Breaking Down The Mag 7 Earnings Outlook

Image Source: Unsplash

- Total 2025 Q1 earnings for the S&P 500 index are expected to be up +5.9% from the same period last year on +3.7% higher revenues, which would follow the +13.8% earnings growth on +5.5% revenue growth in the preceding period.

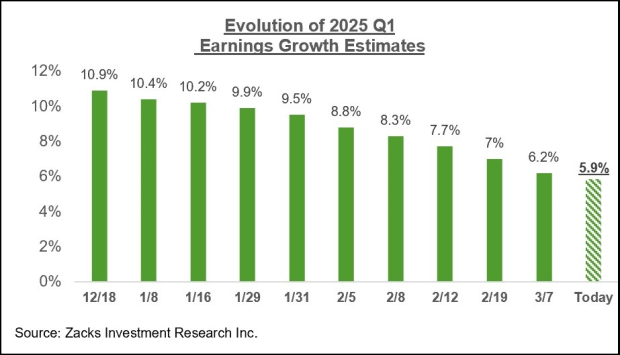

- Q1 earnings estimates have steadily come down since the quarter got underway, with the current +5.9% expected growth pace down from +10.4% at the start of January 2025.

- Q1 earnings for the ‘Magnificent 7’ group of companies are expected to be up +13.1% from the same period last year on +11.9% higher revenues. Excluding the ‘Mag 7’ contribution, Q1 earnings for the rest of the index would be up +3.8% (vs. +5.9%).

- For the Mag 7 group, total earnings are expected to increase by +12.6% on +9.5% higher revenues in 2025. Excluding the Mag 7 contribution, total earnings for the remaining S&P 500 companies are expected to grow +8.7% in 2025, which compares to +3.9% growth in 2024 and -5.2% in 2023.

Magnificent 7 Stocks Lose Their Leadership

The Magnificent 7 stocks have lost ground lately, with the DeepSeek breakthrough putting a spotlight on the group’s ever-rising capital outlays that many in the market were already uncomfortable with.

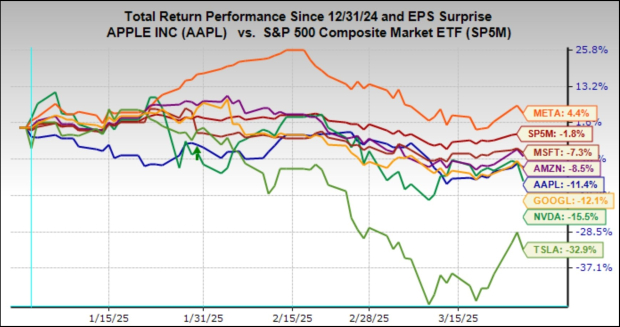

The chart below shows the year-to-date performance of these 7 stocks relative to the S&P 500 index.

Image Source: Zacks Investment Researchx

As you can see here, Meta Platforms (META - Free Report) is the only member of the group in positive territory, outperforming the S&P 500 index (down -1.8%), while Tesla (TSLA - Free Report) is at the bottom, having lost roughly a third of its value.

The rest of the group falls somewhere in the middle of the Meta and Tesla extremes, with Nvidia (NVDA - Free Report) and Alphabet (GOOGL - Free Report) positioned toward the bottom of the list, while Microsoft (MSFT - Free Report), Amazon (AMZN - Free Report), and Apple (AAPL - Free Report) are located in the top half.

With respect to Tesla’s underperformance, it is tempting to blame Elon Musk’s political activities for becoming a headwind for the stock. But there is no shortage of fundamental issues related to the company’s China exposure, trade/tariff vulnerabilities, and the evolving EV competitive landscape that has to also be at play here. Apple is another member of the group that has significant exposure to both China and the trade/tariff issue.

Beyond Tesla and Apple, the outlook for the remaining five members of the group is closely tied to the overall sentiment on the artificial intelligence theme. All stocks related to this broad AI theme have been under a cloud lately, but these AI leaders are particularly vulnerable to this development given their heavy spending on the effort.

The Magnificent 7 Earnings Outlook

One key aspect of the Mag 7 group’s earlier market leadership was its enormous earnings power and strong growth profile. The earnings outlook for the group was consistently positive last year, with analysts steadily raising their estimates.

Our reading of evolving earnings estimates for the group shows that the outlook is a lot less positive than had been the case in the recent past.

For 2025 Q1, the expectation is that Mag 7 earnings will increase +13.1% on +11.9% higher revenues. This would follow the group’s +31% earnings growth on +12.8% revenue growth in the preceding period.

For calendar year 2025, the expectation is that Mag 7 earnings will increase +12.6% on +9.5% higher revenues. This would follow the group’s +40.4% earnings growth on +13.9% revenue growth in 2024.

