Bristol-Myers Squibb: #1 In Big Pharma

In our review of big pharma stocks, Bristol-Myers Squibb (BMY) is our top rated stock, with a five-year annual expected return of 14.0%. The company is a leading drug maker of cardiovascular and anti-cancer therapeutics, with annual revenues of about $42 billion.

The past year has seen the company transform itself, due to the $74 billion acquisition of Celgene, a peer pharmaceutical giant which derived almost two-thirds of its revenue from Revlimid, which treats multiple myeloma and other cancers. The end result is that Bristol-Myers Squibb is now an industry giant, which continues to generate strong results even during the coronavirus pandemic.

Source: Investor Presentation

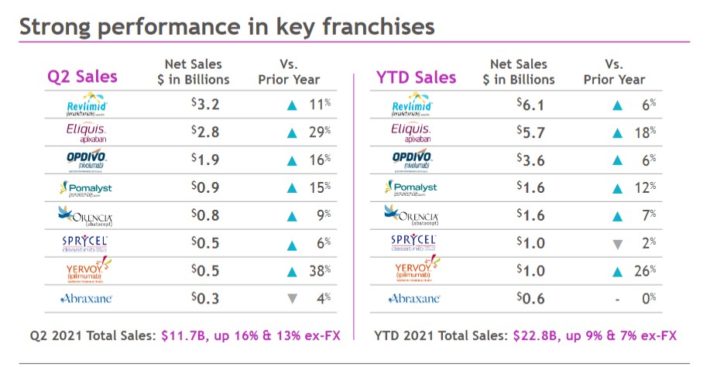

Revenue grew 15.5% to $11.7 billion, coming in $470 million better than expected. Adjusted earnings-per-share of $1.93 compared favorably to adjusted earnings-per-share of $1.63 in the prior year and was $0.03 above estimates.

U.S. revenues improved 14% to $7.5 billion while international was up 18%. Currency exchange was an 8% tailwind to results. For the quarter, Revlimid sales increased 11% to $3.2 billion due to recovery to pre-COVID-19 levels as well as longer treatment duration.

Eliquis, which prevents blood clots, grew 29% to $2.8 billion due to ongoing strength in demand in both U.S. and international markets. Eliquis has become the top oral anticoagulant in several international countries since 2019 and had more than $9 billion in sales last year.

Opdivo, which treats cancers such as advanced renal carcinoma, returned to growth, with sales improving 16% to $1.9 billion due to new launches for use. Revenue for Orencia, which treats rheumatoid arthritis, grew 9% to $814 million.

Bristol–Myers reaffirmed its guidance and expects adjusted earnings–per–share in a range of $7.35 to $7.55 for 2021. We expect 3% annual earnings growth over the next five years for BMY. The company’s recently announced $2 billion addition to its share repurchase is another positive catalyst for earnings-per-share growth.

Based on expected EPS of $7.45, shares of BMY trade for a forward P/E ratio of 9.2. Our fair value P/E estimate is a P/E of 13-14, which is more in-line with the pharmaceutical peer group. Lastly, BMY has a 2.9% dividend yield, leading to total expected returns of 13.4% per year over the next five years.

Disclaimer: © 2021 MoneyShow.com, LLC. All Rights Reserved.