Blue Chip Stocks In Focus: Roche Holding AG

Image Source: Unsplash

When examining blue chip stocks, rarely do international companies get brought up. American stocks have historically exhibited an edge when it comes to shareholder value maximization. However, there are multiple overseas companies with an established track record of value creation and robust performance even during the harshest times.

One such company is Roche Holding AG. With the Swiss healthcare behemoth having grown its dividend for 35 consecutive years, Roche Holding fits our criteria to classify it as a blue chip stock. Sustaining prolonged dividend growth track records is not as common internationally as it is in the United States. Thus, investors who are looking for such companies outside of the United States in order to diversify their holdings have limited options.

As a result, companies such as Roche Holding are rather rare to encounter. Fortunately, we include more than a few international stocks with prolonged dividend growth track records in our Sure Analysis Database.

This installment of the 2022 Blue Chip Stocks In Focus series will analyze Roche Holding AG (RHHBY)

Business Overview

Roche Holding is a research-based healthcare giant headquartered in Switzerland. With its roots dating back to 1896, Roche has grown from producing vitamin preparations to a multinational company with over 100,000 employees. Roche’s operations can be divided into two segments.

The Pharmaceutical segment comprises Genentech and Chugai primarily. Genentech is an American biotechnology company, and Chugai is a Japanese biotechnology company. Thanks to its Pharma Division’s broad-based portfolio, Roche is one of the leading providers of clinically differentiated medicines worldwide.

The Diagnostics division comprises four segments: Centralized and Point Care Solutions, Molecular Diagnostics, Tissue Diagnostics, and Diabetes Care. The company offers the industry’s most comprehensive in vitro diagnostics testing portfolio along with clinical decision support, consultancy, digital diagnostics, disease management, laboratory automation, and software solutions, amongst other services, to over 100 countries.

United States investors can prompt an ownership stake in Roche Holding via American Depository Receipts that trade over-the-counter (OTC) under the ticker RHHBY. The company reports all its financial figures in Swiss francs. We converted all figures in this article to US dollars.

Despite the hardships prevalent in the present trading environment (e.g., surging inflation, global growth rates slowing down, etc.) that could negatively affect the financials of various companies, Roche’s operations should be able to stay solid due to its necessity-type (for those in need) business model. This was exhibited in the company’s latest earnings report.

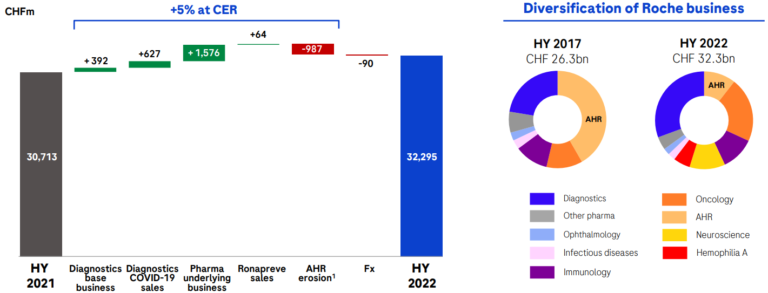

The company released its half-year 2022 results update on July 21, 2022. The group posted sales of $34 billion, a year-over-year increase in constant currency. Higher revenues were mainly driven by Diagnostics’ strong performance, with the segment’s revenues increasing by 11% compared to last year. Diagnostics saw robust growth in the Asia Pacific and North America regions despite a higher base in 2021 due to COVID-19.

Source: Investor Presentation

In addition, pharmaceutical revenues grew by 3% year-over-year, driven by Roche’s ongoing portfolio rejuvenation. As part of this portfolio transformation, Roche successfully launched Vabysmo and Susivmo in ophthalmology, helping offset the effect of biosimilars.

Based on Roche’s financials during the first half of the year and its ongoing portfolio developments, we expect earnings-per-share of $2.76 for fiscal 2022.

Growth Prospects

Roche’s bottom line has been expanding relatively consistently over the years, with cancer drugs Herceptin, Rituxan, and Avastin, helping the company’s earnings-per-share to grow by a CAGR of 10.2% over the past five years. For context, Roche’s earnings-per-share CAGR since 2011 stands at 4.3%.

