Boeing Stock Set For A Ride As NASA Progresses In Artemis II Program

Image: Bigstock

Key Takeaways

- NASA's Artemis II mission hit major milestones, with Boeing being a core contractor in the SLS rocket program.

- Boeing's Defense, Space & Security arm made up 36% of revenues in 2024, anchoring its diversification strategy.

- Boeing's sales are projected to grow 25.6% in 2025 and 16.2% in 2026.

NASA’s Artemis II mission, the first crewed flight in its lunar return program, which is set to launch in April 2026, has reached critical milestones in recent months, reigniting investor interest in aerospace giant Boeing (BA - Free Report), a key contractor in the Space Launch System (SLS) program.

On July 2, 2025, NASA announced on its Facebook page that the Program Specific Engineering Test for the Artemis II core stage had been completed. In early June, the Artemis II team conducted its first mission simulation to rehearse lunar science operations for the upcoming crewed mission.

Earlier, in March, the integration of the Artemis II SLS core stage with its solid rocket boosters was successfully completed, which was another key milestone in preparing the rocket for launch.

To this end, it is imperative to mention that the SLS rocket, designed to carry astronauts farther into space than ever before, is led by Boeing as the prime contractor for its core stage, upper stage, and avionics systems. The jet giant is currently building the core stages for all future Artemis missions.

Thus, for Boeing, Artemis II represents more than just a technological triumph — it’s a strategic revenue driver. With the company’s Defense, Space & Security segment accounting for nearly 36% of total revenues in 2024, space programs like Artemis are key to Boeing’s efforts to gain from a diversified portfolio beyond its struggling commercial aviation business and provide it with a significant financial cushion.

With Artemis II on track, NASA’s commitment to sustaining the Artemis program through Artemis III and beyond implies recurring revenue potential for Boeing over the long run, given its deep involvement in every SLS flight configuration. As investor interest in space stocks has been gaining increasing traction these days, the continued success of the Artemis mission should strengthen Boeing's positioning in the $500 billion gloBoeingl space economy and offer a promising growth vector for its shares.

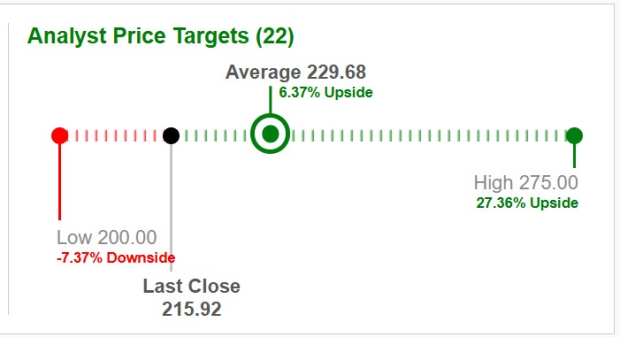

The potential upside reflected in Boeing’s price target further supports this thesis. Boeingsed on short-term price targets provided by 22 analysts, the average Zacks price target for Boeing implies a 6.4% upside from its recent closing price.

Image Source: Zacks Investment Research

Other Space Stocks Warrant a Look

Other stocks involved in the SLS program and Artemis missions, like Lockheed Martin (LMT - Free Report) and L3Harris Technologies Inc. (LHX - Free Report), also stand to benefit from the steady progress of the Artemis II mission.

Notably, Lockheed is the prime contractor involved in the construction of Orion, the spacecraft that will carry the crew of four astronauts in the Artemis II mission. In May 2025, Lockheed achieved a significant milestone in the development of NASA's Orion spacecraft by officially transferring it to NASA's Exploration Ground Systems team, following the completion of the spacecraft’s assembly and testing.

On the other hand, L3Harris is involved in the Artemis II mission through its Aerojet Rocketdyne business unit, which provides the RS-25 engines that power the SLS core stage. In May 2025, Aerojet Rocketdyne completed installation of all four RS-25 main engines on the core stage of NASA’s second SLS exploration rocket, which will be used in the Artemis II mission.

The Zacks Rundown for Boeing

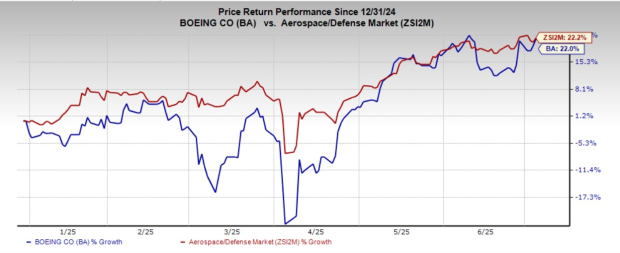

Shares of Boeing have risen 22% year-to-date compared with the industry’s growth of 22.2%.

Image Source: Zacks Investment Research

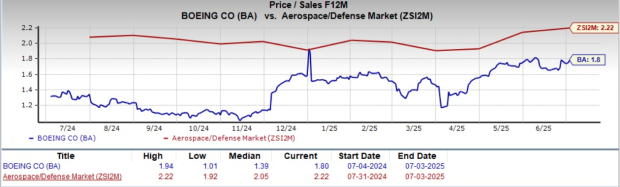

From a valuation standpoint, Boeing has been trading at a forward 12-month sales multiple of 1.80X, a roughly 18.9% discount when stacked up with the industry average of 2.22X.

Image Source: Zacks Investment Research

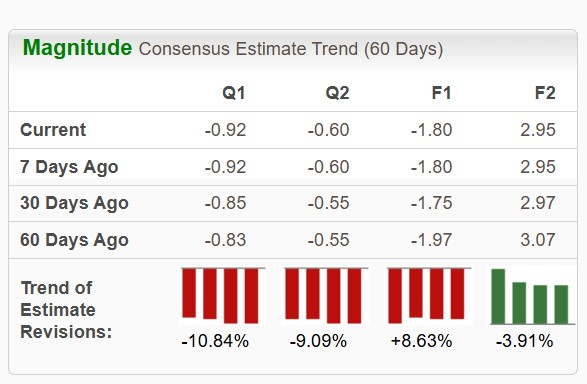

The Zacks Consensus Estimate for Boeing’s 2025 and 2026 sales implies a year-over-year uptick of 25.6% and 16.2%, respectively. The estimate for its earnings per share for 2025 has moved north over the past 60 days, while the estimate for 2026 has moved south.

Image Source: Zacks Investment Research

Boeing stock currently carries a Zacks Rank #3 (Hold) rating.

More By This Author:

Focus On 3 Stocks That Recently Announced Dividend HikesPayroll Stocks To Watch As June's Jobs Report Comes In Strong

Ford Vs GM: Which Auto Stock Is The Better Investment After Revealing Q2 Sales?

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any ...

more