Black Candlesticks Are A Warning, But Not Necessarily A Reversal

When you see 'black' candlesticks; i.e a higher open, a lower close, but a close still above the prior day's close - you need to pay attention. The only good thing is that these warnings typically only matter when 'black' candesticks occur at the end of a rally - not in the middle of a mini-consolidation.

For the Nasdaq, the 'black' candlestick didn't undercut breakout support and volume was relatively light. Technicals were unchanged, the index is still outperforming the S&P but we are still awaiting a new 'buy' signal in On-Balance-Volume.

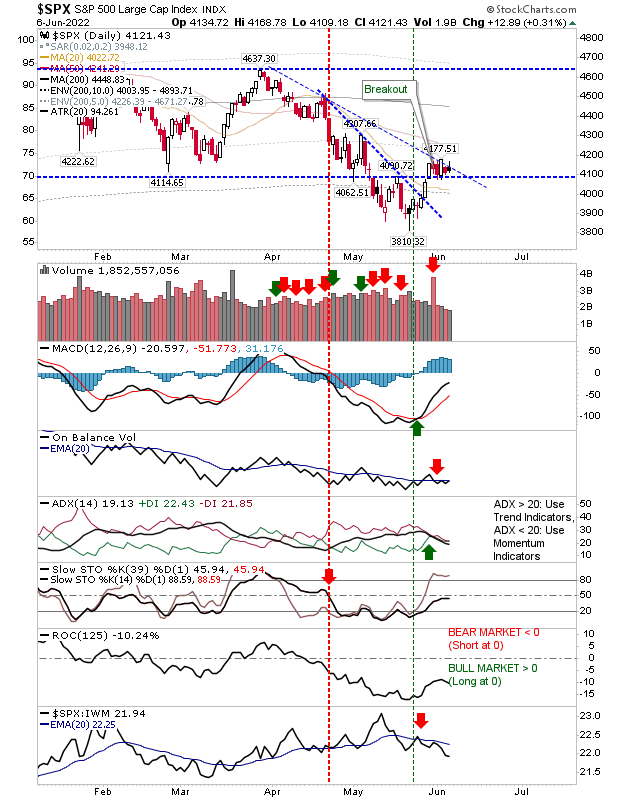

The S&P remains primed to accelerate beyond declining resistance but was pegged back by today's close despite the intraday move higher. Technicals haven't changed from yesterday, but there is room for optimism for stochastics and on-balance-volume.

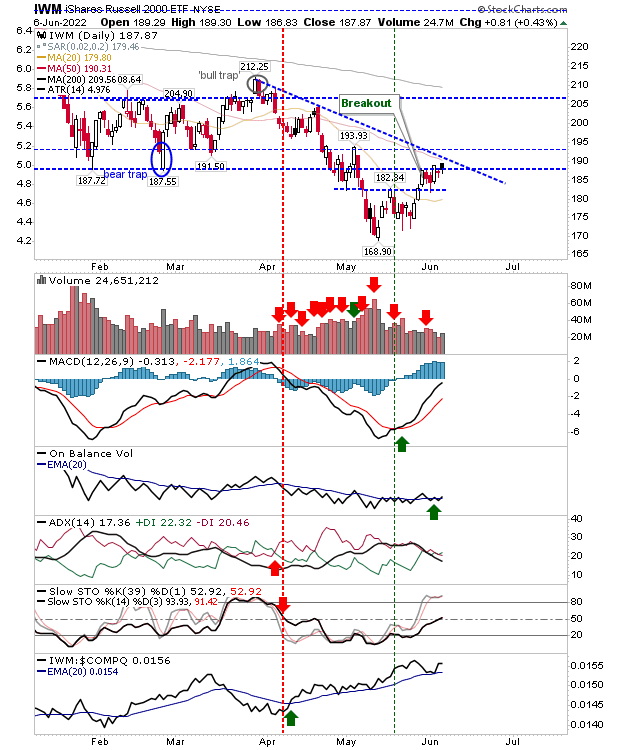

The Russell 2000 (IWM) did end with a 'black' candlestick at the end of a rally and is vulnerable to a gap down tomorrow. The 'black' candlestick has also occurred at 50-day MA resistace. Assuming a down day tomorrow, we need to consider if mini-breakout support can hold (near $182).

The bearishness of today's candlestick will be undone if there is a close above the open of the 'black' candlestick. The Russell 2000 is the index to watch as while I like its bullish tendencies, it had the weakest finish today.

Disclaimer: Investors should not act on any information in this article without obtaining specific advice from their financial advisors and should not rely on information herein as the primary ...

more