Biogen Beats Q4 Earnings & Sales Estimates, Stock Up

Image Source: Unsplash

Biogen (BIIB - Free Report) reported fourth-quarter 2022 adjusted earnings per share (EPS) of $4.05, beating the Zacks Consensus Estimate of $3.51. Earnings rose 19% year over year, driven by lower costs.

Sales came in at $2.54 billion, down 7% on a reported basis (4% on a constant-currency basis) from the year-ago quarter, hurt by lower sales of multiple sclerosis (MS) drugs like Tecfidera. However, sales of the spinal muscular atrophy (SMA) drug, Spinraza improved in the quarter. Sales beat the Zacks Consensus Estimate and our estimate of $2.44 billion and $2.43 billion, respectively.

Product sales in the quarter were $1.91 billion, down 13% year over year. Revenues from anti-CD20 therapeutic programs rose 8% from the year-ago period to $448 million. The revenues include royalties on sales of Roche’s (RHHBY - Free Report) Ocrevus and Biogen’s share of Roche’s drugs, Rituxan and Gazyva. Contract manufacturing and royalty revenues rose 52% in the quarter to $192.0 million.

Multiple Sclerosis Revenues

Biogen’s MS revenues were $1.27 billion in the reporter quarter, down 17% on a reported basis and 14% on a constant currency basis year over year.

Tecfidera sales declined 39% to $297.1 million as multiple generic versions of the drug have been launched in the United States and new generic launches are ongoing in several EU countries. Tecfidera sales were better than our model estimate of $249.5 million as well as the Zacks Consensus Estimate of $291 million.

Vumerity recorded $150.8 million in sales, up 20.7%. Vumerity sales were lower than the Zacks Consensus Estimate of $153 million.

Tysabri sales declined 4.7% year over year to $488.4 million, which missed the Zacks Consensus Estimate of $504 million.

Combined interferon revenues (Avonex and Plegridy) in the quarter were $309.6 million, down 17.9%, hurt by a continued shift from the injectable platform to oral or high-efficacy therapies.

Other Products

Sales of Spinraza rose 4% on a reported basis and 10% on a constant currency basis to $459.0 million. Spinraza sales were better than the Zacks Consensus Estimate of $427 million.

In the quarter, biosimilars revenues decreased 21% year over year (15% in constant currency) to $175 million as increased volumes were offset by the impact of pricing pressure. Biogen announced with its fourth-quarter results that it is considering strategic options for its biosimilars business.

Alzheimer’s drug, Aduhelm recorded sales of $0.3 million in the fourth quarter, compared with $1.6 million in the previous quarter. After the Centers for Medicare & Medicaid Services denied all Medicare beneficiaries access to Aduhelm, in its final NCD decision, Biogen decided to substantially wind down commercial operations for Aduhelm, retaining only minimal resources to manage patients’ access programs.

Research and development expenses were $602.0 million, down 14% year over year. Adjusted selling, general and administrative expenses declined 19% year over year to $632.0 million.

Last month, the FDA granted accelerated approval to Biogen and partner Eisai’s anti-amyloid beta protofibril antibody candidate lecanemab to treat early Alzheimer’s disease. The drug will be marketed under the brand name Leqembi. The accelerated approval is based on data from a phase II study (Study 201), which showed that treatment with lecanemab reduced the accumulation of amyloid beta plaque in the brain. Based on data from this study, Eisai filed a supplemental biologics license application to the FDA to get traditional approval for Leqembi. Eisai also filed marketing authorization applications for lecanemab in Japan and the EU last month.

2022 Results

For 2022, Biogen generated revenues of $10.17 billion, down 7% year over year on a reported basis and 5% on a constant-currency basis. Revenues beat the Zacks Consensus Estimate of $10.07 billion and came ahead of the guidance range of $10.0 to $10.15 billion

Earnings were $17.67 per share, down 8% year over year. Earnings beat the Zacks Consensus Estimate of $17.13 and exceeded the guidance range of $16.50 to $17.15.

2023 Guidance

The company issued fresh earnings and sales guidance for 2023.

Total revenues are expected to decline at a mid-single-digit percentage in 2023 from the 2022 level.

Biogen expects Leqembi to generate “modest in-market revenue” in 2023, though costs to market the drug will exceed revenues. The drug is not expected to contribute much to revenues until the CMS grants reimbursement for the drug under Medicare plans.

Adjusted earnings are expected in the range of $15.00 to $16.00. The Zacks Consensus Estimate is pegged at $15.77 per share.

Our Take

Biogen’s fourth-quarter results were better than expected as it beat estimates on both counts. Its financial outlook for 2023 also was within investors’ expectations. In response, Biogen’s shares were up in pre-market trading.

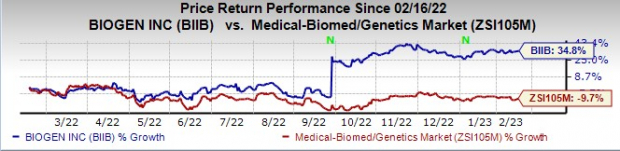

Biogen’s stock has risen 34.8% in the past year against a decline of 9.7% for the industry.

Image Source: Zacks Investment Research

While most of its key drugs are facing declining sales due to intense competitive pressure, Biogen’s potential new product launches such as Leqembi for Alzheimer’s disease and zuranolone for depression could help revive growth. A new drug application seeking approval of zuranolone for major depressive disorder and postpartum depression is under priority review in the United States, with a decision expected on Aug 5, 2023.

More By This Author:

Kraft Heinz Q4 Earnings And Revenues Top EstimatesShopify To Report Q4 Earnings: What's In The Cards?

Deere To Report Q1 Earnings: What's In The Offing?

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any specific ...

more