Bull Of The Day - Applovin Corporation

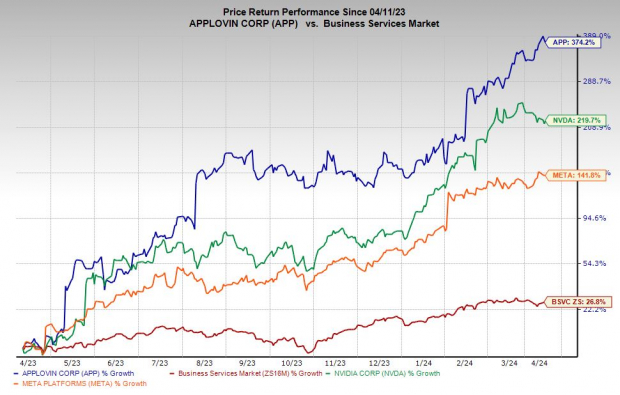

AppLovin Corporation (APP) is an app-monetization company that has skyrocketed 375% in the last 12 months to blow away Tech’s 44%.

AppLovin crushed Nvidia, Meta, and many others during that stretch, yet it trades 33% below its all-time highs and its valuation levels (which are in line with the tech sector) are improving as its earnings outlook soars.

APP’s Bull Case

Wall Street is falling in love with AppLovin because its new AI-enhanced features are boosting ROI for APP’s clients, leading to booming sales and earnings for AppLovin.

AppLovin designs tools to help app developers improve marketing, revenue generation, and beyond to boost profitable expansion. APP’s products are designed to help companies and app developers acquire and keep their ideal users, increase value across a customer’s lifecycle, measure their marketing and reach, and much more.

(Click on image to enlarge)

Image Source: Zacks Investment Research

AppLovin’s new machine learning and AI engine AXON 2.0 is generating impressive results for its clients in mobile gaming and beyond. Plus, digital advertising spending has rebounded after its 2022 slowdown.

Growth, Outlook, and EPS Revisions

AppLovin posted 17% revenue growth in 2023. This came against 1% sales growth in 2022, following its whopping 93% expansion in 2021.

AppLovin crushed our Q4 FY23 EPS estimate by 40% and provided upbeat guidance. The firm cited its “MAX bidding enhancements and the market shift to real-time bidding,” as well as the rebounding mobile app advertising market as key reasons for its bullish outlook.

(Click on image to enlarge)

Image Source: Zacks Investment Research

AppLovin is projected to post 23% sales growth in 2024 to surge from $3.28 billion to $4.05 billion and then expand by another 10% next year to reach $4.45 billion—a massive jump from 2020’s $1.45 billion.

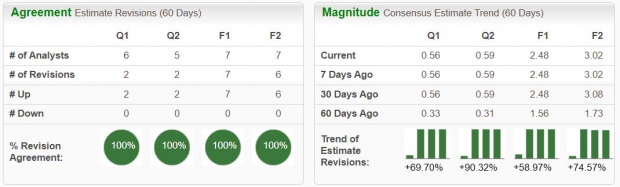

Zacks estimates call for AppLovin’s adjusted earnings to soar 153% from $0.98 a share last year to $2.48 a share in 2024 and then climb 22% higher next year to $3.02 a share.

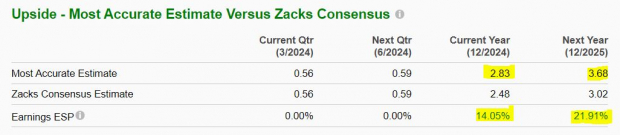

APP’s consensus Zacks earnings estimates have soared by roughly 59% for FY24 and 75% for FY25 since its fourth quarter release. AppLovin’s most accurate/recent EPS estimate for 2024 came in 14% above the greatly improved consensus, with 2025’s figure 22% higher.

APP’s upgraded bottom-line outlook helps it earn a Zacks Rank #1 (Strong Buy) right now.

(Click on image to enlarge)

Image Source: Zacks Investment Research

Other Fundamentals

AppLovin went public in April 2021, not too long before tech stocks started to cool and companies such as Meta and others began to suffer from a pullback in digital ad spending.

AppLovin shares have skyrocketed roughly 375% during the past 12 months to blow away Nvidia’s (NVDA) 220% and Meta’s (META) 140%. This run includes a 90% YTD surge, topping Nvidia’s 75% and Meta’s 45%.

APP stock trades 33% below its all-time highs from November 2021.

(Click on image to enlarge)

Image Source: Zacks Investment Research

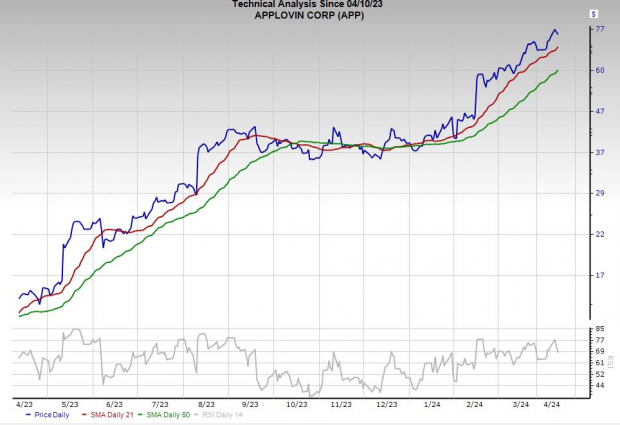

AppLovin stock has pulled back from its 52-week highs and it might slide to its 21-day or 50-day moving averages, especially if the Nasdaq faces selling pressure. Any downturn to those levels likely represent attractive buying opportunities for potential investors and traders.

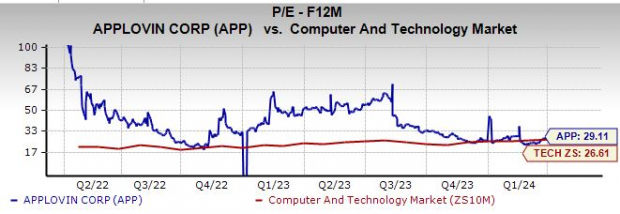

Turning to valuation, AppLovin trades at a 75% discount to its two-year highs at 29.1X forward 12-month earnings. APP also trades 24% below its two-year median and near the Zacks Tech sector’s 26.6X.

(Click on image to enlarge)

Image Source: Zacks Investment Research

Bottom Line

APPLovin helps its clients thrive in a world where countless companies fight for visibility, downloads, screentime, and profitable success in our smartphone and app-obsessed world.

More By This Author:

Buy this Surging, Top-Ranked Dividend Aristocrat Stock?3 Soaring, Highly-Ranked Value Stocks To Buy In April

Nuclear Energy: Transforming the World, Wall Street & Your Portfolio

Disclaimer: Neither Zacks Investment Research, Inc. nor its Information Providers can guarantee the accuracy, completeness, timeliness, or correct sequencing of any of the Information on the Web ...

more