Bull Of The Day: Davita - Friday, September 6

Known to be the most volatile month for stocks, September is when many investors rebalance their portfolios to include less risky assets such as equities that provide exposure to essential healthcare services.

One such candidate is DaVita (DVA) , the leading provider of kidney care services in the United States. With its growth prospects cemented on critical dialysis and lab-related services, DaVita’s stock covets a Zacks Rank #1 (Strong Buy) and lands the Bull of the Day.

DaVita Has Remnants of a Growth Stock

As a medical stock that can potentially provide defensive safety DaVita also has the remnants of a growth stock, on top of having the value and essential services investors seek amid heightened market volatility.

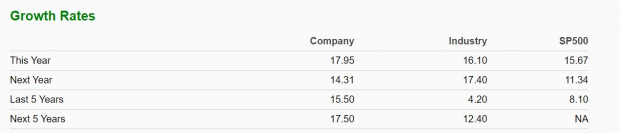

Over the last five years, DaVita’s EPS growth rate of 15.5% has easily trumped its industry average of 4.2% and the S&P 500’s 8.1% average. The impressive trend looks set to continue with DaVita’s bottom line expected to expand roughly 18% in fiscal 2024 with FY25 EPS projected to increase another 14% to $11.42 per share.

(Click on image to enlarge)

Image Source: Zacks Investment Research

Earnings Estimate Revisions

Suggesting more short-term upside in DaVita’s stock is that earnings estimate revisions for FY24 and FY25 have remained noticeably higher over the last 30 days. Correlating with such, it's noteworthy that DaVita’s Medical-Outpatient and Home Healthcare Industry is currently in the top 19% of over 250 Zacks industries.

(Click on image to enlarge)

Image Source: Zacks Investment Research

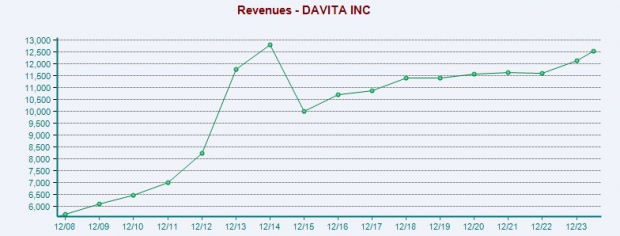

Top Line Expansion

DaVita’s top line has increased by a modest 6% in the last five years with sales at $12.14 billion in 2023 compared to $11.38 billion in 2019. Still, DaVita’s sales have been on a steady ascension over the last two decades and are forecasted to increase more than 3% in FY24 and FY25 with projections edging north of $13 billion.

(Click on image to enlarge)

Image Source: Zacks Investment Research

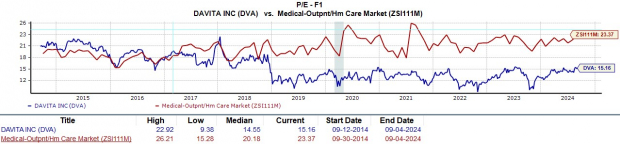

Defensive Safety & Value

Seeing as DaVita’s growth is also crucial to societal health, its valuation is very intriguing. Trading just under $150, DVA is at a very reasonable 15.6X forward earnings multiple. This is a pleasant discount to its industry average of 23.3X forward earnings and the S&P 500’s 23.2X.

(Click on image to enlarge)

Image Source: Zacks Investment Research

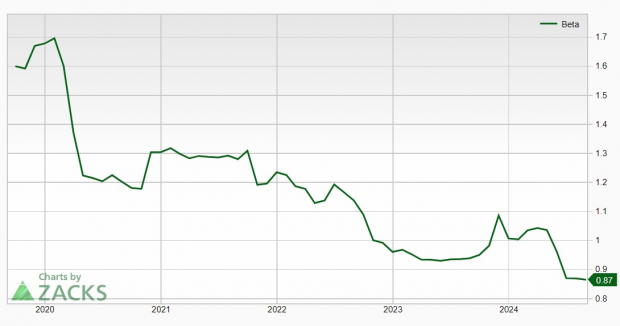

Low Beta

With Beta being a measure of risk commonly used to compare the volatility of stocks among other securities, it’s important to point out that DaVita’s calculated beta value is at the preferred level of less than 1.0.

(Click on image to enlarge)

Image Source: Zacks Investment Research

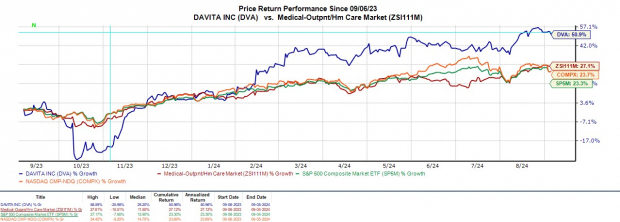

While low beta stocks may tend to have a tight nit 52-week range, DaVita’s expansion has catapulted its price performance despite being a less volatile investment in regards to downside risk.

Hovering near its 52-week high, DVA has soared 108% from a low of $71 a share over the last year and is sitting on +40% gains year to date.

(Click on image to enlarge)

Image Source: Zacks Investment Research

Bottom Line

DaVita's appealing growth prospects and attractive valuation suggests that now is an ideal time to invest considering its crucial healtchare services. Furthermore, DVA may be a viable defensive hedge regarding the unfavorable seasonality of the “September Effect” on the broader market.

More By This Author:

Nvidia Approves $50 Billion Stock Buyback: Time To Buy?

Top Medical Stocks To Hedge Against The September Effect

2 Small Caps Recently Upgraded To Outperform - Sunday, Sept. 1

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any specific ...

more