(Click on image to enlarge)

Image Source: Zacks Investment Research

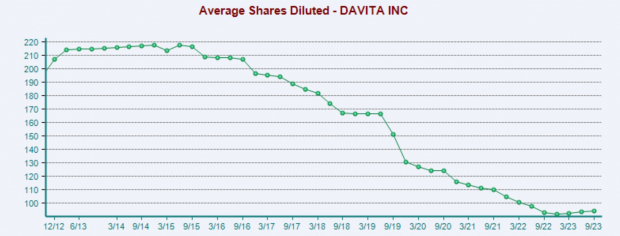

Massive Share Repurchase Programs

DaVita is also a chronic buyer of its owner shares, which has dramatically reduced the shares outstanding. Over the last ten years, the total share count has been reduced by an impressive 57%, showing a strong commitment to returning cash to shareholders.

(Click on image to enlarge)

Image Source: Zacks Investment Research

Discount Valuation

DaVita is also trading at a historically discounted valuation, with its earnings multiple well below the industry average and the broad market average. Today, it is trading at a one year forward earnings multiple of 13x, which is below its 20-year median of 15.9x.

Furthermore, with EPS forecast to grow at an annual pace of 17.3%, DVA has a PEG Ratio of just 0.75x, indicating that the company is cheap based on its growth.

(Click on image to enlarge)

Image Source: Zacks Investment Research

Bottom Line

With a historically low relative valuation limiting the downside, and high expected earnings growth improving upside potential, DaVita makes for a fantastic investment opportunity.

The added catalyst of Warren Buffett possibly buying out the company, along with its near monopolistic control over the dialysis industry demonstrates just how appealing and deeply entrenched the company is in the healthcare infrastructure. This is exactly what a business moat looks like and ensures long-term staying power for DaVita.

As icing on the cake, DaVita also has an “A” across the Value, Growth, and VGM style scores, and sits in the top 17% (43 out of 251) of the Zacks industry rank. Investors looking to add exposure to top-ranked healthcare stocks should definitely consider investing in DaVita.

More By This Author:

Bear Of The Day: Masimo2 Highly Ranked Stocks To Buy For Growth & Value At Year's End

Here Are 2023's Top-Performing Stocks From The S&P 500

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any specific ...

more