Boeing Found Sellers After Elliott Wave Zig Zag Pattern

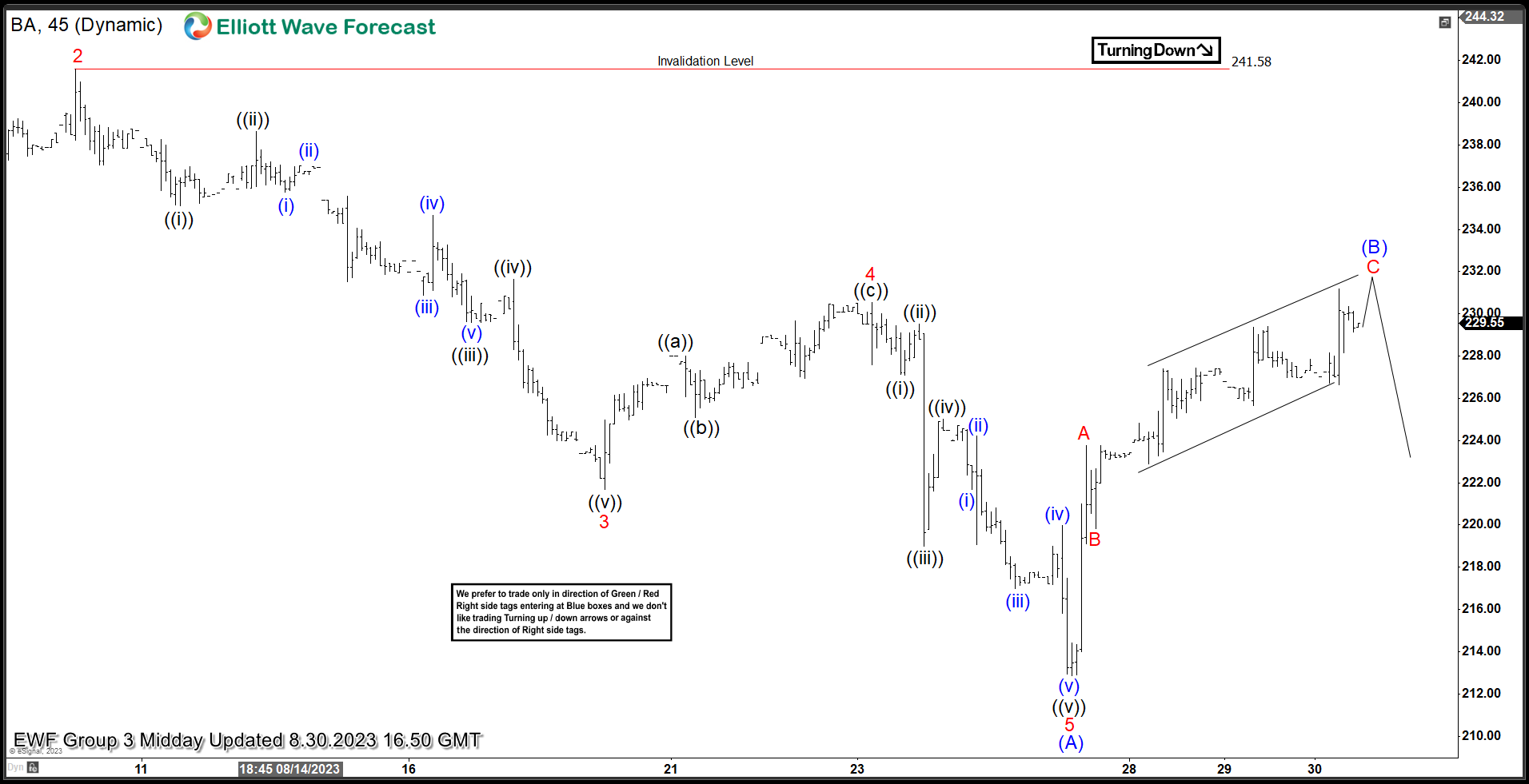

BA H1 Elliott Wave Analysis 08.30.2023

BA is showing 5 waves down from the July peak (243.26). That indicates the stock ended only first leg of the larger pull back and we should ideally see further weakness once (B) blue recovery completes. Wave (B) correction looks to be unfolding as Elliott Wave Zig Zag pattern. First leg A of (B) is impulsive, sharp rally, while C leg seems to be unfolding as Ending Diagonal pattern. Approximate area where (B) can end is equal legs A-B red that comes at 229.95-232.51. We don’t recommend buying the stock and expect to see decline in a 3 waves pull back at least or toward new lows ideally.

