Broadcom Both Benefits And Suffers From The AI Surge

Image Source: Pexels

Broadcom (AVGO) incurred a 3% loss during the late-afternoon session as the broader market struggled with less-than-desirable earnings disclosures. Specifically, the one print that appeared to weigh the heaviest on the tech-centric Nasdaq was Meta Platforms (META), which beat consensus revenue targets but fell short on earnings per share. The culprit? A one-time, tax-related charge, along with increased capital expenditures for this year and next due to artificial-intelligence-related investments.

META fell sharply during yesterday’s after-hours session, and the decline extended to the current session.

Obviously, AVGO stock represents an entirely different entity than META. However, the two share the same AI-related catalyst, which, in the case of Broadcom, has led to a robust return of over 61% year-to-date, inclusive of today’s volatility. Over the past 52 weeks, AVGO has gained nearly 112%, a beneficiary of the surge in AI-related spending.

During the midweek session, the security appeared to enjoy residual tailwinds from a partnership involving the U.S. Department of Energy, Argonne National Laboratory, Nvidia (NVDA), and Oracle (ORCL). Under the terms of the landmark deal, the partnership will deliver the DOE’s largest AI supercomputer and accelerate scientific discovery.

While Broadcom wasn’t mentioned in the press release, such large-scale catalysts may reasonably extend to other major AI players, thereby lifting AVGO stock. However, the disappointing response to Meta’s financial disclosure indicates that investors are leery about excessive exposure to AI.

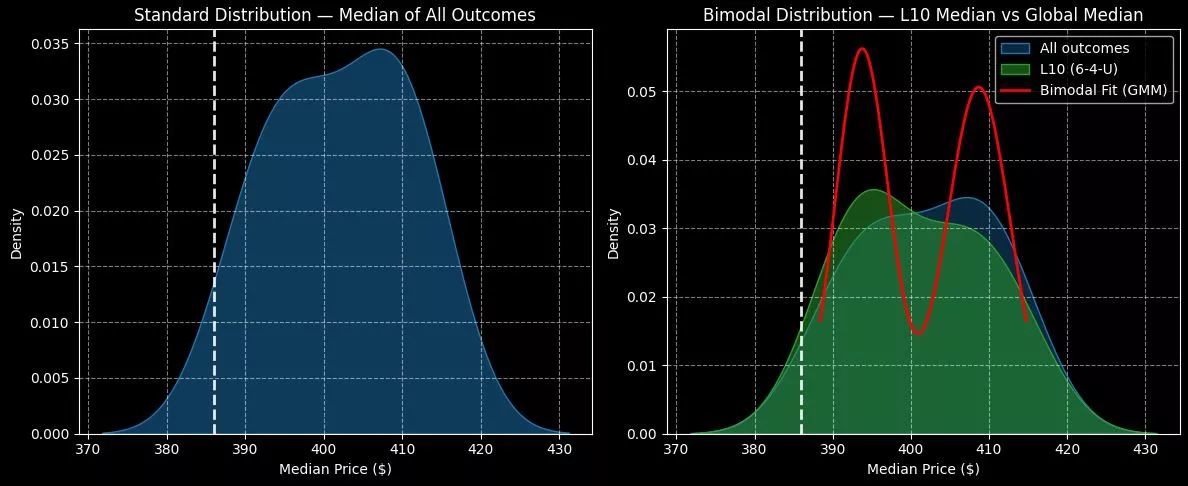

In the quantitative arena, the baseline performance of AVGO stock since January 2019 indicates a strong upward bias. Notably, AVGO’s 10-week projected returns features a bullishly skewed distributional curve, with median price outcomes ranging from $370 to a little over $430. Price clustering is expected to be predominant at around $408.

Currently, though, AVGO stock is structured in a 6-4-U formation: six up weeks, four down weeks, with an overall upward slope. Under this condition, the range of outcomes is about the same as the baseline state. However, price clustering would be expected to occur at around $393.

That’s still bullish but there’s a 3.68% negative delta in expected price density dynamics relative to baseline. Keep that in mind if you’re considering an acquisition of the red ink.

More By This Author:

Why Investors Are Turning Bearish On METAWhat Can Investors Expect From Archer Aviation Earnings Next Week?

How Nvidia’s $5 Trillion Windfall Could Make 2 Quantum Computing Stocks Go Even More Parabolic