Bull Of The Day: Cboe Global Markets

CBOE Global Markets (CBOE), a Zacks Rank #1 (Strong Buy), is one of the largest stock exchange operators by volume in the United States. The company boasts a compelling inorganic growth story given its prudent string of acquisitions. CBOE shares are widely outperforming the market this year with the backing of a leading industry group. The stock is hitting all-time highs and displaying relative strength as buying pressure accumulates in this market leader.

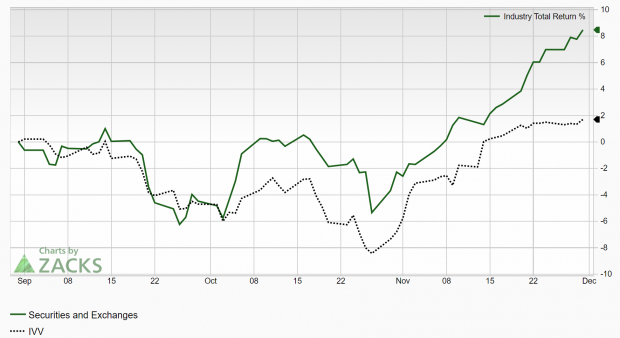

The market operator is part of the Zacks Securities and Exchanges industry group, which currently ranks in the top 25% out of more than 250 Zacks Ranked Industries. Because it is ranked in the top half of all Zacks Ranked Industries, we expect this group to outperform the market over the next 3 to 6 months. This industry really picked up momentum over the past 3 months:

(Click on image to enlarge)

Image Source: Zacks Investment Research

Historical research studies suggest that approximately half of a stock’s price appreciation is due to its industry grouping. In fact, the top 50% of Zacks Ranked Industries outperforms the bottom 50% by a factor of more than 2 to 1. It’s no secret that investing in stocks that are part of leading industry groups can give us a leg up relative to the market. By focusing on leading stocks within the top 50% of Zacks Ranked Industries, we can dramatically improve our stock-picking success.

Company Description

CBOE Global Markets operates primarily as a global options exchange. The company offers cutting-edge trading and investment solutions and operates through five segments: Options, North American Equities, European Equities, Futures, and Global FX. CBOE also provides exchange-traded products (ETP) transaction and listing services.

In addition, the company offers CBOE Clear Digital, a regulated clearinghouse. CBOE Global Markets has strategic relationships with well-known industry players such as S&P Dow Jones Indices, IHS Markit Ltd., and MSCI Inc. CBOE was founded in 1973 and is based in Chicago, IL.

Strategic acquisitions are improving CBOE’s competitive edge by diversifying its portfolio, generating expense synergies, and expanding into new geographies. The purchase of BATS Global extended and diversified its product portfolio with the addition of U.S. and European cash equities. The company’s acquisition of Trade Alert enabled it to provide real-time data, market information and alerts. The buyout of MATCHNow also helped CBOE venture into Canada; since then, the company closed the investment in Aequitas Innovations (rebranded to CBOE Canada) in an effort to strengthen its foothold in a key capital market.

Earnings Trends and Future Estimates

CBOE has built up an impressive earnings history, surpassing earnings estimates in each of the last four quarters. Last month, the company reported third-quarter earnings of $2.06/share, a 10.75% surprise over the $1.86/share consensus estimate. Earnings grew 18.4% year-over-year; CBOE has established a healthy track record of rising earnings and sales as we can see below.

(Click on image to enlarge)

Image Source: Zacks Investment Research

The established market exchange has delivered a trailing four-quarter average earnings surprise of 4.07%. Consistently beating earnings estimates is a recipe for success.

Analysts covering CBOE are in agreement and have been increasing their earnings estimates across the board. For the current quarter, analysts have bumped up earnings estimates by 6.08% in the past 60 days. The Q4 Zacks Consensus EPS Estimate now stands at $1.92/share, reflecting potential growth of 6.7% relative to the prior year. Revenues are projected to climb 7.88% to $493.1 million.

(Click on image to enlarge)

Image Source: Zacks Investment Research

Let’s Get Technical

CBOE shares have advanced more than 45% this year. This is the kind of stock we want to include in our portfolio – one that is trending well and receiving positive earnings estimate revisions.

(Click on image to enlarge)

Image Source: StockCharts

Notice how both the 50-day (blue line) and 200-day (red line) moving averages are sloping up. The stock has been making a series of higher highs. With both strong fundamentals and technicals, CBOE is poised to continue its outperformance.

Empirical research shows a strong correlation between near-term stock movements and trends in earnings estimate revisions. As we know, CBOE Global Markets has recently witnessed positive revisions. As long as this trend remains intact (and CBOE continues to deliver earnings beats), the stock will likely continue its bullish run this year.

Bottom Line

As trading volumes continue to increase, the future looks bright for this highly-ranked, leading stock. CBOE has shown an ability to adapt to the ever-changing technological landscape, which puts the company in a strong position moving forward.

Backed by a leading industry group and impressive history of earnings beats, it’s not difficult to see why this company is a compelling investment. Robust fundamentals combined with an appealing technical trend certainly justify adding shares to the mix.

More By This Author:

Bear Of The Day: Issuer Direct10 Timeless Wall Street Lessons

5 Stocks To Buy As Inflation Continues To Cool And Q3 GDP Grows

Disclaimer: Neither Zacks Investment Research, Inc. nor its Information Providers can guarantee the accuracy, completeness, timeliness, or correct sequencing of any of the Information on the Web ...

more