Bilibili Bets On The Game Business To Boost Growth

Bilibili (Nasdaq: BILI), an iconic brand and a leading video community for young generations in China, witnessed a tenfold increase in share price within three years after its listing on the Nasdaq and elevated its market cap to near US$50 billion in 2020, making it one of the biggest internet giants in mainland China. Last year, this video operator launched a secondary listing on the Hong Kong Stock Exchange with ambitious xpectations. Unfortunately, its stock price has been on a losing streak since the second half of 2021 that evaporates nearly 80% of its market cap to date.

Weigh more on user growth

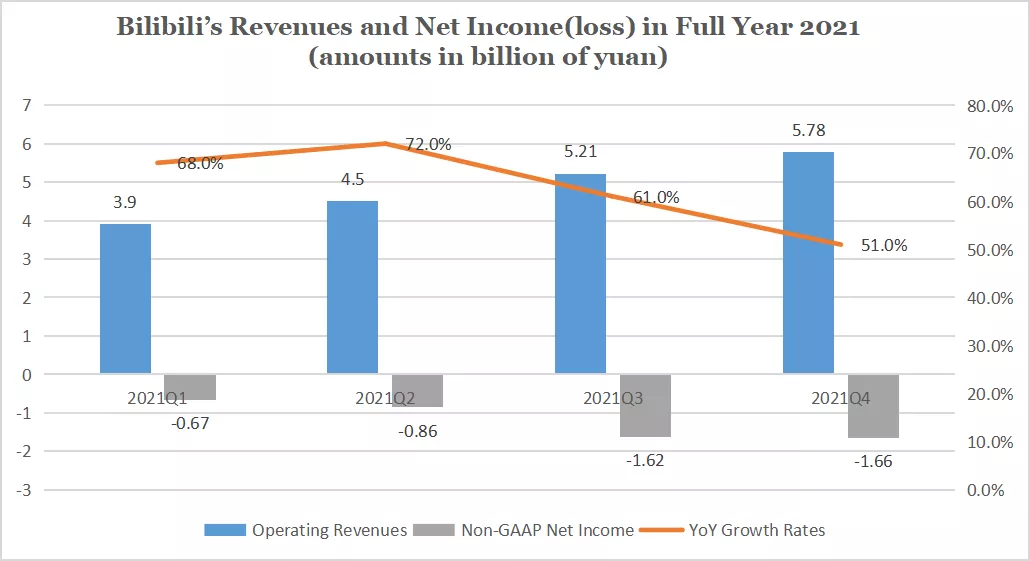

Bilibili recently released its 2021 fourth quarter and fiscal year financial results with continued expansion both in revenue and net loss. Financials showed that the company logged revenue of RMB5.78 billion (US$907.1 million) for Q4 2021, a 51% increase to the same period in 2020, and revenue of RMB19.4 billion (US$3.0 billion) for the full year 2021, representing an increase of 62% from 2020.

But the bad trajectory throughout the Q4 2021 pulled the rug under from the overall performance in 2021, which saw the company's non-GAAP net loss for the quarter and the full year 2021 reaching RMB1.66 billion (US$US$260.5 million) and RMB5.5 billion (US$862.7 million), respectively, both swelling by over 110% from the same period of 2020.

(Source: Company announcement)

Despite revenue volume being on the rise for years, Bilibili's unremitting efforts to realize profitability were disappointingly in vain. Mr. Rui Chen, Chairman and Chief Executive Officer of Bilibili, explained in the earnings call that the company used to weigh more on the growth of users while sparing less attention on the revenue growth was to blame for the conundrum.

