Boeing Tumbles After "Another Dreadful Quarter"

In another quarter, another dismal report from the deadly company best known for making airplanes such as the 737-MAX which was "designed by clowns, who are in turn supervised by monkeys.”

Three months after Boeing stock jumped when it unexpectedly reported its first positive cash flow since March 2019 despite another huge 787 charges, things are back to normal at the scandal-plagued jet maker and weapons giant, which has tumbled as much as 4% after reporting that adjusted free cash flow once again turned negative, and was worse than analysts’ projections with revenues also missing badly.

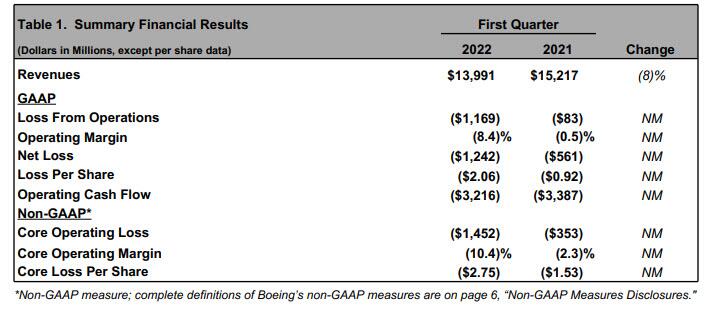

Here is what Boeing just reported, which as usual, was disappointing from top to bottom.

- Revenue of $13.99 billion, down 8% Y/Y, and badly missing the estimate of $15.94 billion

- EPS loss per share of $2.75 was far worse than the loss of $1.53 y/y, and a big miss to expectations of ($0.27)

We get airplane sales sucking, but how on earth could Boeing miss its "defense, space and security" revenue? Not enough wars?

Remarkably, as the following table from Boeing's earnings release shows, pretty much every Y/Y comparison is NM, which should tell you all you need to know about the company's headline financials.

And a prettier rendering:

Looking at revenue we get the following disappointing picture:

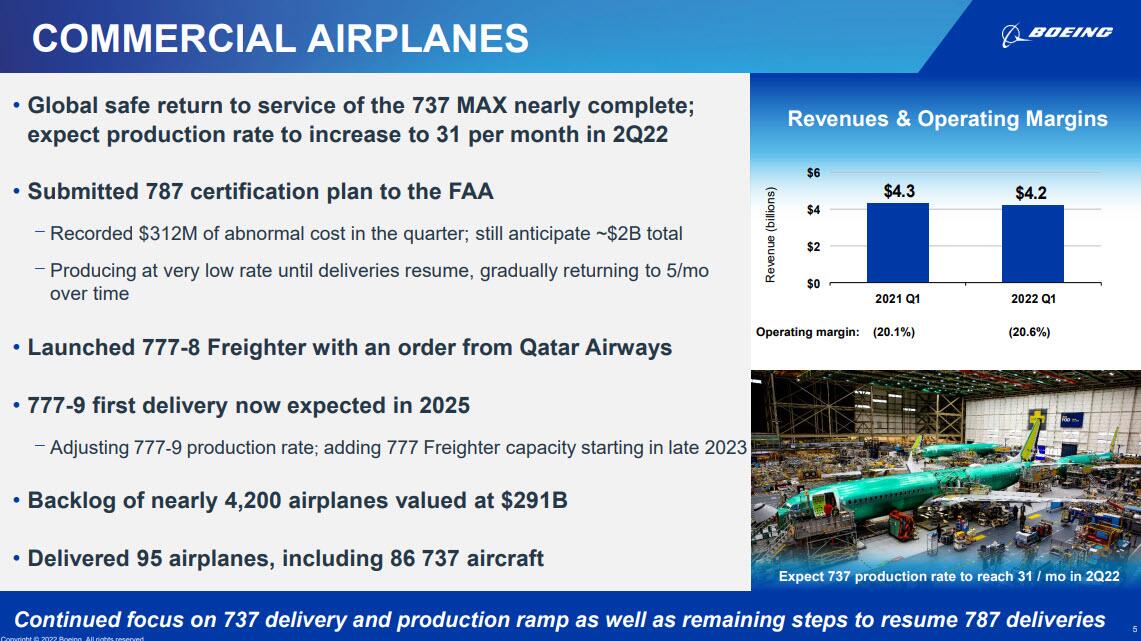

- Commercial Airplanes revenue $4.16 billion, -2.5% y/y, missing estimates of $4.78 billion

- Defense, Space & Security revenue $5.48 billion, -24% y/y, missing estimates of $6.84 billion

- Global Services revenue $4.31 billion, +15% y/y, beating the estimate of $4.19 billion

- Boeing Capital's revenue was $46 million, missing the estimate of $59.8 million

- Backlog $371 billion

Operating income was even worse:

- Commercial airplane operating loss of $859 million, +0.4% y/y, missing the estimated loss of $201.5 million

- Defense, space & security oper loss $929 million vs. profit of $405 million y/y, missing the estimated profit of $552.7 million

- Global services oper earnings $632 million, +43% y/y, beating the estimate of $564.6 million

- Boeing Capital's operating loss of $36 million, missing the estimated profit of $15.4 million

