Builders FirstSource: Doors To Roofs

Image source: Unsplash

Unless you are in the home construction business, you’ve probably never heard of Builders FirstSource (BLDR). But for those in the business, it is a trusted, respected name, points out Tony Sagami, editor of Weiss Ultimate Portfolio.

Builders FirstSource is in the engineered wood products business: plywood, oriented strand board, roof trusses, wood flooring, wall panels, windows, doors, and interior trim products.

Builders FirstSource provides all the basic building blocks for new home construction/renovation: walls, windows, doors, trusses, etc. With 550 distribution facilities in 40 states (including 44 of the top 50 metro markets), Builders FirstSource is a direct beneficiary of America’s building boom. Here are 4 reasons we like the stock.

Reason No. 1: Building Boom

Home prices are at all-time highs, but home sales are close to all-time lows. How’s that possible? Home construction is simply not keeping up with population growth and as a result has pushed home inventory to all-time lows. The only solution to that housing shortage is to build more homes, and that is happening in a big way.

Reason No. 2: Construction Inflation

Inflation is at the front of many Americans' minds, and construction materials are soaring. The costs of materials for home construction/remodeling have jumped in 2021 and this shows no signs of slowing down this year.

I wouldn’t want to be in only the lumber redistribution business, but a full 45% of Builders FirstSource’s business is value-added, engineered construction products. Builders FirstSource turns raw wood/lumber into high value engineered products, so instead of getting hurt by inflation, Builders FirstSource profits from it.

Reason No. 3: Growth Through Strategic Acquisitions

An important part of Builders FirstSource’s growth strategy is the acquisition of smaller, strategic competitors.

For example, in 2021 Builders FirstSource bought CaliTruss, the largest truss manufacturer in California; Cornerstone Alliance, the largest independent building material supplier in Arizona; and John's Lumber, a family owned company founded in 1947 with 14 stores. These value-added acquisitions are expected to be immediately accretive to the bottom line.

Builders FirstSource is also becoming a stealth technology giant in the construction industry. The company bought two software companies — Kattera and Paragidm — that automate construction project management, budgeting, workflows, design collaboration, and workforce scheduling.

Reason No. 4: By the Numbers

How good is business? In the most recent quarter, Builders FirstSource reported revenues of $4.6 billion, an 83.1% year-over-year increase. Profits of $442.5 million, or $2.31 per share, were a whopping 216% year-over-year increase.

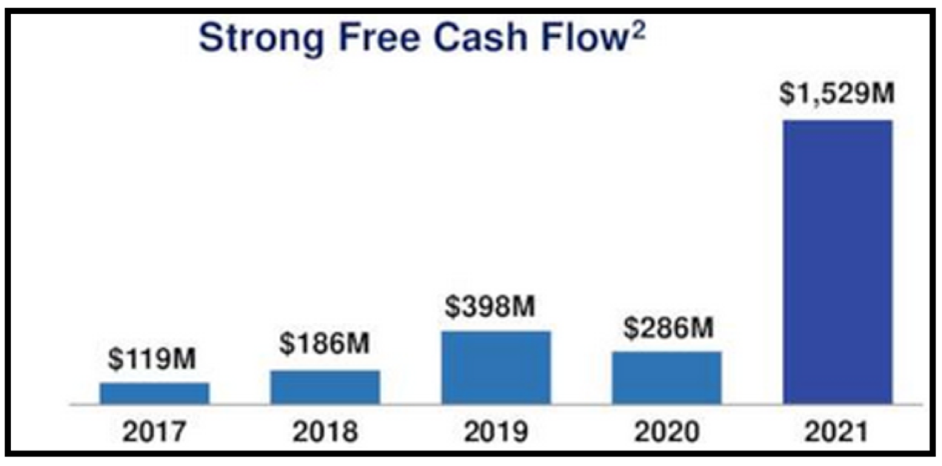

For a company whose profits are growing like a weed, Builders FirstSource is selling for only 10.9 times forward earnings. That’s cheap. That $442 million of profit is impressive, but even more impressive is the $1.53 billion of free cash flow that Builders FirstSource generated last year.

It is using most of that free cash flow to buy back its own shares. In February, Builders FirstSource announced a massive $1 billion stock buyback program. For context, that $1 billion translates into 7.6% of outstanding shares. That’s huge. Buying Builders FirstSource is a smart move to build our portfolio to new heights.

Disclaimer: © 2022 MoneyShow.com, LLC. All Rights Reserved.