Boeing Seeks 'Tens Of Billions' In Bailouts After Fully Drawing-Down $13Bn Credit Line

A new disclosure on Tuesday afternoon details yet another troubling development for Boeing.

In its latest 8K, the plunging planemaker has completely drawn down its $13.8 billion credit line that it entered in October 2018 as it "navigates current business challenges" exposing just how fast this company is burning through cash.

"As of March 13, 2020, Boeing has fully drawn on the Credit Agreement, consisting of approximately $13.8 billion, which amount includes additional commitments made subsequent to the initial closing date.

For additional information on the terms and conditions of the Credit Agreement, see Boeing's Current Report on Form 8-K dated February 6, 2020.

We continue to have access to revolving credit agreements entered into on October 30, 2019, which have also been disclosed. These facilities, which to date have not been drawn upon, provide us with additional liquidity as we navigate the current business challenges. For additional information on these credit facilities, see Boeing's Current Report on Form 8-K dated October 30, 2019."

This comes just hours after sources told Reuters that Boeing is seeking a bailout of 'tens of billions' in US government loan guarantees amid the Covid-19 crisis.

President Trump has already been on record telling airlines that his administration is prepared to pledge $50 billion in support after passenger activity has fallen off a cliff due to the virus scare.

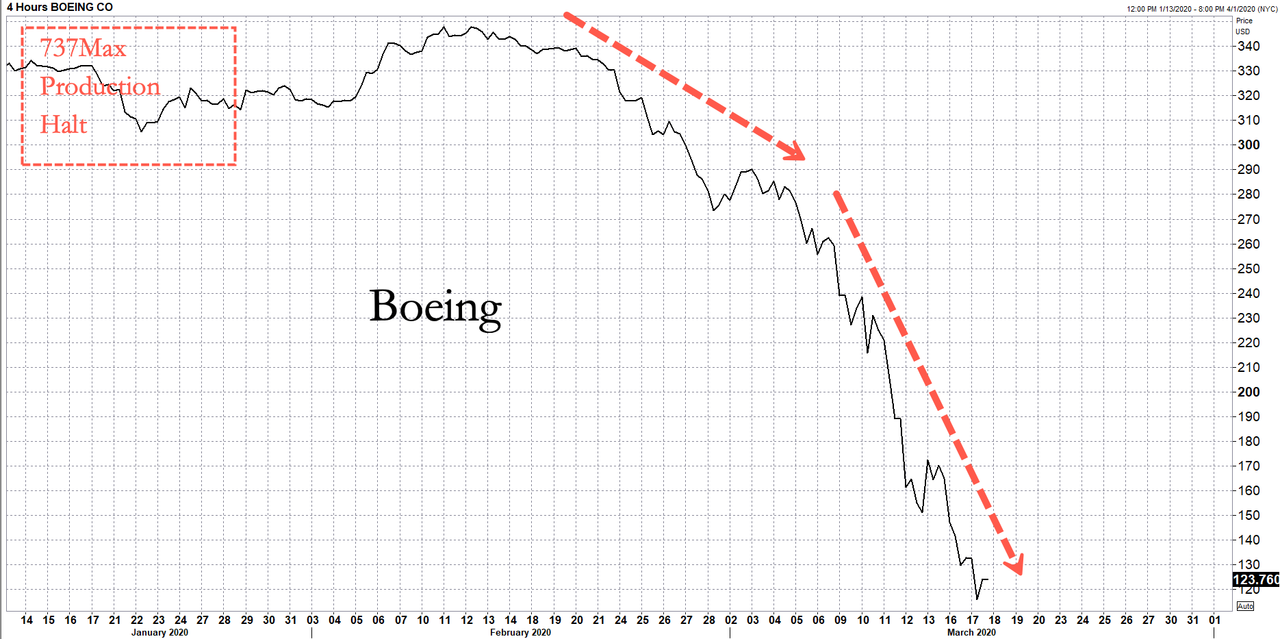

Boeing was struggling before the virus outbreak, dealing with 737 Max groundings, production halts, and cancellation orders.

(Click on image to enlarge)

Boeing shares have dropped 64% in the last 23 sessions.

As we raged previously, this bailout demand comes after the company blew nearly $100 billion on stock buybacks since 2013 helping push its stock to all-time highs not that long ago, and instead of selling stock to get liquidity, they're asking the Trump administration for a massive bailout.

(Click on image to enlarge)

Because it's called capitalism, and because there is no reason why taxpayers should foot the bill for a company which instead of saving cash when times were good, was handing it out to shareholders and a handful of executives, and which should now for some insane reason be eligible for a bailout when times suddenly go bad.

No: force Boeing - and others like it that spent billions repurchasing its stock while incurring massive amounts of debt - to sell its stock. After all that's what a public company's stock is - a currency - and just as Boeing could repurchase it when it had cash, and lifted its stock price to all-time highs, it should now sell its stock and use the proceeds to fund itself, like any other corporation does when it needs funding. Last time we checked, Boeing's market cap was $73 billion, and it certainly afford to drop much more as the company now does the buyback in reverse.

This is also a warning to Congress and the White House: if chronic stock repurchasers such as Boeing, are bailed out instead of ordered to find their own sources of liquidity, there will be a mutiny in America and rightfully so, because it was Boeing's shareholders that got rich on the way up, and now it is somehow up to taxpayers to make sure the company, loaded up with record amounts of debt used to fund buybacks, survives one more quarter.

That, in a word, is bullshit.

Disclaimer: Copyright ©2009-2020 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more

At the end of the day, #Boeing is too big too fail. $BA