BofA Beats Boosted By Buybacks As FICC Revenue Rebounds While NIM Tumbles

Continuing the barrage of Q4 bank earnings reports started with better than expected results by JPMorgan and Citi, and offset by the latest dismal report from Wells Fargo, moments ago BofA reported so-so Q4 earnings, with better than expected earnings driven by a surge in FICC trading, while overall revenue disappointed as the bank's consumer division disappointed as Net Interest Margin tumbled to a new all-time low.

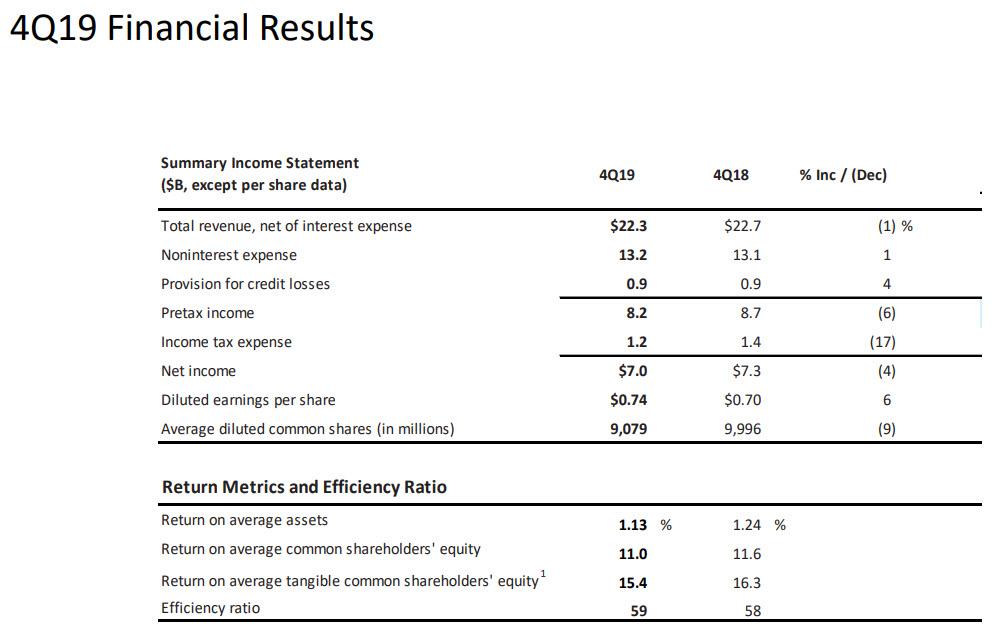

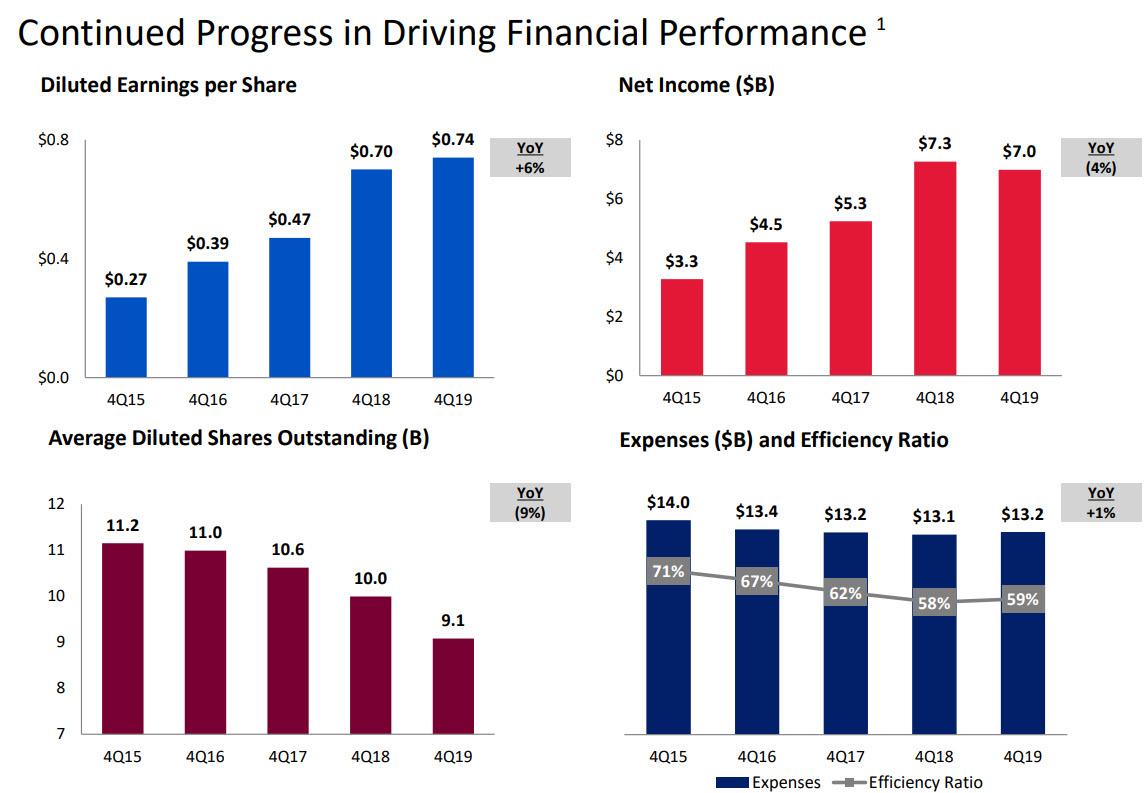

Starting at the top, BofA reported Q4 EPS of $0.74, beating expectations of $0.70, and up 6% from the prior year, even as revenues of $22.3BN declined 1% from $22.7BN one year ago, missing expectations of a $22.36BN print, with Net Income also declining to $7.0BN from $7.3BN.

But how did EPS rise 6% even as Net Income declined 4% Y/Y? Simple: the bank repurchased 9% of its shares outstanding while keeping its expenses flat.

