Brightening Outlook For 2023 Dividends Boosts S&P 500

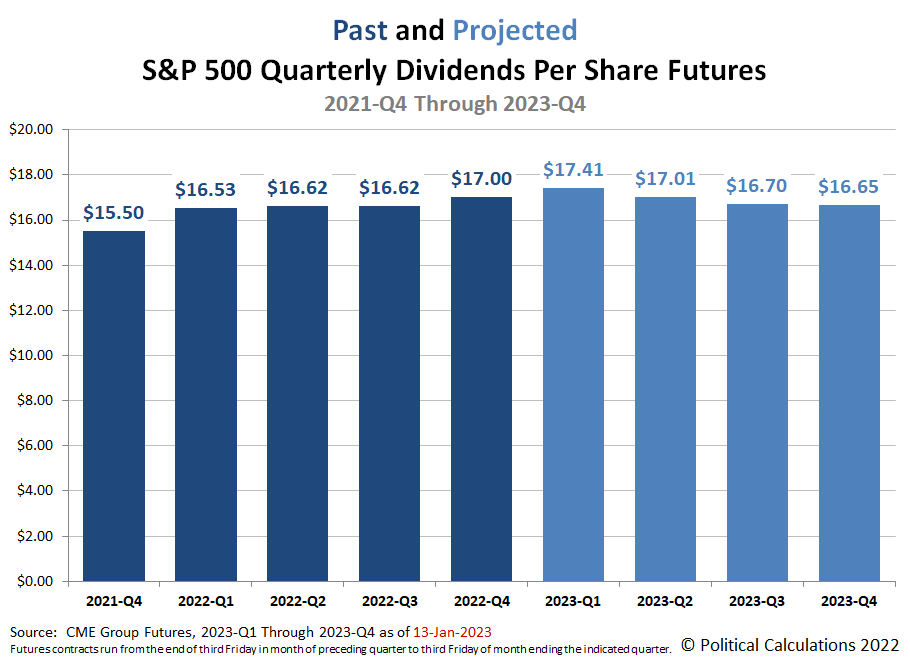

We're seeing a remarkable change in investors' expectations for 2023's dividends for the S&P 500 (Index: SPX). The outlook for quarterly dividends has brightened considerably from the outlook we featured just a few weeks ago. Instead of falling year-over-year from the levels recorded in 2022, the CME Group's quarterly dividend index futures are now projecting they'll show positive gains with respect to last year's results for all but the fourth quarter at this writing.

The following chart shows the expectations for the S&P 500's quarterly dividends per share as of Friday, 13 January 2022.

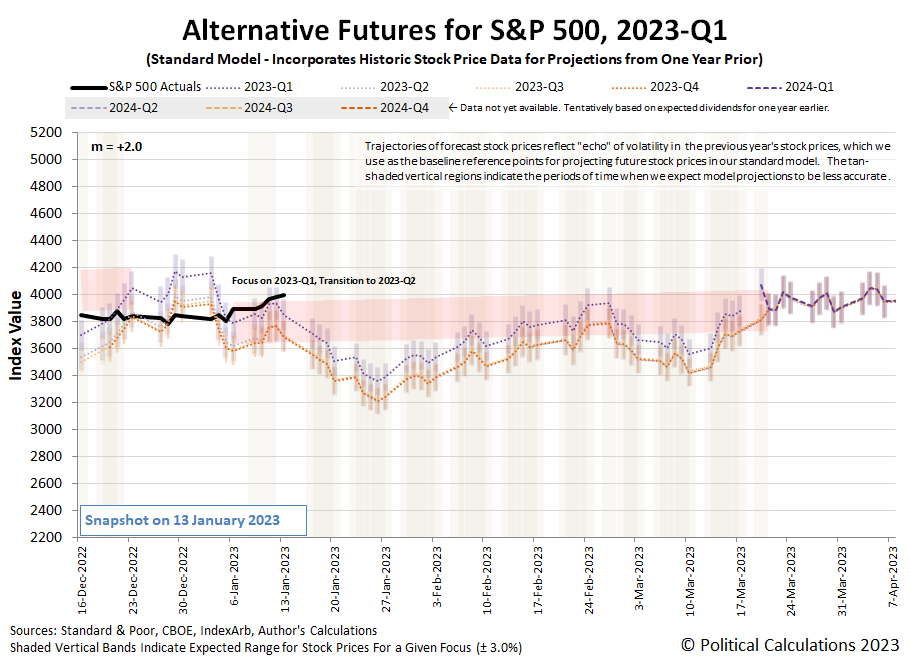

That change in expectations for dividends has boosted the outlook for stock prices through the first quarter of 2023. The dividend futures-based model is now projecting a more positive trajectory for stock prices, as indicated by the slight upward slope of the redzone forecast range indicated on the latest update for the alternative futures chart.

