Breaking Down The Outlook For S&P 500 Margins

The 2022 Q1 earnings season has gotten underway already, with results from 13 S&P 500 members with fiscal quarters ending in February getting counted as part of the official March-quarter tally. We have another 5 S&P 500 members on deck to report results this week, including Micron Technology (MU - Free Report), Walgreens (WBA - Free Report), and Paychex (PAYX - Free Report).

The geopolitical uncertainty in the wake of the Ukraine situation adds to the market’s existing worries about inflation and supply-chain challenges that have remained recurring themes in recent months. The addition of geopolitical tensions to the mix has direct implications for the inflation outlook through higher prices for energy and other commodities. All of that has a bearing on the earnings outlook.

We knew all along that earnings growth was expected to decelerate significantly in the current and coming quarters, after remaining very strong in the preceding periods. But the outlook for earnings had started easing even before the recent geopolitical developments. We saw this in the revisions trend, which had been mixed at best.

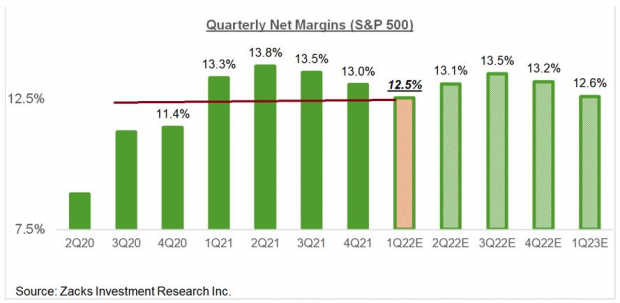

The chart below of actual and expected revenue growth on a quarterly basis shows this decelerating trend visually.

Image Source: Zacks Investment Research

The expectation currently is for 2022 Q1 earnings to be up +3.6% from the same period last year on +10.1% higher revenues. In other words, current bottom-up estimates reflect compression in margins, which is in line with the aforementioned inflationary trends.

Negative Estimate Revisions

Revisions to the 2022 Q1 estimates are mixed, with estimates for 9 of the 16 Zacks sectors going down since the start of January, with the Consumer Discretionary, Transportation, and Aerospace sectors suffering significant estimate cuts. In fact, Q1 estimates for the Transportation sector are down by more than a third since the start of the quarter and Consumer Discretionary estimates have been cut by almost -30%.

Offsetting the estimate cuts are positive revisions to other sectors, with the Energy sector enjoying the most positive revisions. Other sectors enjoying positive estimate revisions include Medical, Autos, and Construction.

Had it not been for the strong earnings growth expected for the Energy sector (up +193.5% from the same period last year), Q1 earnings for the remaining 15 sectors would be down -1.4% from the year-earlier period.

With respect to estimate revisions, Q1 estimates would have come down since the start of the period had it not been for the offsetting upward revisions to Energy sector estimates.

In the aggregate, 2022 Q1 estimates for the S&P 500 index are up +0.1% since the start of the quarter. However, if we look at the revisions trend on an ex-Energy basis, Q1 estimates for the rest of the 15 sectors are down -1.1% since the start of the quarter.

For full-year 2022, the expectation is of earnings growth +7% on +5.9% revenue growth. This would follow the +50.1% earnings growth in 2021.

Full-year 2022 earnings estimates have modestly inched up since the start of the year, with total S&P 500 earnings up +1.3% since the start of January. But there are a lot of cross-currents at the sector level, with estimates going down for 9 of the 16 Zacks sectors and going up for the rest.

In fact, it is the positive revisions to the Energy sector that are offsetting the estimate cuts in the aggregate.

Excluding the positive revisions to the Energy sector, total S&P 500 earnings for 2022 would be down -11.9% since the start of January. The biggest declines have been for the Consumer Discretionary, Transportation and Utilities sectors.

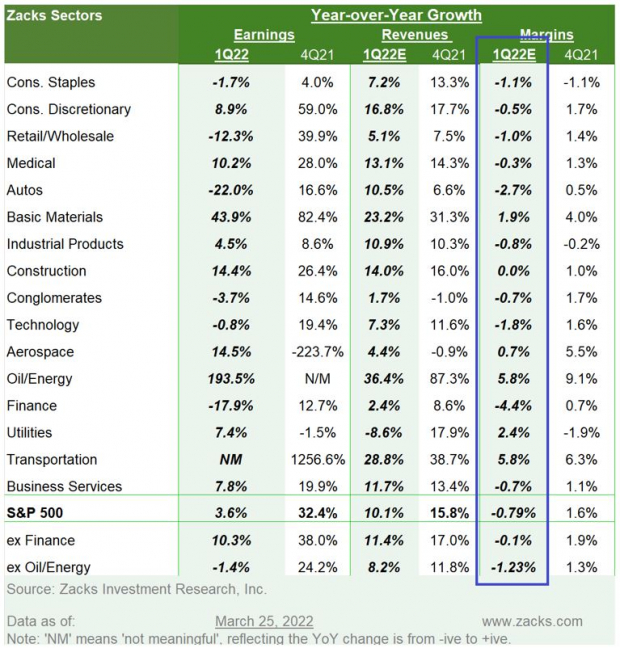

The chart below shows quarterly net margins for Q1 in the context of where margins have been in recent quarters and what is embedded in current estimates for the coming quarters.