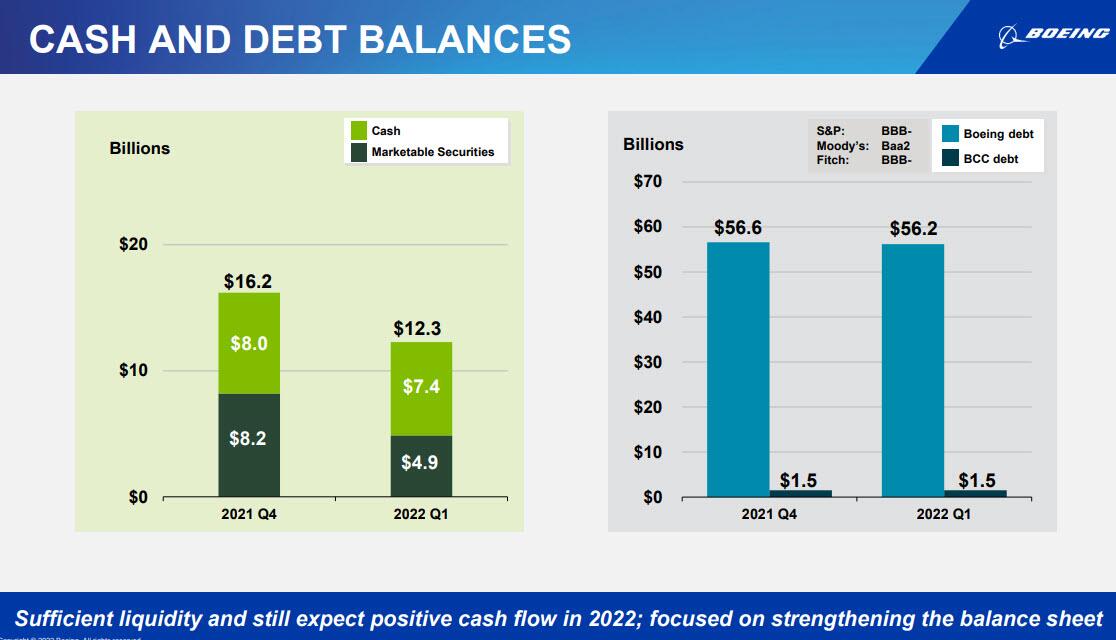

But the biggest disappointment was that after turning positive FCF in Q4 2021 for the first time since March 2019, the company's cash flow once again turned sharply negative, and missed expectations:

- Negative adjusted free cash flow of $3.57 billion, estimated negative $3.23 billion

- Negative operating cash flow of $3.22 billion, estimated negative $2.61 billion

Additionally, Boeing racked up about $1 billion in new accounting charges for its defense division.

And adding insult to injury, Boeing also said it was pausing production of its 777X jetliner through 2023 and postponing the initial delivery of the hulking twin-engine aircraft to 2025. The accounting charge shows the risks that high inflation poses to Boeing’s strategy last decade of counting on its once-robust commercial business to help it aggressively underbid competitors for defense franchises. The company wrote off $691 million weeks after winning contracts for the U.S. Air Force trainer and a Navy refueling drone in 2018.

In short, just another quarter of non-stop bad news, even if CEO Calhoun tried to put at least a modest favorable spin:

“The first quarter presented new challenges for our world, our industry, and our business,” Chief Executive Officer Dave Calhoun said in a memo to employees. “Despite the current environment, we continue to make important progress toward our key commitments.” Of course, looking forward Calhoun remains optimistic that the company will generate cash on an annual basis this year for the first time since 2018. Not like he would say anything else that is.

The CEO said Boeing has filed a certification plan with U.S. authorities for the Dreamliner and completed the required work to address tiny structural flaws in an initial batch of the carbon-fiber jets. Test flights have begun, he added without specifying what other tasks remain or when Dreamliner handovers will resume.

According to Bloomberg, the results highlighted the magnitude of issues facing the planemaker, stretching beyond the 787 delays to include the impact of war, inflation, and tougher regulatory scrutiny in the wake of two fatal 737 Max crashes.

Boeing is also facing pressure in its defense and space division - yes, despite World War III raging, Boeing is still having challenges making money in defense - whose longtime CEO, Leanne Caret, stepped down at the end of March. Inflation and Covid-19 accelerated the company’s losses on two fixed-price contracts: retrofitting 747 jumbos for the next Air Force One fleet and developing a T-7A jet to train U.S. Air Force pilots.

There was some good news in that Boeing reduced its debt modestly in Q1 compared to a year ago, but that was only on a total basis. On a net basis, when looking at the $4 billion drop in company cash, the company's net leverage actually rose!

“This was another dreadful quarter from Boeing,” Robert Stallard, an analyst with Vertical Research Partners, said in a note. “And what we think will really worry investors is that we keep getting more bad news.”

The market agreed, and shares which have been a one-way street lower this year, tumbled 3.6% in premarket trading. This is remarkable because investors had already been bracing for a poor quarterly showing, sending Boeing shares to a 52-week low Tuesday after General Electric Co. and Raytheon Technologies Corp. warned of supplier strains and spiking costs for raw materials. Well, the numbers were even worse than expected.

(Click on image to enlarge)

Boeing's full Q1 earnings presentation is below (pdf link).

Disclosure: Copyright ©2009-2022 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more