Bruker Measures Up!

Summary

- 100% technical buy signals.

- 13 new highs and up 13.45% in the last month.

- 92.43% gain in the last year.

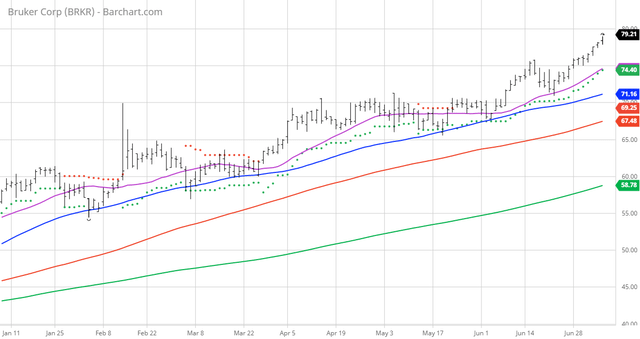

The Barchart Chart of the Day belongs to the medical analytic instruments company Bruker (NASDAQ: BRKR). I found the stock by using Barchart's powerful screening tools to find the stocks with the highest Weighted Alpha and technical buy signals. That resulted in a watch list of 34 stocks. After I sorted for the most frequent number of new highs in the last month, I used the Flipchart feature to review the charts for consistent prices appreciation. Since the Trend Spotter signaled a buy on 5/24 the stock gained 13.19%.

Bruker Corporation develops, manufactures, and distributes scientific instruments, and analytical and diagnostic solutions in the United States, Europe, the Asia Pacific, and internationally. The company operates through three segments: Bruker Scientific Instruments (BSI) Life Science, BSI NANO, and Bruker Energy & Supercon Technologies. It offers life science tools based on magnetic resonance technology; life science mass spectrometry and ion mobility spectrometry solutions; analytical and process analysis instruments and solutions based on infrared and Raman molecular spectroscopy technologies; and radiological/nuclear detectors for chemical, biological, radiological, nuclear, and explosive detection. The company also provides X-ray instruments, atomic force microscopy instrumentation, fluorescence optical microscopy instruments, analytical tools for electron microscopes and X-ray metrology, defect-detection equipment for semiconductor process control, and spark optical emission spectroscopy systems, as well as handheld, portable, and mobile X-ray fluorescence spectrometry instruments. In addition, it offers superconducting and non-superconducting materials and devices. The company serves academic and government research customers; pharmaceutical and biotechnology, diagnostics, chemical, food and beverage, clinical, nanotechnology, semiconductor, and other industrial companies; nonprofit laboratories; academic institutions and medical schools; contract research organizations; nonprofit and for-profit forensics, and environmental and clinical microbiology laboratories; agriculture, food, and beverage safety laboratories; hospitals and government departments; agencies; raw material manufacturers; and other businesses involved in materials analysis through direct sales forces, distributors, independent sales representatives, and other representatives. Bruker Corporation was incorporated in 1991 and is headquartered in Billerica, Massachusetts.

Barchart technical indicators:

- 100% technical buy signals

- 102.05+ Weighted Alpha

- 92.43% gain in the last year

- Trend Spotter buy signal

- Above its 20, 50 and 100 day moving averages

- 13 new highs and up 13.45% in the last month

- Relative Strength Index 76.50%

- Technical support level at 77.60

- Recently traded at 79.21 with a 50 day moving average of 71.15

Fundamental factors:

- Market Cap $11.83 billion

- P/E 47.01

- Dividend yield .21%

- Revenue expected to grow 17.70% this year and another 6.00% next year

- Earnings estimated to increase 40.00% this year, an additional 16.90% next year and continue to compound at an annual rate of 16.56% for the next 5 years

- Wall Street analysts issued 5 strong buy, 7 old and 1 underperform recommendation on the stock

- The individual investors following the stock on Motley Fool voted 240 to 16 that the stock will beat the market

- 3,432 investors are monitoring the stock on Seeking Alpha

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the ...

more