Broad Stock Market Index Testing Extremely Important Breakout Level

The Value Line Geometric Index is one of the broadest stock market indices. So when its price records a notable reversal, breakout, or breakdown, investors should listen.

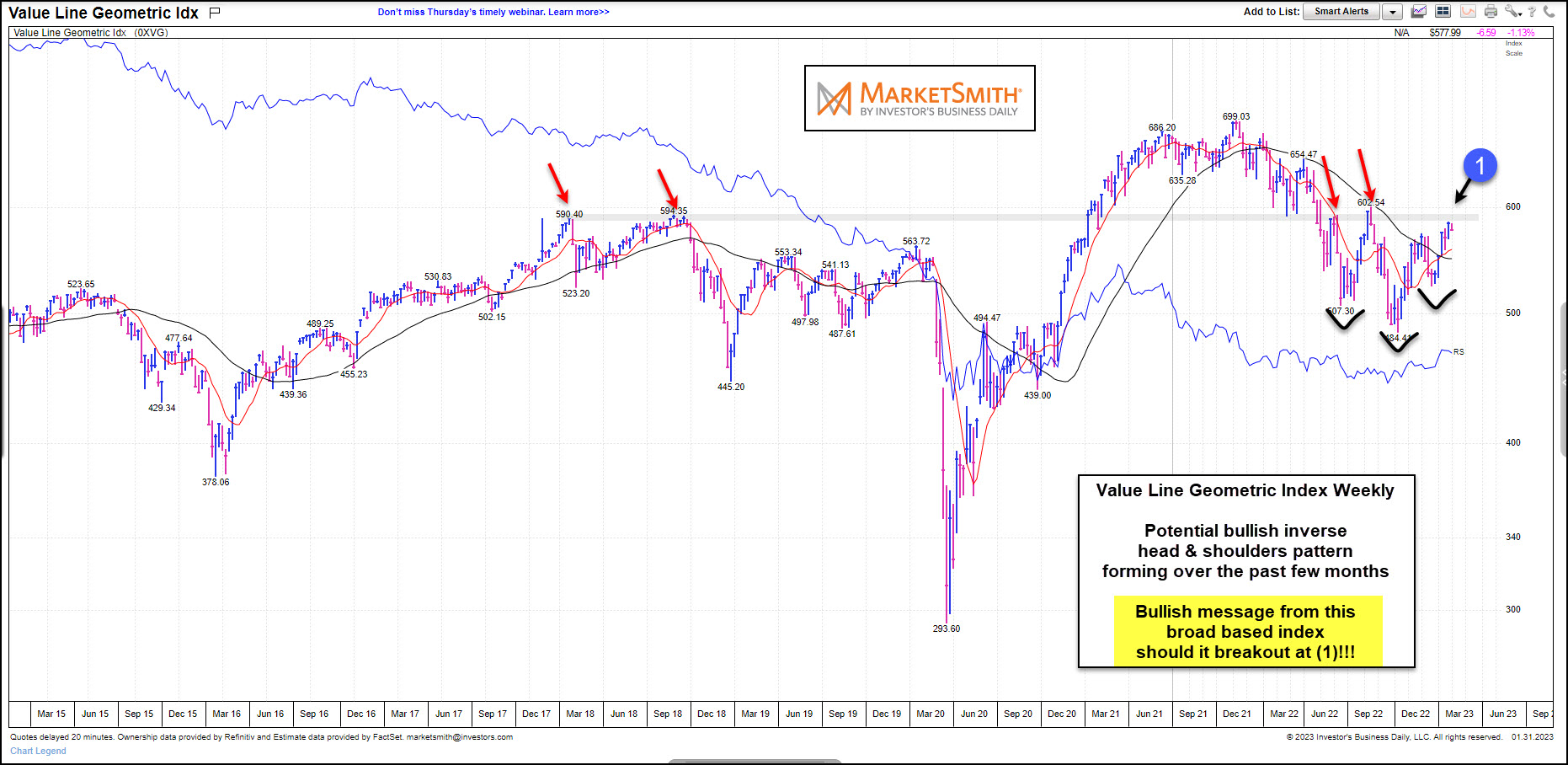

Today we take a closer look at the “weekly” chart of the Value Line Geometric Index that comes from Marketsmith.com and highlights why investors should be paying attention.

Like other stock market indices, the Value Line Geometric Index declined sharply from its 2021 high. While bottoming over the past few months, however, this index formed a wide base in what could be an inverse head and shoulders pattern.

The neckline for this pattern comes into play at (1), and it made even more important when we consider that this level has been resistance on 4 prior occasions. So this won’t be an easy breakout… That said, this would also make a breakout a huge development for bulls.

So keep an eye on this pattern and resistance. A breakout at (1) would send a very bullish message to the broad markets!

(Click on image to enlarge)

More By This Author:

Are Consumer Stocks Sending Chills To Broader Market?Tech Bulls Eye Potentially Explosive Stock Market Pattern

Short-Term Government Bonds Suggesting Fed Funds Peak

Disclosure: Sign up for Chris's Kimble Charting Solutions' email alerts--click here.