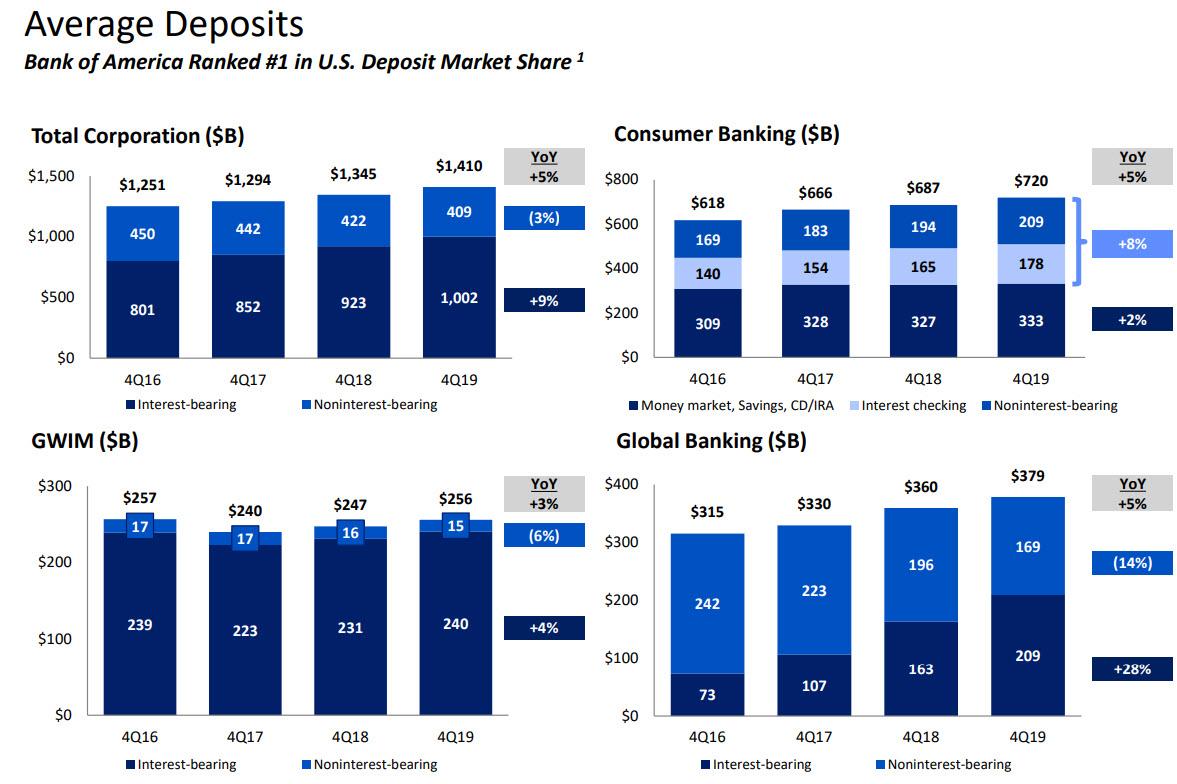

A quick look at the company's balance sheet reveals a continuation of historical