Broadcom Beats Earnings Estimates As AI Revenue Triples

Image: Bigstock

Broadcom (AVGO - Free Report), one of America’s premier semiconductor companies, announced Q4 earnings results on Thursday and beat analyst earnings estimates by 2%.

Broadcom reported record fiscal year 2024 revenue of $51.6 billion, a 44% year-over-year increase, driven by a 220% surge in AI-related revenue to $12.2 billion, aided by strong performances in the semiconductor and infrastructure software segments. Adjusted EBITDA rose 37% to $31.9 billion, with free cash flow reaching $21.9 billion.

In response to its strong financial performance, Broadcom announced an 11% increase in its quarterly dividend to $0.59 per share for fiscal 2025, marking the fourteenth consecutive annual dividend increase since 2011.

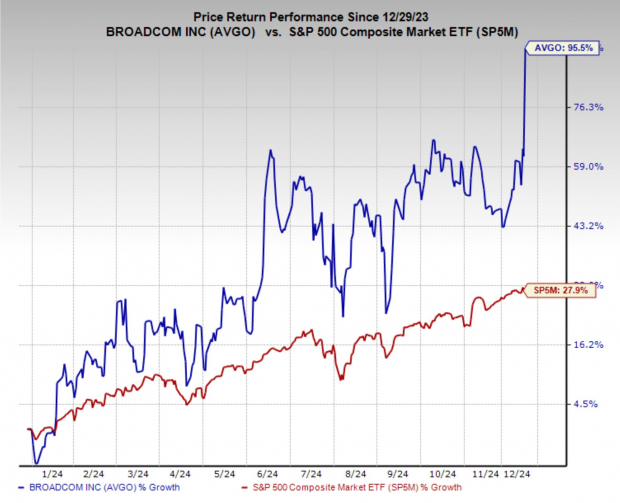

Broadcom's stock has been on a tear this year, climbing 95% and breaking out to all-time highs following the banner report. The company currently has a Zacks Rank #3 (Hold) rating, but I would not be surprised to see analysts start to raise earnings estimates after witnessing such promising results.

AI infrastructure continues to be one of the main driving forces in the stock market and the economy, and Broadcom is playing an increasingly important role in the complex technology space.

Image Source: Zacks Investment Research

Custom AI Chips may Boost Broadcom and Expand Opportunities

For most of this week I have been putting out write-ups on the developments in custom silicon, as it appears to be the next big thing in AI, and this Broadcom report has confirmed that.

Last week, it was Marvell (MRVL - Free Report) that broke out to new highs on the back of a strong quarter in custom AI sales and a new deal with Amazon (AMZN - Free Report). Now, Broadcom is showing how rapidly this niche industry is growing, and the company recently struck a deal with Apple (AAPL - Free Report) to develop custom AI solutions for their new expansion in servers.

The rise of artificial intelligence has driven a surge in demand for custom-designed chips, known as Application-Specific Integrated Circuits (ASICs), which are tailored to optimize specific AI workloads. Companies like Marvell and Broadcom are joining industry leaders such as Nvidia in developing specialized solutions that address these needs.

These custom chips are highly efficient, cost-effective, and compact, offering significant advantages over general-purpose chips for targeted AI applications, though they lack flexibility for broader tasks.

Broadcom Stock Breaks Out to All-Time Highs

Broadcom’s impressive quarterly results and optimistic guidance have recently ignited a rally in its stock, pushing it to all-time highs with a single-day gain of over 22%. This breakout follows months of consolidation, as investors waited for a catalyst to validate the company’s growth potential. The robust AI revenue growth and expanding role in custom silicon markets provided just that.

Despite the sharp move, Broadcom’s long-term outlook remains highly compelling. With projected earnings growth of 16.5% annually over the next three to five years, the company is well-positioned to benefit from surging investments in AI infrastructure and custom chip solutions.

This quarter’s results confirm Broadcom’s ability to capitalize on these trends, solidifying its role as a key player in the rapidly evolving and extremely complex semiconductor landscape.

Image Source: TradingView

Should Investors Buy Shares in Broadcom?

Broadcom’s strong performance and robust outlook may make it an attractive stock for investors seeking exposure to the AI revolution.

However, with the stock up over 22% in a single session and recently trading at all-time highs, prospective buyers may want to consider waiting for a pullback to establish a position. Long-term investors confident in Broadcom’s leadership in custom AI chips and infrastructure may find opportunities to accumulate shares over time, as the company is well-positioned to benefit from sustained growth in AI and data-centric technologies.

More By This Author:

2 Top-Performing Stocks To Watch After Earnings: AI, UNFIMacy's Lags Q3 Earnings Estimates

Bear Of The Day: Ford Motor

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any specific ...

more