Buckle Up: S&P 500 May Plunge Towards Immediate Support Zone Amidst Market Volatility

Photo by Maxim Hopman on Unsplash

The increasing volatility and volume in S&P 500 could cause further weakness to test the immediate support zone. Watch the video below to find out how to use the Wyckoff method to anticipate the price action and the potential price target before it happens in S&P 500.

Video Length: 00:07:53

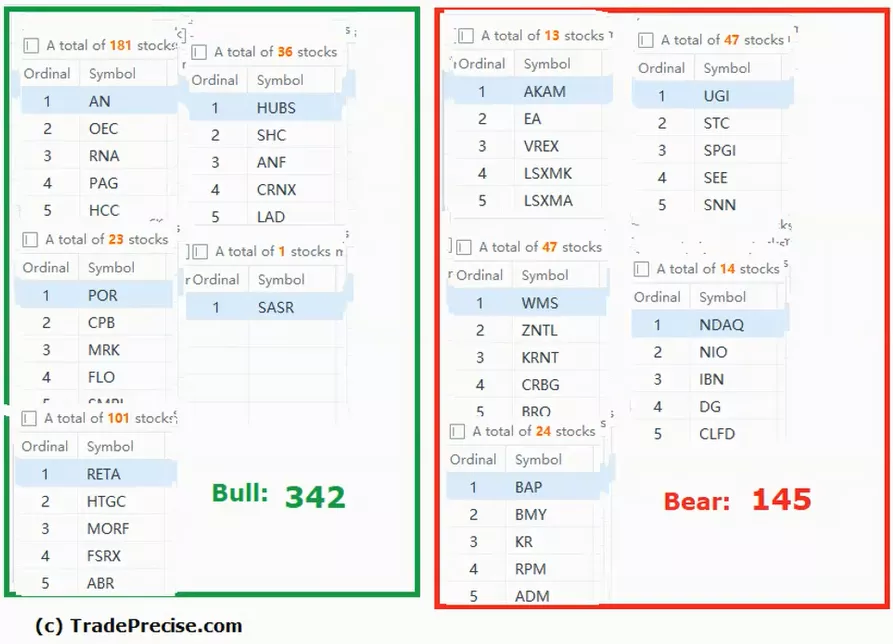

The bullish setup vs. the bearish setup is 342 to 145 from the screenshot of my stock screener below suggesting still a positive market environment.

However, the frequent failure of the breakout trade setups last week should remind us of the increasing market volatility. It is time to be defensive with a smaller size based on conservative risk management and lock in the profit for existing positions.

More By This Author:

Interactive Brokers Unstoppable Rally: 2-Year Causes That Will Take It Even Higher

Bullish Momentum On FCX: Are We About To See A Historic Comeback?

Miniso Rockets Ahead With Bullish Momentum - How High Can It Go?

Disclaimer: The information in this presentation is solely for educational purpose and should not be taken as investment advice.