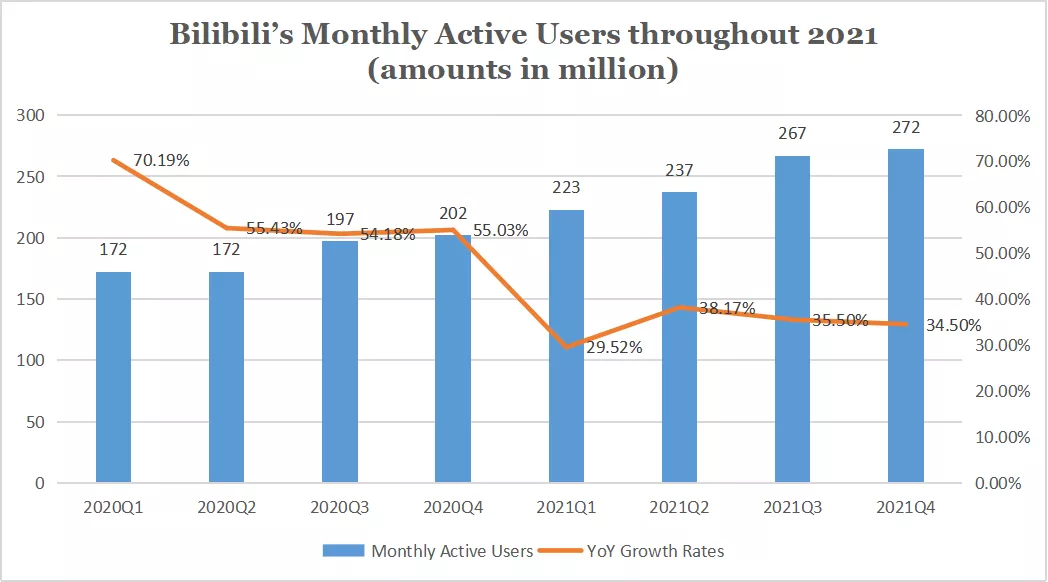

Bilibili is hailed as a dark horse racing on the Chinese internet industry that boasts a vast user base. For Q4 2021, the community's average monthly active users (MAUs) reached 271.1 million, representing an increase of 34.5% over the same period in 2020. Meanwhile iQIYI (Nasdaq: IQ), a bigger video platform backed by Baidu (Nasdaq: BIDU), ran into a different scenario. Its average daily subscription membership reportedly was 97 million in the fourth quarter of 2021, a decline of 5.7 million year-on-year; IQ also saw contraction in its MAUs, which reduced by 7% to 481 million as of last December. At a time when user growth shifts to user retention being a focus among Chinese internet enterprises, Bilibili's excellent user growth in Q4 2021 was laudable.

(Data source: company announcement)

However, burning through cash in pursuit of a bigger user base - long Bilibili's stock-in-trade to attract new users - also comes with a cost of graver burden on its financial position. In the current stage, how to monetize the user traffic should be a top priority for Bilibili as its user acquisition costs are rising. Mr. Rui Chen mentioned in the earnings call that resources and money that are given away to drive revenue growth in 2022 will be as much as those be put into user growth. He also added that the company would narrow its net loss amount in 2022 and aim to reach a Non-GAAP-based break-even by 2024.

But the path to net remains unclear.

Dependent on the game business?

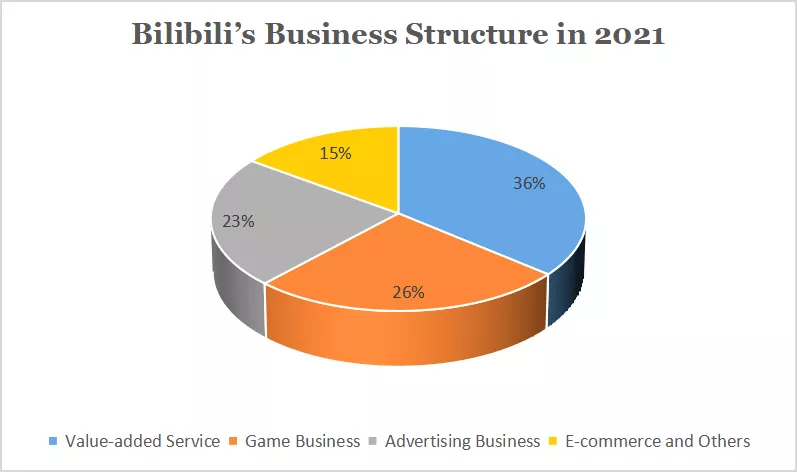

In 2017, the game business was the gold mine for Bilibili, whose revenue accounted for 83% of the total revenue, while revenues derived from live-broadcasting business and advertising business took up a minority of 7% and 6%, respectively. But the Chinese government's policy tightening on game titles in recent years, coupled with the lack of popular self-developed games, has given a beating to Bilibili's game business, which contributed only 26% share of total revenue in 2021. The cash cow for the company now shifts to value-added service (VAS) business, including the live-broadcasting business and premium memberships.

(Source: Company announcement)

Bilibili credits the successful commercialization in businesses for its diverse revenue structure that the market loves to see. But huge expenses being poured into the development of the live-broadcasting business also weakens its overall gross profit capability. At the same time, competition with the likes of Douyin, the Chinese version of TikTok, and Kuaishou, which are more versatile short video communities in vertical fields with more addictive feeds, adds a layer of difficulty for it to thrive.

In such context, the company looks to gaming, the initial mainstay of the company, in hope of it becoming an engine of the company's further growth. This year, 7 of 14 new investments by the company go to game developers, including 4 conducted just two weeks ago. The latest four investment activities primarily focus on the game agent of ACGN (Animation, Comic, Game Novel), self-developed games, web games and console games.

At the end of the day, Bilibili's genesis of commercialization of the game business in the early days paves the way for its refocus on this sector. It could even realize the 2024 goal as scheduled if it finds out a way to turn its vast video audience into gamers.

Disclaimer: This article is informational only. This article is prepared by Mentor Finance (the "Company") and by certain qualified investors (such as professional investors). By reading ...

more