trends, with total deposits up 5%...

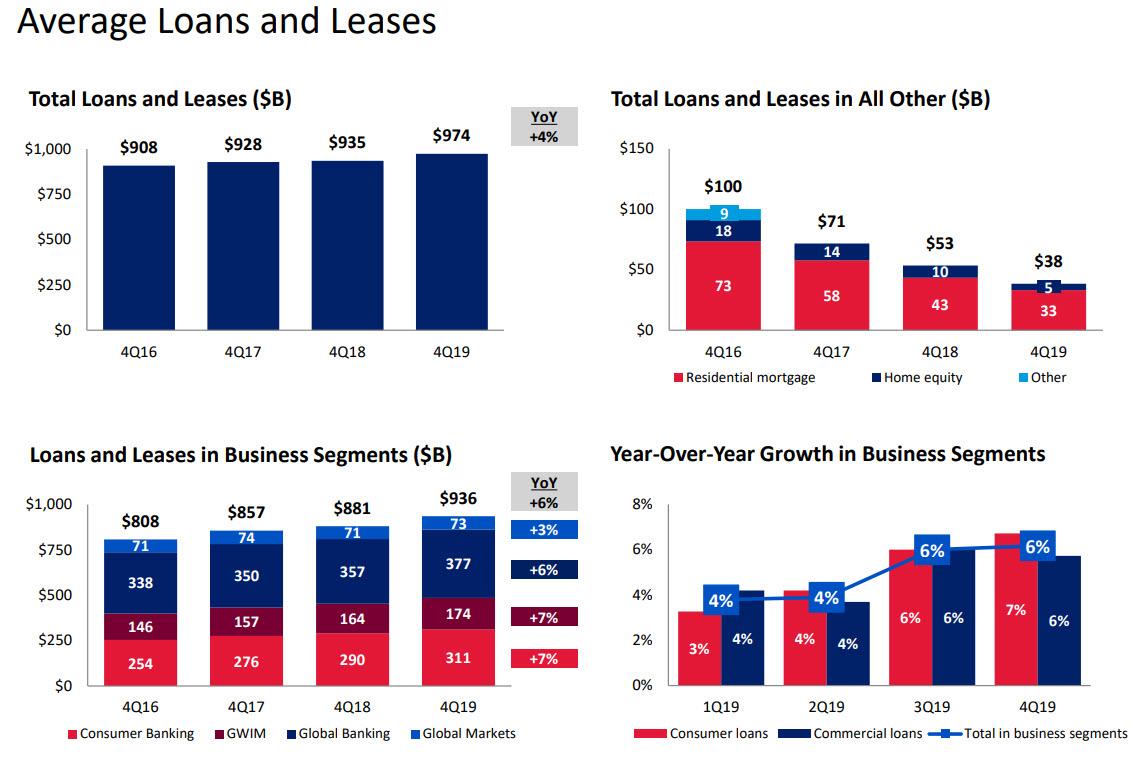

... while total loans and leases increased 4% Y/Y.

