Bull Of The Day: Amazon

Image Source: Pixabay

Amazon (AMZN - Free Report) , the world's leading e-commerce and cloud services provider, is benefiting from strong growth across its business segments, boosting analysts’ expectations for the stock and giving it a Zacks Ranks #1 (Strong Buy) rating.

Notable developments at Amazon include continued growth in Amazon Prime users, a reacceleration of cloud service sales growth as businesses shift their focus from cost-cutting to workload expansion, and huge advances in its burgeoning advertising business.

In addition to the multitude of business progress at Amazon, the stock is also breaking out from a compelling technical chart pattern. These bullish catalysts make Amazon one of the most appealing stocks in the market today.

Earnings Climb Aggressively Higher

At its most recent quarterly earnings report, Amazon crushed analysts’ estimates. Earnings of $0.65 per share were 89.5% above expectations of $0.34 per share, while sales of $134.4 billion surprised the upside by 2.3% and showed an 11% YoY increase.

North America revenues (61% of sales) rose 11% YoY, International revenues (22% of sales) increased 10%, and Amazon Web Services revenues (17% of sales) rose 12% YoY.

Amazon is having incredible success with its newer Advertising business, which is suddenly bringing in $10 billion a quarter. The margins for this business are very high and it is growing 22% annually. Even more impressive is that the advertising business is growing rapidly while incumbent advertising businesses like Meta Platforms and Alphabet deal with slowdowns.

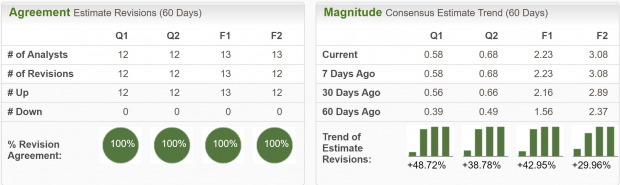

Following such stellar quarterly results and strong business momentum, analysts have unanimously upgraded Amazon’s earnings expectations. Current quarter earnings estimates have been revised higher by 49% and are projected to climb 190% YoY to $0.58 per share. FY23 earnings estimates have been lifted by 43% and are forecast to grow 214% YoY to $2.23 per share.

EPS is expected to grow at nearly 34% annually over the next 3-5 years, while sales are expected to grow more than 10% annually over the next two years.

(Click on image to enlarge)

Image Source: Zacks Investment Research

Technical Setup

Amazon stock has been trading sideways and building out a convincing bull flag over the last 6 weeks. On Monday, the stock broke out above the upper bound of the range, signaling a breakout. So long as the stock doesn’t trade back into the trading range, AMZN should continue higher into the year end.

(Click on image to enlarge)

Image Source: TradingView

Valuation

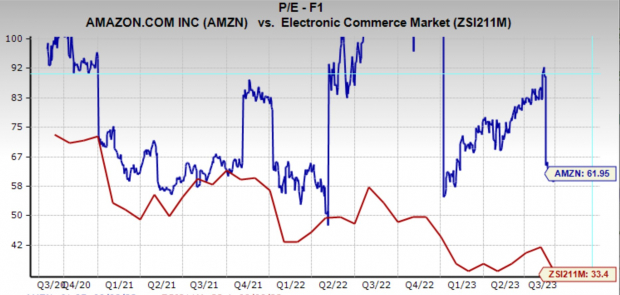

Amazon has been one of the best-performing stocks ever, compounding at 32% annually since its IPO. Additionally, it has always carried a very high, and somewhat confusing earnings multiple, because of the slim margins in e-commerce and huge reinvestment opportunities.

However, now that the company has matured significantly, it is a bit easier to understand the business model, and it now boasts one of the most reasonable earnings multiples in the company’s history.

Today, Amazon is trading at a one-year forward earnings multiple of 62x which is above the industry average of 33x but is well below its 20-year median of 80x.

Image Source: Zacks Investment Research

Bottom Line

Amazon remains one of the market’s preeminent technology stocks. It continues to dominate both the e-commerce and cloud services industries, which are some of the fastest growing industries in the world and is innovating new businesses such as advertising like it is in start-up mode.

Furthermore, it is likely to be a major beneficiary of the Artificial Intelligence revolution. As companies realize the power this new technology offers, they are forced to dramatically increase their computing abilities. Amazon Web Services is going to be a direct recipient of this new demand for processing power.

More By This Author:

Oracle Q1 Earnings Top EstimatesBuy These 3 Low-Beta Stocks To Counter Market Volatility

Can Home Depot's (HD) Strategies Help Overcome Near-Term Woes?

Disclaimer: Neither Zacks Investment Research, Inc. nor its Information Providers can guarantee the accuracy, completeness, timeliness, or correct sequencing of any of the Information on the Web ...

more