Blue Chip Stocks In Focus: V. F. Corporation

There is no exact definition for blue chip stocks. We define it as a stock with at least 10 consecutive years of dividend increases. We believe an established track record of annual dividend increases going back at least a decade, shows a company’s ability to generate steady growth and raise its dividend, even in a recession.

As a result, we feel that blue chip stocks are among the safest dividend stocks that investors can buy.

This installment of the 2022 Blue Chip Stocks in Focus series will analyze the apparel company V.F. Corporation (VFC) in greater detail.

Business Overview

V.F. Corporation is one of the world’s largest apparel, footwear, and accessories companies. Its core brands include The North Face, Vans, Timberland, and Dickies. The company has been around since 1899 and has transformed a lot in the more than 120 years since.

The company was first named the Reading Glove and Mitten Manufacturing Company. During the 1960s, the company changed its name to V.F. Corporation. The company has a diverse product portfolio, which consists of many leading apparel brands.

In 2019, V.F. Corp separated its VF’s Jeanswear organization, including the Wrangler, Lee, and Rock & Republic brands. The separation was completed via a 100% distribution of shares to V.F. Corp shareholders, with the new entity named Kontoor Brands trading as an independent, publicly-traded company under the ticker KTB.

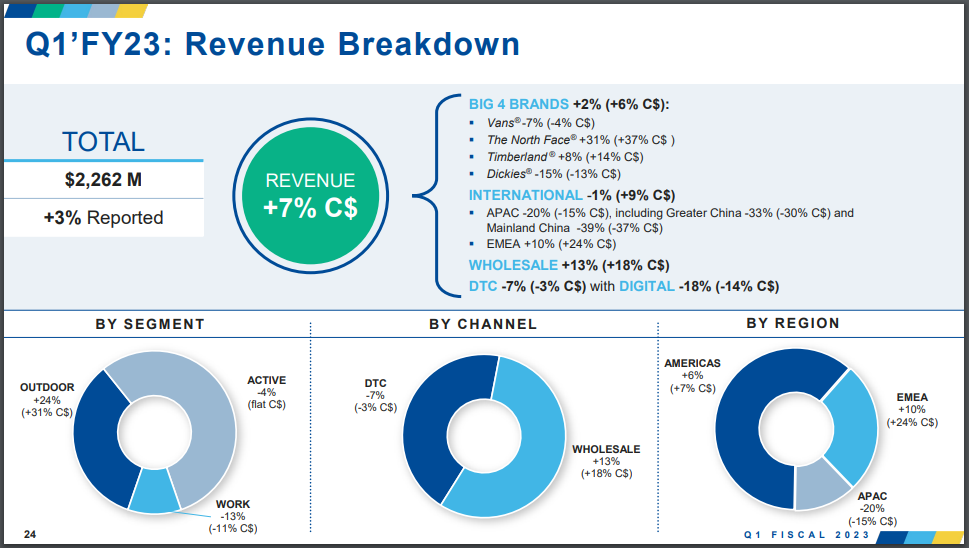

V.F. Corp reported first-quarter FY 2023 results on July 28th, 2022. In the quarter, revenue came in at $2.3 billion, a 3% increase, driven by strength in The North Face brand, and growth in the EMEA region.

Source: Investor Presentation

Operating income equaled $63.4 million compared to $202.9 million previously. Adjusted earnings-per-share equaled $0.09 and was down 68% year-over-year. V.F. Corp also updated its fiscal 2022 guidance, anticipating adjusted earnings-per-share of approximately $3.10, down from previous guidance.

Growth Prospects

V.F. Corp will continue to focus on its four core brands, The North Face, Vans, Timberland, and Dickies. In the first quarter, the corporation’s outdoors brands performed strongly compared to the priory year. The North Face grew sales by 31% year-over-year, and Timberland had sales growth of 8%. In constant currency, growth was even higher at 37% and 14%, respectively.