Biosimilars have notably affected the performance of all three drugs, with sales down 28% for Herceptin and 37% for Avastin in H1-2022. However, the company’s reliance on cancer drugs is slowing down as new product sales accounted for over 50% of all Pharmaceutical sales in Roche’s latest report, with Hemlibra being the stand-out performer.

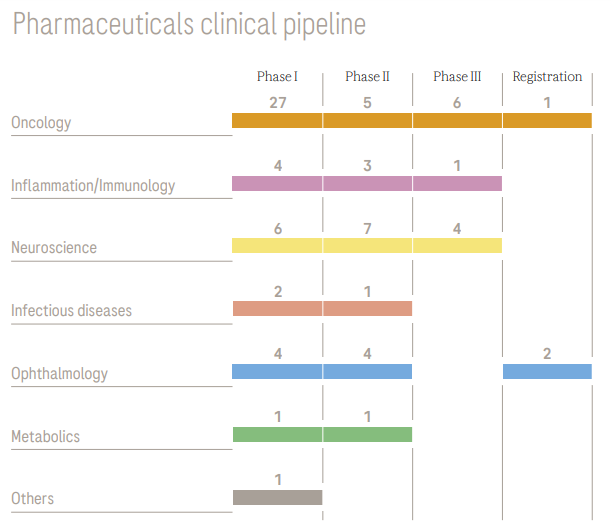

Further, new medicines continue to deliver strong growth in all regions, offsetting the impact of biosimilars. Additionally, with 80 new molecular entities in its clinical pipeline that cover a broad range of diseases, Roche is investing heavily in its future growth prospects.

Source: Annual report

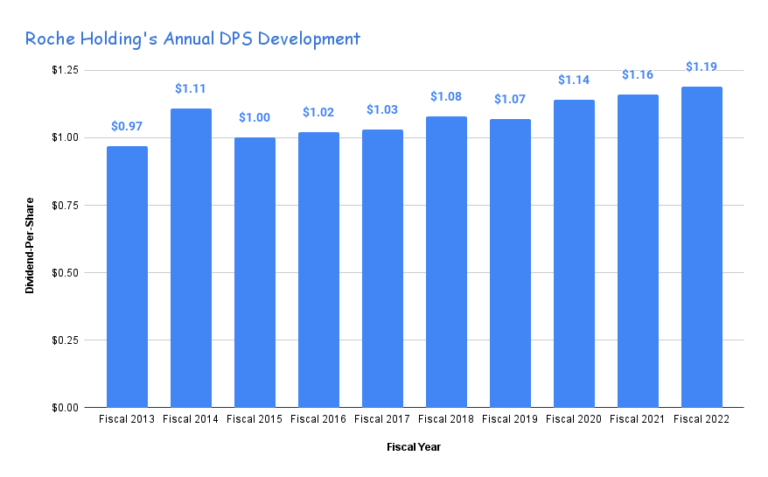

Still, with its business model requiring tons of R&D spending, the company expects earnings-per-share to grow in the low single-digit sales. Regarding its dividend, Roche has maintained its impressive dividend growth streak and has again committed to further increasing the dividend for the 36th straight year.

U.S-based investors may notice a slightly lower dividend in some years, like in 2015 and 2019, due to FX fluctuations affecting the dividend in US dollar terms. But in local currency, the dividend has indeed been growing.

Even in local currency, however, the dividend-per-share has grown at a 10-year CAGR of just 3.2%. Roche is a very mature company and a capital-intensive one. Thus, dividend growth must be managed prudently. Investors should continue to expect future dividend hikes to remain in the very low single digits.

Source: SEC filings, Author

Competitive Advantages & Recession Performance

Healthcare is a competitive sector, but the primary competitive advantage for Roche is its world-class R&D department. Last year, the company had 16 Phase III trials initiated and 18 new molecular entities in late stages. They have also been researching novel techniques to cure diseases such as Alzheimer’s using quantum computing.