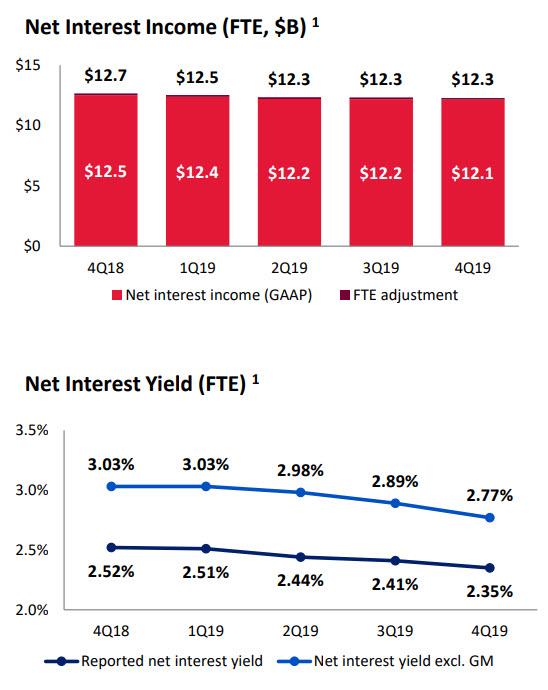

However, in a concerning similarity to Wells Fargo, BofA's Net Interest Income declined once again, with its net interest margin sliding to 2.35% from 2.41%, a fresh all time low. The good news: despite the ongoing slowdown, the bank's unadjusted net interest income of $12.1BN just barely beat expectations of $12.09BN. This is how the bank described this segment:

Net interest income of $12.1B ($12.3B FTE), "decreased $0.4B, or 3%, from 4Q18, driven primarily by lower interest rates, partially offset by loan and deposit growth." The NII declined modestly from 3Q19, as lower asset yields were partially offset by lower funding costs as well as benefits of loan and deposit growth. Worse, the net interest yield of 2.35% decreased 17 bps from 4Q18 and decreased 6 bps from 3Q19. And is where the Fed's rate cuts helped: the average rate paid on interest-bearing deposits declined 15 bps from 3Q19 to 0.61%.

“We enter 2020 with momentum,” CEO Brian Moynihan said in a statement, although one look at the chart below and one can see that he wasn't referring to the company's core Net Interest Income: indeed, the trend here shows NIM continuing to decline as the Fed is now terrified of ever again hiking rates.

