Bull Of The Day: Baidu

Image Source: Pixabay

Zacks Rank #1 stock (Strong Buy) Baidu (BIDU - Free Report) is a Chinese-language internet search provider based in Beijing. Baidu is the largest search provider in China. Like its American counterpart, Alphabet (GOOGL - Free Report), Baidu offers a plethora of services beyond traditional search, including maps, online communities, an encyclopedia, and a cloud-based storage service.

Breaking into Artificial Intelligence

Open AI’s artificial intelligence chatbot called ChatGPT launched in 2022. Though artificial intelligence has been around for years, ChatGPT is the first AI chatbot to go viral. The service reached 100 million daily active users just two months after launch and already has a valuation of around $30 billion and investments from notable tech juggernauts such as Microsoft (MSFT).

Now, Baidu is looking to follow suit and drive growth through a chatbot dubbed “Ernie Bot,” which the company announced last month. With the announcement of “Ernie Bot”, Baidu is the front runner in the Chinese race to make a ChatGpt competitor and is positioning itself well to do so. In Baidu’s last earnings call, management underscored the importance of AI for BIDU by saying:

“2022 was a challenging year, but we used this period to prepare the company for better times. In 2023, we believe we have a clear path to reaccelerate our revenue growth, and we are now well positioned to make use of the opportunities that China’s economic recovery offers us,” said Robin Li, Co-founder and CEO of Baidu. “With our long-term investments in AI, we are poised to capitalize on the imminent inflection point in AI, unlocking exciting new opportunities across our entire business portfolio - from mobile ecosystem to AI Cloud, autonomous driving, smart devices, and beyond.”

Analysts Have High Expectations

With Baidu’s “Ernie Bot” set to launch soon, analysts are warming up to the stock. Zacks Consensus Analyst Estimates suggest that earnings will reaccelerate by 46% year-over-year for the current quarter. On an annual basis, analysts expect healthy growth of 35% year-over-year.

Image Source: Zacks Investment Research

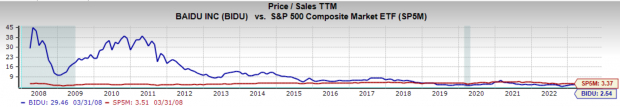

Valuation

From a price-to-sales perspective, Baidu’s valuation is nearly the lowest it has been since its inception.

(Click on image to enlarge)

Image Source: Zacks Investment Research

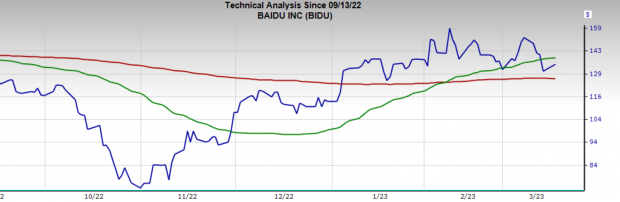

Technical View

BIDU shares have performed well over the past six months. In January, shares leaped back over the 200-day moving average for the first time in months. The 50-day moving average also recently crossed back above the 200-day moving average – signaling a bullish “Golden Cross”. Shares are now retesting the 200-day.

(Click on image to enlarge)

Image Source: Zacks Investment Research

Takeaway

Artificial intelligence is already driving significant changes across multiple industries and is expected to play an increasingly important role in shaping the future. Shares of Baidu should benefit handsomely from the launch of their chatbot, a recovering Chinese economy, and a reacceleration of revenue growth. Furthermore, with its historically low valuation, BIDU will likely attract investors who follow a “GARP” (growth at a reasonable price). Expect shares to move higher over the next 6-12 months.

More By This Author:

Bear Of The Day: Park NationalAirline Stock Roundup: Gol Linhas & Azul's Q4 Loss, Delta's Deal With Pilots & More

3 Stocks To Buy For Consistent Dividend Growth

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any specific ...

more