Bull Of The Day: Alibaba Group

Alibaba Company Overview

Zacks Rank #1 (Strong Buy) stock Alibaba Group (BABA) is a Chinese e-commerce juggernaut that runs popular storefronts such as AliExpress, which caters to global shoppers, and Taobao, which serves its domestic market segment. Like its U.S. counterpart Amazon (AMZN), BABA has businesses that stretch beyond e-commerce, such as its Alibaba Cloud service. Launched in 2009, the cloud business is one of the biggest in China and has ballooned to the second-largest revenue source for the company. Alibaba also benefits from strong momentum in its international wholesale, digital payments, and logistics businesses.

China Stimulus and Recovering Economy

The Chinese government completed a full 180 degree turn in 2024 and delivered a massive stimulus package. As if slashing interest rates and loosening restrictions weren’t enough, Chinese government officials promise to do more moving forward. People’s Bank of China Governor Pan said that the reserve requirement ratio could be reduced again this year and that the loan prime rate will likely be lowered on Monday. Meanwhile, China recently reported more robust growth numbers, and retail sales impressed investors. A flood of liquidity and a more robust economy bode well for Chinese stocks like BABA. Also, understand that the Chinese economy is coming from such a trough that even a reversion to the mean would result in a massive move for these stocks.

BABA’s Dirt-Cheap Valuation

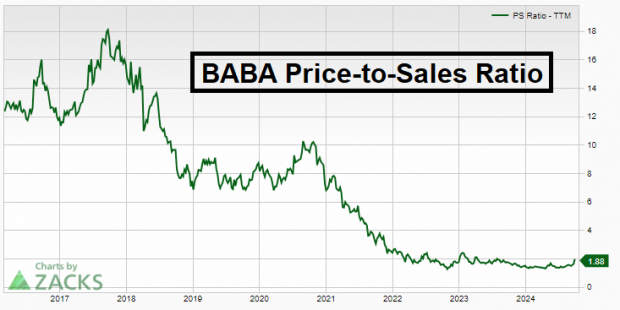

Though BABA shares have gained a healthy 34% year-to-date, its valuation remains at bargain basement lows. For instance, BABA’s price-to-sales ratio of 1.88x is close to all-time lows and is well off the all-time high of 18x in 2018.

(Click on image to enlarge)

Image Source: Zacks Investment Research

BABA Stock Repurchase Program

Alibaba is in the middle of a massive share repurchase program. The company bought back shares on almost every trading day in September. On October 17th, BABA bought back more than $17 million worth of shares. Share buybacks can be bullish because they reduce the number of shares outstanding. Apple (AAPL) is an excellent precedent of this phenomenon. AAPL shares stagnated for years before Carl Icahn and other institutional investors urged the company to repurchase shares.

Smart Money is Invested in BABA

The 13F disclosure requires institutional investors with more than $100 million in assets under management to divulge their positions. The most recent 13F disclosures revealed that BABA was a top holding for some savvy investors such as Michael Burry and David Tepper.

HK Listing & Stock Connect Program to Boost Investor Access

Millions of investors will gain access to BABA shares through a Hong Kong listing and China’s “Stock Connect” program. Goldman Sachs (GS) and Morgan Stanley (MS) expect $10-$20 billion inflows into the stock.

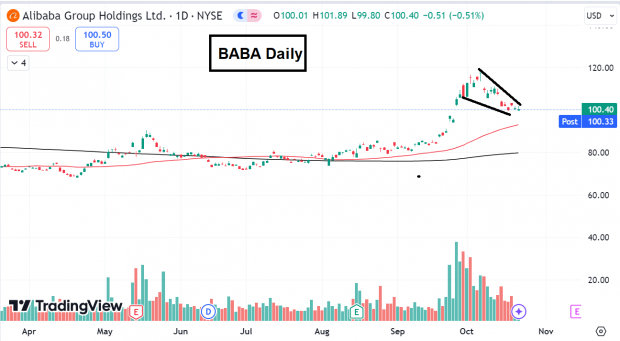

First Pullback After Breakout

BABA shares are retreating towards their 50-day moving average for the first time since the massive stimulus-induced breakout. Though there is room for more downside, the first pullback of this nature after a major breakout is typically buyable.

(Click on image to enlarge)

Image Source: TradingView

Bottom Line

China’s dominant e-commerce player is making a comeback driven by strength in its international business. BABA enjoys a dirt-cheap valuation, increased investor access, and institutional sponsorship.

More By This Author:

MicroStrategy Breaks Out: Time To Buy The Bitcoin Proxy?Bear Of The Day: Delta Air Lines

Bear Of The Day: American Airlines

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any ...

more