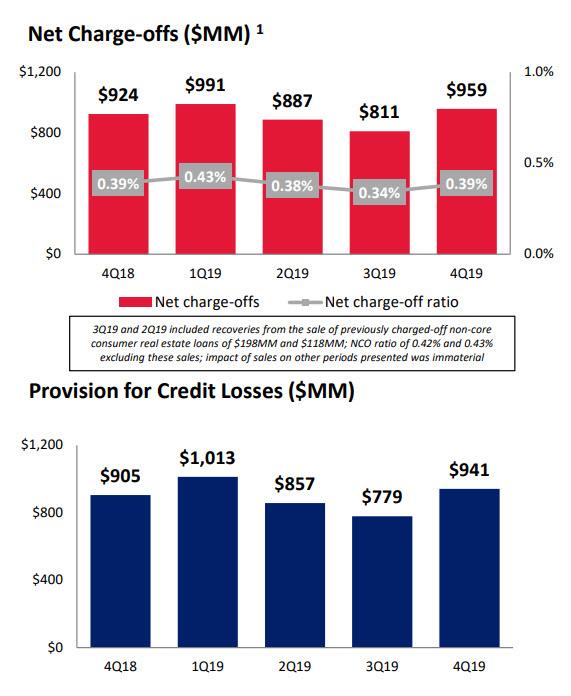

And balance sheet highlight: BofA's total net charge-offs in Q4 jumped to $959MM from $811MM in Q3, if modestly down from 3Q19, although one should note that the 3Q19 and 2Q19 included recoveries from the sale of previously charged-off non-core consumer real estate loans of $198MM and $118MM, resulting in NCO ratio of 0.42% and 0.43%. Excluding the loan sales in 3Q19, net charge-off ratio decreased 3 bps to 39bps.

Putting this together revealed a rather unpleasant picture, as net income at the bank's consumer division slid 9.7% to $3.11 billion as interest income fell, with revenue dropping 4% to $9.5B, driven primarily by lower NII.

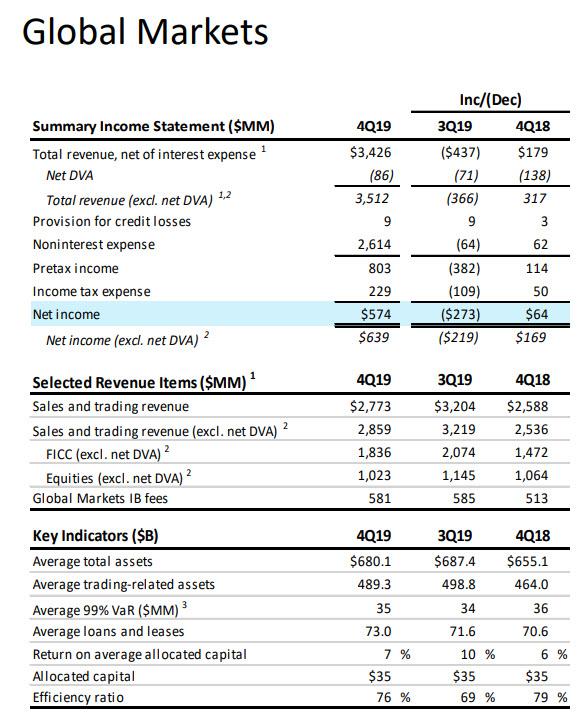

But if the bank's core business was the bad news, this was more than offset by the bank's Investment Banking and Markets results, as trading revenue climbed 13% to $2.86 billion, beating the estimate of $2.76 billion, helped by fixed-income activity even as equities trading disappointed. Here is the full breakdown:

- 4Q FICC trading revenue excluding DVA $1.84 billion estimate $1.68 billion, +25% y/y, "driven by an improvement in most products, particularly mortgages"

- 4Q equities trading revenue excluding DVA $1.02 billion vs estimate $1.08 billion, -3.3% y/y, "driven by lower levels of client activity in derivatives"

- 4Q trading revenue excluding DVA $2.86 billion, +13% y/y, estimate $2.76 billion.

Meanwhile, Bank of America’s investment-banking fees rose 9.3% from a year earlier to $581 million after a blockbuster third quarter, with the investment-banking division continuing its turnaround under Matthew Koder.

As Bloomberg notes, the fourth-quarter markets results were similar to those of JPMorgan which posted a record performance in bond trading Tuesday, and Citigroup Inc., where debt trading jumped by more than double what analysts had forecast.

The bottom line: Bank of America, and other banks which have solid trading desks and benefited from the Fed's launch of QE4 in the fourth quarter, managed to report (somewhat) stronger than expected results (also benefiting from massive stock buybacks), even as their core Net Interest Income continued to decline. Meanwhile, banks such as Wells which remain entirely dependent on NIM continue to sink as central banks have no choice but to cut rates ever lower to zero and below, and one should merely look to Deutsche Bank to find out how this all ends.

BofA's full presentation is below (pdf link)

Disclosure: Copyright ©2009-2020 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more