Also during the past week, investors shifted more of their attention toward the current quarter of 2023-Q1. The S&P 500 ended the trading week at 3,999.09, rising to the high side of the redzone forecast range. That change is consistent with how we described stock prices would behave in that scenario in the previous edition of the S&P 500 chaos series.

How long might that last? That remains to be seen, but you can see some of the positive change in sentiment in the week's market-moving headlines, where expectations strengthened that the Fed's nearly year-old series of rate hikes will come to an end in this current quarter.

Monday, 9 January 2023

- Signs and portents for the U.S. economy:

- Fed minions looking ahead to next rate hike:

- Bigger stimulus developing in China:

- ECB minions have wage inflation, slowing Eurozone economy to worry about:

- S&P 500 near flat as investors weigh chances of less aggressive rate hikes

Tuesday, 10 January 2023

- Signs and portents for the U.S. economy:

- U.S. small-business sentiment skids to half-year low

- U.S. imports of containerized goods retreat to pre-pandemic level

- U.S. banks get ready for shrinking profits and recession

- U.S. wholesale inventories rise strongly in November as demand falters

- Oil edges higher as petroleum demand set to touch record next year

- Fed minions don't want to get involved in social policy:

- Bigger trouble developing in Japan:

- Bigger stimulus rolling out in China:

- ECB minions thinking they should stop rate hikes:

- Wall St ends higher, Powell comments avoid rate policy

Wednesday, 11 January 2023

- Signs and portents for the U.S. economy:

- Fed minions signal smaller rate hikes ahead:

- Bigger stimulus developing in China:

- Milder recession developing in Eurozone:

- Bigger trouble developing all over:

- BOJ minions looking forward to fighting higher inflation:

- ECB minions excited about keeping rate hikes going:

- Stocks rally, bond yields fall with bets on easing U.S. inflation

Thursday, 12 January 2023

- Signs and portents for the U.S. economy:

- Fed policymakers signal rate-hike slowdown coming, but no easing

- Bigger trouble, stimulus developing in China:

- BOJ minions starting to wonder if never-ending stimulus has unintended consequences, feel more upbeat:

- Wall St ends up as data suggests inflation may be on downward trend

Friday, 13 January 2023

- Signs and portents for the U.S. economy:

- Fed minions losing money, say they're balancing risks:

- Bigger trouble, stimulus developing in China:

- Better than expected, but still bad, economic news for the Eurozone:

- Central bankers signal they're ready to stop hiking rates:

- BOJ minions rethinking never ending stimulus as Japanese inflation doubles their target:

- ECB minions readying for next rate hike, start gearing up for recession impact:

- S&P 500 ends at highest in month, indexes gain for week as earnings kick off

The CME Group's FedWatch Tool continues to project quarter point rate hikes at both the Fed's upcoming 1 February and 22 March (2023-Q1) meetings, with the latter representing the last for the Fed's series of rate hikes that started in March 2022. The FedWatch tool then anticipates the Fed will maintain the Federal Funds Rate at a target range of 4.75-5.00% through November 2023. After which, developing expectations for a U.S. recession in 2023 have the FedWatch tool projecting a quarter point rate cut in December (2023-Q4). Or rather, no change at all from last week!...

We did see change for the Atlanta Fed's GDPNow tool's latest projection for real GDP growth in the fourth quarter of 2022, which increased to +4.1% from last week's +3.8% estimate. The BEA will issue its first estimate of 2022-Q4's GDP later this month, on 26 January 2023.

More By This Author:

U.S. Imports From China Collapse In November 2022U.S. New Homes Stay Out Of Affordable Reach

U.S. New Home Market Enters 2023 In Distress

Disclosure: Materials that are published by Political Calculations can provide visitors with free information and insights regarding the incentives created by the laws and policies described. ...

more