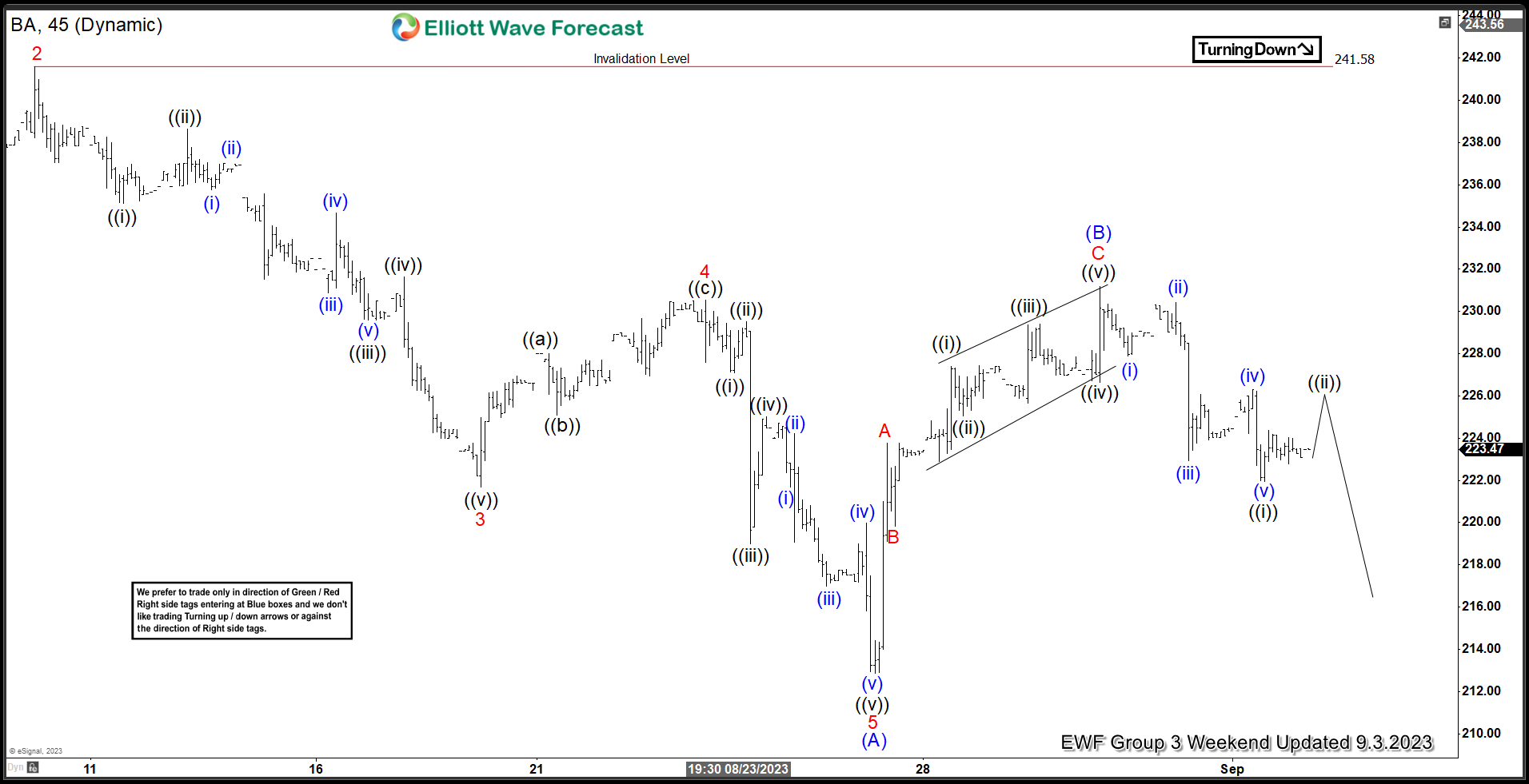

BA H1 Elliott Wave Analysis 08.30.2023

The stock made decline from the equal legs area 229.95-232.51 as expected. As far as the price stays below 231.2 high, we can count correction completed. However , we would like to see further separation lower and break of 08/25 low to confirm next leg down is in progress. Decline from the 231.2 peak looks like 5 waves which means we should ideally get further decline after 3 waves bounce ends.

Keep in mind market is dynamic and presented view could have changed in the mean time. You can check most recent charts in the membership area of the site. Best instruments to trade are those having incomplete bullish or bearish swings sequences. We put them in Sequence Report and best among them are shown in the Live Trading Room.

More By This Author:

FTSE Rally Expected To Turn LowerProcter & Gamble Next Investment Opportunity

Apple 3 Waves Corrective Rally in Progress

Disclaimer: Futures, options, and over the counter foreign exchange products may involve substantial risk and may not be suitable for all investors. Leverage can work against you as well as for ...

more