Bull Of The Day: CF Industries Holdings, Inc.

CF Industries Holdings (CF), a Zacks Rank #1 (Strong Buy) stock, has benefitted immensely in the current inflationary environment from higher prices for agricultural inputs. The stock hit an all-time high in April before retreating slightly as the market continues its move lower. CF sports the highest-possible rating of ‘A’ in our Growth Style Score category, indicating high-quality growth prospects and sound financial strength. CF Industries is vastly outperforming the market this year and looks to build on the recent momentum.

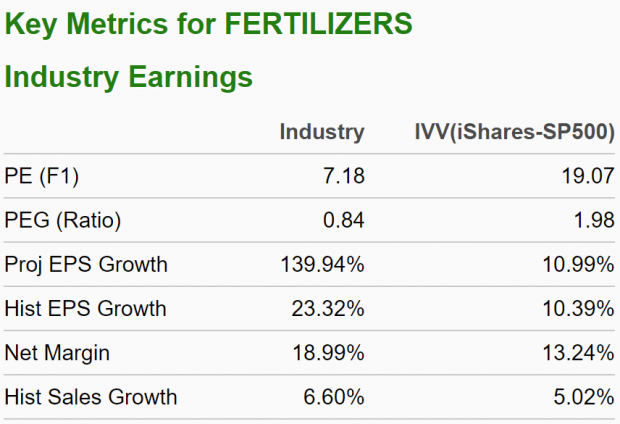

CF is a component of the Zacks Fertilizers industry, which ranks in the top 2% out of about 250 industry groups. Because it is ranked in the top half of all Zacks Ranked Industries, we expect this group to outperform over the next 3 to 6 months. The Fertilizers industry has risen 44.31% year-to-date while the market has been in correction mode.

Quantitative research studies have shown that approximately half of a stock’s future price appreciation can be attributed to its industry grouping. By targeting stocks located within leading industries, we can dramatically improve our odds of success. Also note the favorable characteristics for this industry below:

(Click on image to enlarge)

Image Source: Zacks Investment Research

Company Description

CF Industries is a global leader in transforming natural gas into nitrogen products. The company manufactures and sells hydrogen and nitrogen products for fertilizer, energy, emissions abatement, and other industrial activities. CF Industries is one of the largest manufacturers and distributors of nitrogen fertilizer in the world. Its principal products include anhydrous ammonia, granular urea, and ammonium nitrate. CF Industries was founded in 1946 and is headquartered in Deerfield, IL.

Recent Earnings and Future Estimates

CF has either met or exceeded earnings estimates in four out of the past six quarters. The fertilizer manufacturer most recently reported Q1 EPS earlier this week of $4.21, matching the consensus estimate. The figure compares favorably to the $0.70/share that the company reported a year ago.

CF posted Q1 revenues of $2.87 billion, surpassing the consensus estimate by 10.44%. Revenues nearly tripled from the $1.05 billion during the same quarter in the prior year.

The company has been on the receiving end of several positive earnings estimate revisions as of late. For the current quarter, analysts have revised EPS estimates upward by 19.47% in the past 60 days. The Q2 Zacks Consensus Estimate now stands at $5.46, reflecting a 378.95% growth rate relative to Q2 of last year.

It’s a similar story when we zoom out and view full-year figures. Analysts have increased their 2022 EPS estimates by 22.72% in the past 60 days. The Zacks Consensus Estimate is now $16.58, translating to potential growth of 291.04% versus last year. Sales are anticipated to rise by 63.65% to $10.7 billion. Clearly, the sales and earnings trends point to continued growth for CF.

Charting the Course

CF Industries has advanced over 400% from the March 2020 bottom and is showing signs of relative strength. The stock hit an all-time high last month and is up 42% this year while the S&P 500 is down over 13%. New highs are a sign of strength and indicate that institutional buying remains solid.

This is the kind of stock we want to include in our portfolio – one with both strong fundamentals as well as technicals. The stock has trended very well over the last 12 months, and we can see below that the 50-day moving average (blue line) served as support throughout the majority of the last year.

(Click on image to enlarge)

Image Source: StockCharts

The moving average lines are all sloping up and the stock continues to make a series of new 52-week (and all-time) highs. While CF has pulled back slightly in recent weeks along with the market, the stock is looking to find support at a familiar trendline and new highs may be just around the corner. Cautious investors may feel hesitant about investing in a stock that has come this far, but the fact is this elite company is still outperforming.

Valuation and Near-Term Outlook

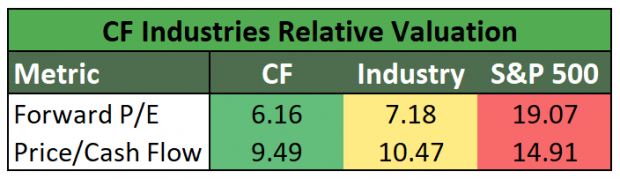

Despite the impressive price move, CF is relatively undervalued, irrespective of the metric used:

(Click on image to enlarge)

Image Source: Zacks Investment Research

The company is well-positioned to profit from higher global demand in major markets for nitrogen fertilizers. Rising crop commodity prices also contributed to larger demand. High levels of corn-planted acres as well as more industrial and economic activity bodes well for CF Industries, particularly in emerging markets such as Brazil and India.

CF paid a dividend totaling $260 million last year and completed $1 billion in share repurchases. The current dividend is $1.20, translating to a yield of 1.18%. In November of last year, management approved a new $1.5 billion buyback program.

Bottom Line

Recent positive earnings estimate revisions should serve to create a ‘floor’ for any sudden or unexpected downside moves. The Zacks Rank #1 (Strong Buy) stock is a compelling investment with powerful price momentum.

A strong technical trend along with relative undervaluation certainly justify adding shares to the mix. Solid institutional buying and a high-performing industry group should continue to provide a tailwind for the stock price. If you’re looking for a way to diversify your portfolio, make sure to put CF on your shortlist.

Disclaimer: Neither Zacks Investment Research, Inc. nor its Information Providers can guarantee the accuracy, completeness, timeliness, or correct sequencing of any of the Information on the Web ...

more