Bull Of The Day: AppLovin Corporation

AppLovin Corporation (APP) shares have soared over 280% YTD to blow away Nvidia and many other tech standouts. Wall Street is diving into the digital application and marketing tool developer for its growth potential within a vital area of the economy, with more people glued to their smartphones and devices than ever before.

AppLovin’s earnings outlook keeps improving and clients are gravitating toward its new AI-enhanced offerings. APP stock also still trades about 60% below its highs, and Wall Street is very high on AppLovin stock.

Driving Growth in the App Economy

AppLovin designs tools to help app developers improve marketing, revenue generation, and other critical aspects of the app business to help drive profitable near-term and long-term expansion. The firm plays a key role in the app ecosystem, with end-to-end software solutions that aim to optimize monetization through various products and solutions.

APP’s products are designed to help companies and app developers acquire and keep their ideal users, increase value across a customer’s lifecycle, measure their marketing and reach, and much more. AppLovin’s solutions aim to boost the average revenue per user, scale ad impressions, acquire more valuable users, and beyond.

(Click on image to enlarge)

Image Source: Zacks Investment Research

AppLovin has been gaining steam recently through new advancements in its machine-learning and AI-focused offerings. The company’s machine learning and AI engine dubbed AXON 2.0, which powers its AppDiscovery platform, is generating strong results, helping it post “record software platform revenue, high margins, impressive operating leverage and ultimately robust free cash flow.”

APP’s CEO believes that AXON 2.0 will help improve nearly every aspect of the business, including its ability to help clients gain exposure in the booming Connected-TV landscape.

Earnings Revisions and Growth Outlook

AppLovin crushed our second quarter EPS estimate by 175% and boosted its guidance as it improves its margins and attracts more business through its predictive, AI-driven updates. AppLovin’s enhanced offerings are leading to better ROIs for its customers, which should lead to further expansion, greater market share, and stability down the road for AppLovin.

(Click on image to enlarge)

Image Source: Zacks Investment Research

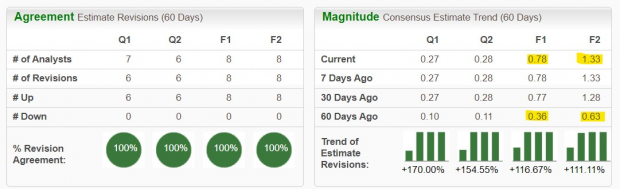

APP’s consensus Zacks earnings estimates have soared by 117% for FY23 and 111% for FY24 since its Q2 report to help it land a Zacks Rank #1 (Strong Buy) right now.

Zacks estimates call for AppLovin’s adjusted earnings to skyrocket 333% from $0.18 per share last year to $0.78 a share in 2023 and then climb another 71% higher next year to reach $1.33 a share.

(Click on image to enlarge)

Image Source: Zacks Investment Research

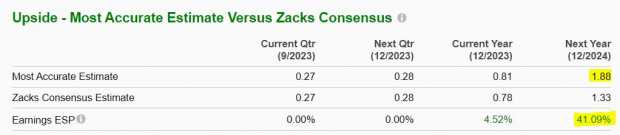

Plus, AppLovin’s most recent/most accurate estimates came in solidly above its already much-improved consensus. For instance, its most up-to-date EPS estimate for FY23 is 5% higher than the current consensus, with its newest EPS figure now 41% higher for FY24 at $1.88 vs. $1.33.

On the revenue front, AppLovin is projected to post roughly 10% sales growth this year and another 13% top-line expansion next year to climb from $2.82 billion in FY22 to $3.48 billion in FY24.

Other Fundamentals

APP shares have skyrocketed roughly 280% YTD to crush Nvidia’s (NVDA) 200% and the market. This performance includes a 56% surge from AppLovin during the past three months.

Despite the run, APP stock still trades roughly 60% below its November 2021 records—APP went public in April 2021. AppLovin’s average Zacks price also marks 5% upside to Monday’s levels.

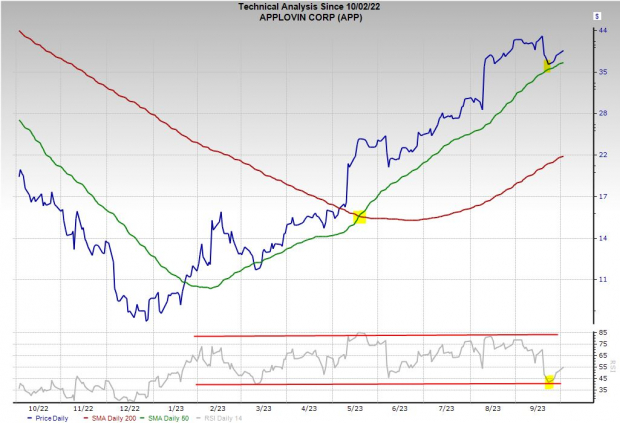

AppLovin’s stellar run helps it trade above its 50-day and 200-day moving averages right now. The stock experienced the bullish golden cross back in May, where the shorter-dated trendline climbs above the long-term average.

On top of that, APP found buyers around its 50-day moving average recently, following its pullback that sent it from overbought RSI levels to solidly below neutral.

(Click on image to enlarge)

Image Source: Zacks Investment Research

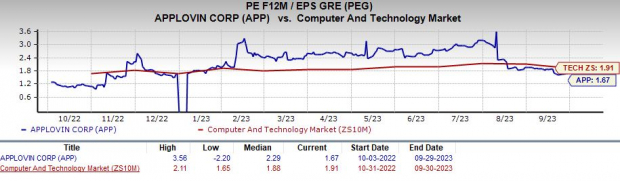

Turning to valuation, AppLovin currently trades at 33.4X forward 12-month earnings, which marks 27% value compared to its own year-long median and a 20% discount against its Technology Services industry. APP’s PEG ratio (which factors in its long-term earnings growth outlook) of 1.7 marks a discount to the Zacks Tech sector’s 1.9 and its industry’s 1.8.

Bottom Line

AppLovin’s portfolio of products and solutions are vital in the highly competitive world of digital apps, where countless companies are constantly competing for awareness, screentime, and profitable success in our smartphone-obsessed world.

Wall Street is also very high on APP stock, with 11 of the 16 brokerage recommendations Zacks has coming in at “Strong Buys.”

More By This Author:

Bear Of The Day: Gildan Activewear Inc.Buy this Tech Stock on the Dip in October for 50% Upside?

3 Top Stocks to Buy in October Despite Market Fears

Disclaimer: Neither Zacks Investment Research, Inc. nor its Information Providers can guarantee the accuracy, completeness, timeliness, or correct sequencing of any of the Information on the Web ...

more