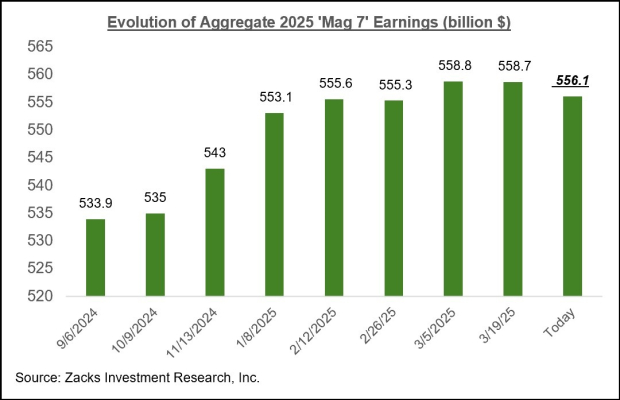

In the aggregate, the Mag 7 group is expected to bring in $556.1 billion in earnings, up from the 2024 aggregate total of $493.7 billion. The chart below shows how the aggregate 2025 earnings total has evolved in recent months.

Image Source: Zacks Investment Research

The levelling out of the revisions trend in the above chart reflects how estimates for Tesla, Apple, and Meta have been unfolding in recent days, with the outlook for the rest of the group still very much positive.

The Tech Sector Remains a Growth Driver

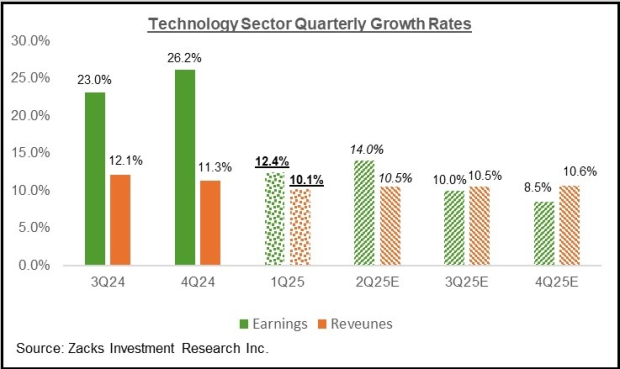

The Tech sector has been a significant growth driver in recent quarters, and we saw the same trend at play in 2024 Q4. For Q1, Tech sector earnings are expected to be up +12.4% from the same period last year on +10.1% higher revenues, the 7th quarter in a row of double-digit earnings growth.

This would follow the sector’s +26.2% earnings growth on +11.3% higher revenues in 2024 Q4. As the chart below shows, the sector’s growth trajectory is expected to continue in the coming quarters.

Image Source: Zacks Investment Research

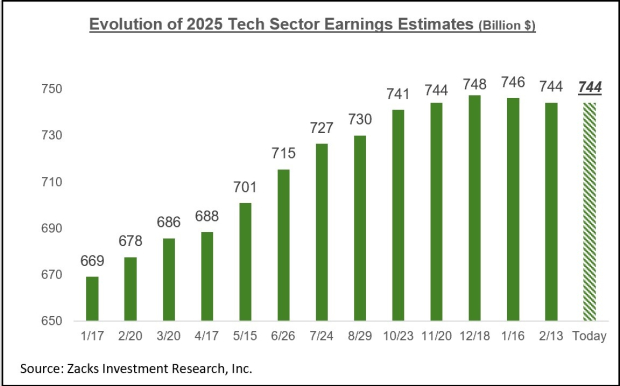

The Tech sector has also been among the few sectors that have steadily enjoyed an improving earnings outlook, with estimates increasing steadily over the past year. However, the more recent data on this count shows a shift in the revisions trend, with estimates for Q1 modestly under pressure since January, though they remain positive for the full year of 2025. You can see this in the chart below of aggregate 2025 earnings estimates for the sector.

Image Source: Zacks Investment Research

The Earnings Big Picture

The chart below shows expectations for 2025 Q1 in terms of what was achieved in the preceding four periods and what is currently expected for the next three quarters.

Image Source: Zacks Investment Research

As you can see in the above chart, total S&P 500 earnings for the current period (2025 Q1) are currently expected to be up +5.9% from the same period last year on +3.7% higher revenues.

Estimates for the period have been coming down since the quarter got underway, as the chart below shows.

Image Source: Zacks Investment Research

The revisions trend is broad-based, with estimates for 14 of the 16 sectors down since the start of January (Medical and Construction are the only sectors whose estimates have increased). Sectors suffering the most significant cuts to estimates include Conglomerates, Aerospace, Construction, Basic Materials, Autos, and others. Unlike other recent periods, estimates for the Tech sector have also been under pressure.

The chart below shows the overall earnings picture on an annual basis.

Image Source: Zacks Investment Research

As you can see, the expectation is for double-digit earnings growth in each of the next two years, with the number of sectors enjoying strong growth notably expanding from the narrow base we have been seeing lately.

In fact, 2025 is expected to have nearly all Zacks sectors enjoy earnings growth, with 6 of the 16 Zacks sectors expected to produce double-digit earnings growth. Unlike the last two years, when the Mag 7 group drove all or most of the aggregate earnings growth, we will have strong earnings growth in 2025, even without contributions from this mega-cap group.

More By This Author:

Making Sense Of Early Q1 Earnings ReportsLooking Ahead To The Q1 Earnings Season

The Earnings Impact Of The New Tariff Regime