In addition, Roche can accelerate future growth through acquisitions; for example, in 2019, they made a significant acquisition of Spark Therapeutics, and in 2020, they also acquired companies such as Stratos Genomics.

As a European Dividend Aristocrat with 35 (and soon 36) years of consecutive dividend increases, Roche has demonstrated resilience to withstand recessions and increase harsh trading periods. It makes sense, after all, since its products are vital for its patients and thus recession-proof.

You can see a rundown of Roche Holding’s earnings-per-share from 2007 to 2011 below:

- 2007 earnings-per-share of $10.07.

- 2008 earnings-per-share of $9.80.

- 2009 earnings-per-share of $8.76.

- 2010 earnings-per-share of $10.85.

- 2011 earnings-per-share of $11.77.

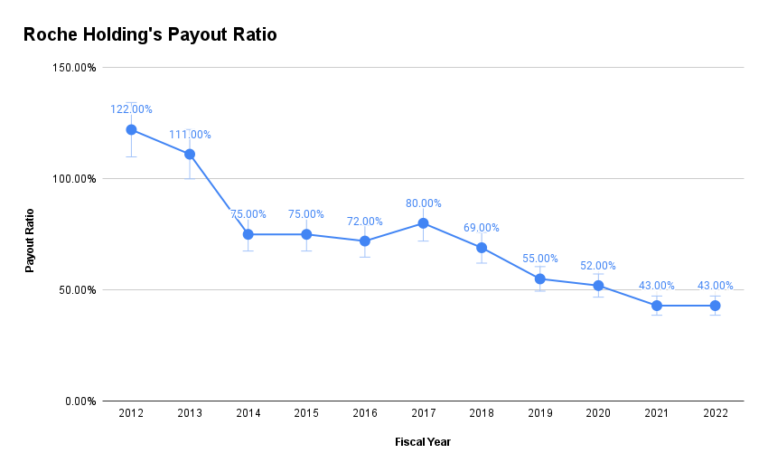

As you can see, Roche’s earnings-per-share were hardly affected even during the Great Financial Crisis due to the necessity-type nature of its business model. It’s worth noting that due to earnings growth outpacing dividend growth over the past decade, Roche’s payout has significantly improved during the past decade.

Source: SEC filings, Author

With earnings and dividend growth likely to remain in the very low single digits moving forward, we expect a similar payout ratio to be maintained through the medium term.

Valuation & Expected Returns

Roche shares have traded with an average price-to-earnings ratio of 19.3 over the last five years. We have set our 2027 target P/E at 18 to reflect management’s expectations of softer earnings-per-share growth in the coming years. The stock has recently been trading at a P/E of 15.2, implying the potential for a valuation tailwind nonetheless.

Assuming the price-to-earnings multiple expands from 15.2 to 18, future returns would be amplified by 3.5% per annum over the next five years. Combined with our expectations for EPS & DPS growth of roughly 3% per annum over the medium-term and the 2.8% yield, we forecast an annualized return potential of 8.9% through 2027.

Accordingly, we rate Roche Holding stock a hold.

Final Thoughts

Roche Holding features attractive traits and competitive advantages that can encourage investors, especially during the current volatile environment. Earnings and sales have grown over the last ten years, and the company has an impressive dividend growth track record spanning over three decades.

However, Roche does carry some risks. The healthcare sector is inherently competitive, and biosimilars and capital investments continue to impact the company’s bottom line. Further, while the FX rate between the Swiss franc and the US dollar has been very steady over the years, fluctuations can still somewhat impact Roche’s total return potential either way for U.S.-based investors.

Still, with noteworthy total return prospects ahead and robust qualities that have been demonstrated through various market cycles over the decades, Roche is blue chip stock that should serve investors looking for international exposure in their portfolios rather well.

More By This Author:

Blue Chip Stocks In Focus: Community Trust Bancorp, Inc.Blue Chip Stocks In Focus: V. F. Corporation

Blue Chip Stocks In Focus: 3M Company

To explore different blue chip companies, including international ones, we have created a list of 350+ blue-chip stocks, which you ...

more