Image Source: Zacks Investment Research

As you can see above, Q1 margins are expected to be the lowest since 2020 Q4. But current estimates for Q2 and beyond reflect some improvement in margins. It is this margins outlook that is most likely at risk of weakening in the coming days, given the darkening clouds on the horizon.

For Q1, margins are expected to be below the year-earlier level for 9 of the 16 Zacks sectors, with strong margin gains for three sectors (Energy, Transportation, and Basic Materials).

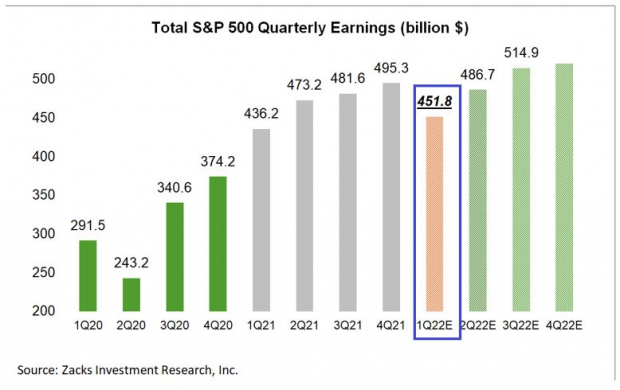

Image Source: Zacks Investment Research

As you can see in the table above, the growth picture has shifted materially for the Finance and Technology sectors, the two biggest earnings contributors to the index. Total Finance sector earnings are expected to be down -17.9% from the same period last year on +2.4% higher revenues while Tech sector earnings are expected to be down -0.8% in Q1 on +7.3% higher revenues.

The chart below shows the quarterly earnings estimate for Q1 in the context of the actual quarterly totals in the preceding 8 quarters and estimates for the following three quarters.

Image Source: Zacks Investment Research

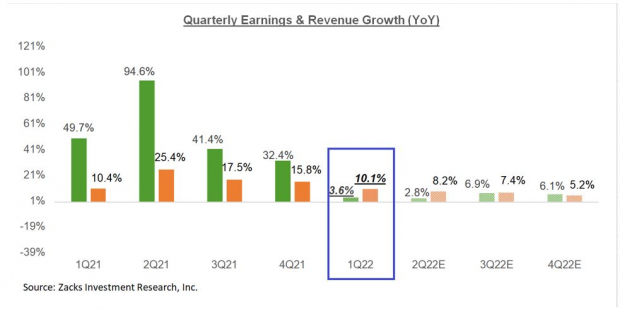

The chart below presents the earnings and revenue growth picture on a quarterly basis, with expectations for 2022 Q1 contrasted with the actual growth achieved over the preceding four quarters and estimates for the following three.

Image Source: Zacks Investment Research

The 2022 Q1 Earnings Season Scorecard

The Q1 earnings season will really get going with the big banks reporting March-quarter results in mid-April, but the early reports have come out already. As mentioned earlier, the recent February-quarter results from 13 S&P 500 members form part of our March-quarter tally. We will have seen such Q1 results from almost two dozen S&P 500 members by the time JPMorgan (JPM - Free Report) comes out with quarterly results on April 13th.

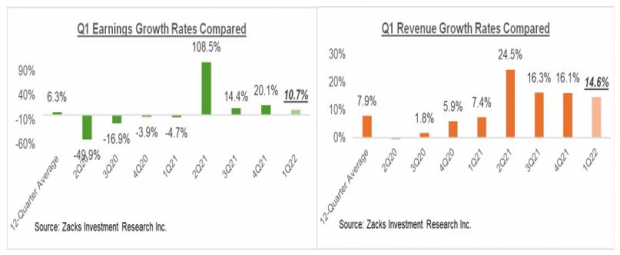

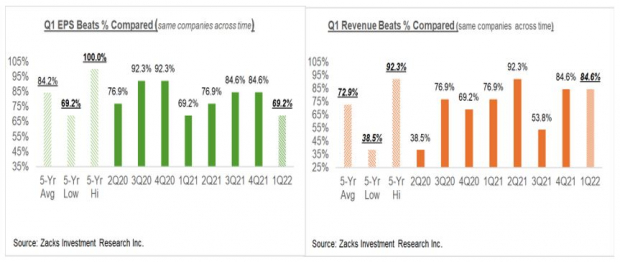

For the 13 index members that have reported Q1 results already, total earnings are up +10.7% from the same period last year on +14.6% higher revenues, with 69.2% beating EPS estimates and 84.6 beating revenue estimates.

Not to make too big of a deal out of these very early results, but the comparison charts below put the 2022 Q1 earnings and revenue growth rates for these 13 index members in the context of what we had seen from the same group of companies in other recent periods.

Image Source: Zacks Investment Research

The comparison charts below show the Q1 EPS and revenue beats percentages for these 13 index members in a historical context.

Image Source: Zacks Investment Research

The chart below shows the comparable picture on an annual basis.

Image Source: Zacks Investment Research

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any specific ...

more