The company also has a focus on acquisitions, which has made the company what it is today. One recent example is the acquisition of Supreme in December 2020, a popular global streetwear brand, for $2.1 billion. In years prior, the company partnered with Supreme on products related to its Vans, The North Face, and Timberland brands, so it was already an established fit.

As a result of the pandemic, many companies accelerated their digital platforms to capture the share of transactions occurring through online shopping. Digital direct-to-consumer (DTC) sales grew 14% in fiscal 2022. However, in the most recent quarter, digital DTC sales decreased by 18% compared to the prior-year quarter. Time will tell, but it is a potential growth catalyst if the company can get it right and reach their consumers on a massive scale.

Earnings growth, for the time being, will be weighed down by margin pressures amid supply chain disruptions and higher freight costs. The company will attempt to offset this through price increases. The company has now caught up on inventory, but softness in consumer demand is beginning to show. It is possible that interest rate hikes and runaway inflation in other spending categories for consumer could dampen this demand even further.

We estimate that V.F. Corp will grow earnings-per-share at a rate of 7% annually in the intermediate term.

Competitive Advantages & Recession Performance

V.F. Corporation sports a few competitive advantages which has enabled the company to continue growing profitably for so many years. The corporation has multiple strong billion-dollar brands which lead in their categories and offer pricing power.

Additionally, the company’s products (apparel) have not changed much in the past century. As a result, V.F. Corp is not required to invest heavily in research and development and can use those funds for other purposes.

As a result, V.F. Corp is a profitable company, even throughout economic downturns. This profitability has allowed for V.F. Corp to raise its dividend through the Great Recession and the COVID-19 pandemic.

The company’s earnings during the Great Recession are below:

- 2007 earnings-per-share of $1.35

- 2008 earnings-per-share of $1.39 (3% increase)

- 2009 earnings-per-share of $1.29 (7% decline)

- 2010 earnings-per-share of $1.61 (25% increase)

V.F. Corp faced an earnings decline in 2009, however it was quite mild given what the majority of companies experienced at the time. And in 2010, the company already surpassed its pre-recession earnings and continued to grow beyond.

During the coronavirus pandemic, the company faced a large earning decline. Still, the company remained profitable, and it raised its dividend, which kept its dividend increase streak intact. However, the dividend was not covered in the year. In 2021, earnings returned to a more normalized level, and the dividend was again well-covered.

Valuation & Expected Returns

Shares of V.F. Corporation have traded for an average price-to-earnings multiple of around 21.5. Shares are now trading below this average, which indicates that shares could be undervalued at the current 14.5 times earnings.

Our fair value estimate for V.F. Corp stock is 19.0 times earnings. If this proves correct, the stock will benefit from a 5.5% annualized gain in its returns through 2027.

Shares of V.F. Corp currently yield 4.4%, which is above its 10-year average yield of 2.3%. On a dividend yield basis, VFC shares seem to be trading below fair value.

The current dividend payout is adequately covered by earnings, with room to grow. Based on expected fiscal 2022 earnings, VFC has a payout ratio of 65%. We anticipate low single-digit dividend increases in the years to come.

Putting it all together, the combination of valuation changes, EPS growth, and dividends produces total expected returns of 15.6% per year over the next five years. This makes V.F. Corporation a buy.

Final Thoughts

V.F. Corporation has restructured its brand portfolio following the divestiture of its jeans businesses and has since made acquisitions such as Supreme, which it had previously partnered with to create products.

The North Face brand is really the shining star in the recent quarter, with phenomenal revenue growth. Its largest brand, Vans, faced some decline. Given the company’s share price decline, resultant increased dividend yield, and forecasted earnings growth, the stock earns a buy rating.

The Blue Chips list is not the only way to quickly screen for stocks that regularly pay rising dividends.

More By This Author:

Blue Chip Stocks In Focus: 3M Company

Blue Chip Stocks In Focus: Enterprise Bancorp, Inc.

Blue Chip Stocks In Focus: Tyson Foods