Bull Of The Day: Amazon

Amazon.com, Inc. (AMZN) is finally back on the Zacks Rank #1 (Strong Buy) list. The e-commerce giant hasn't been a Strong Buy stock since 2019.

Amazon is an online retail giant, a technology company with AWS, Kindle, and Fire TV, a film studio with Amazon Studio and a publisher with Kindle Direct Publishing.

Focus is Back on Earnings

On Aug 3, 2023, Amazon reported its second quarter results and beat big on the Zacks Consensus reporting $0.63 versus the consensus of $0.34.T That's a beat of $0.29. It was the third big beat in a row.

Net sales were up 11% to $134.4 billion from $121.2 billion a year ago. All of its three key segments saw double digit sales growth.

North America segment sales jumped 11% from last year to $82.5 billion. International sales rose 10% year-over-year to $29.7 billion. AWS sales grew 12% year-over-year to $22.1 billion.

Free cash flow is back on track. It improved to an inflow of $7.9 billion for the trailing 12 months, compared with an outflow of $23.5 billion for the trailing 12 months ended June 30, 2022.

Lower costs helped drive the quarter. It's been a different Amazon with Andy Jassy at the helm. He just finished his second year as CEO. Even the earnings reports and conference calls are different with Jassy than they were with Jeff Bezos, who rarely even went on the calls by the end of his tenure.

Analysts Finally Bullish

Analysts have been bearish on Amazon for the last several years, even though it was a big winner during the pandemic. But analysts are now seeing an upside to the earnings again.

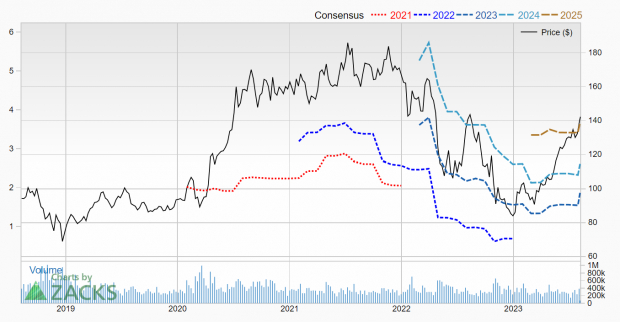

6 estimates were raised in the last week for 2023 and 2024. The 2023 Zacks Consensus has jumped to $1.88 from $1.55 during that time. That is earnings growth of 164.8% as Amazon only made $0.71 per share last year.

The 2024 Zacks Consensus is equally bullish, with analysts expecting another 39.4% growth with the Zacks Consensus jumping to $2.62 in the last 7 days.

Here's what it looks like on the chart.

(Click on image to enlarge)

Image Source: Zacks Investment Research

Big Rally in Amazon Shares in 2023

Amazon, like the other big cap FAANG stocks, sold off last year but it has rallied big in 2023. Shares are up 66.5% year-to-date. However, they still have some work to do to wipe out last year's sell-off. There's no new all-time highs, yet, on Amazon. Shares are still down 16.3% over the 2 year period.

Is it cheap? Not on a P/E basis. It trades at 75.8x. But Amazon has never had a "low" P/E, not even in 2022 after the shares sold off.

It has a PEG ratio of just 2.2, however. That is not a "value" PEG level but it's low.

Analysts expect sales to grow 10.7% in 2023 and another 12.7% in 2024.

Amazon's #1 Rank is a sign that the earnings are turning around. For investors interested in the Magnificent 7 stocks, Amazon is one to keep on the short list.

More By This Author:

5 Cheap Strong Buy Stocks In 2023How Value Investors Can Use The Power Of Compounding

5 Must-See Earnings Charts

Disclosure: Tracey owns shares of AMZN in her personal portfolio!

Disclaimer: Neither Zacks Investment Research, Inc. nor its Information Providers can guarantee the accuracy, ...

more