Big Tech Earnings Loom: What Can Investors Expect?

Image Source: Unsplash

Tech stocks have maintained their market leadership in the New Year, building on last year’s standout performance. Driving this momentum has been a combination of favorable developments on the macro front, primarily growing confidence that the Fed is on track to start easing policy, having subdued inflation without endangering the economy.

More specific to the Tech sector is optimism about the impact of artificial intelligence (AI) that some view warily as reminiscent of the late 1990s and an emerging sense we are getting close to putting the worst of Tech spending headwinds behind us.

With many Tech companies on deck to report December-quarter results this week, the market will be looking for more color on business spending trends, particularly on the cloud side.

A big part of Tech’s improved earnings outlook in 2023 was a function of more effective cost controls that helped stabilize margins. Improved clarity on top-line trends will help solidify the favorable revisions trend and undergird the group’s impressive stock market momentum.

On top of it all is the AI debate, where we have already seen direct revenue impact from the likes of Nvidia (NVDA - Free Report) and some ideas from Microsoft (MSFT - Free Report). Still, the innovation’s productivity-enhancing potential appears to be some ways off in the future.

The stock market is essentially a discounting system of the future. To the extent that we see viable business models in the days ahead that make use of AI and the so-called large language models, beyond Nvidia selling more capable chips and Microsoft starting to charge for new AI-driven bells and whistles in its Office productivity suite, the stock market excitement would be totally justified.

These topics will be front and center in this week’s earnings reports from five of the ‘Big 7 Tech players’ - Alphabet (GOOGL - Free Report) and Microsoft (MSFT) after the market’s close on Tuesday (1/30), Meta Platforms (META - Free Report), Amazon (AMZN - Free Report) and Apple after the close on Thursday (02/01). Of the remaining two members of this ‘club,’ Tesla has reported already, and Nvidia’s results will be coming out at the end of February.

The chart below shows the one-year stock market performance of the Zacks Technology sector (up +46.1%), Microsoft (up +62.6%), Amazon (up +55.6%), Alphabet (up +52.6%), Meta (up +161.3%) and Apple (up +32.1%). The S&P 500 index gained +20.7% during this period.

Image Source: Zacks Investment Research

Apple shares may not have had as impressive a showing as the other distinguished members of this club, but it has nevertheless been a standout performer. The bigger question in the Apple story appears to be the China outlook, though headlines about the watch line may have also weighed on sentiment.

Digital advertising has historically been seen as core to Alphabet and Meta, but Amazon has steadily become a major player in the space as well. Ad spending has stabilized in the last couple of quarters, and it will be interesting to see how these management teams see trends for the current and coming periods, given the macroeconomic uncertainties. This will also be at play in the Snap report, which reports Q4 results the following week (February 6th).

All of these companies are big players in the artificial intelligence (AI) space, with the Microsoft vs. Alphabet rivalry particularly intense. With the initial excitement around ChatGPT and other AI applications now behind us, the questions now center around how these AI capabilities will be monetized through new and existing business models. It is reasonable to expect each of these management teams to spend considerable time on their Q4 earnings calls on their AI plan.

Take a look at the chart below that shows current consensus expectations for the ‘Big 7 Tech Players’ as a whole for the current and coming periods in the context of what they were able to achieve in the preceding period.

Image Source: Zacks Investment Research

As you can see, the group is expected to bring in +38.6% more earnings relative to the same period last year on +12.4% higher revenues. Please note that these expectations have steadily increased in recent months.

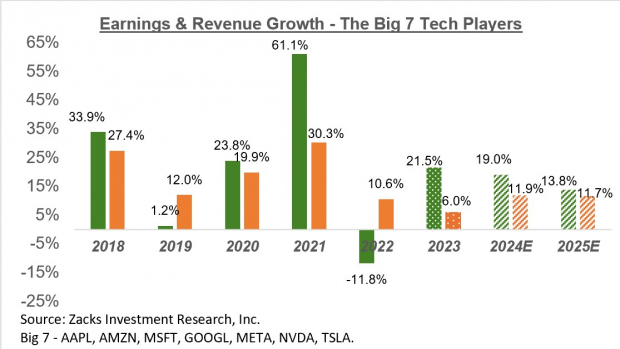

The chart below that shows the group’s earnings and revenue growth on an annual basis.

Image Source: Zacks Investment Research

As we all know by now, the group’s phenomenal boost in 2021 partly reflected pulled-forward demand from future periods that got primarily adjusted in 2022. As you can see above, the expectation is for the group to be firmly back in the ‘regular/normal’ growth model, but much of that is contingent on how the macroeconomic picture unfolds.

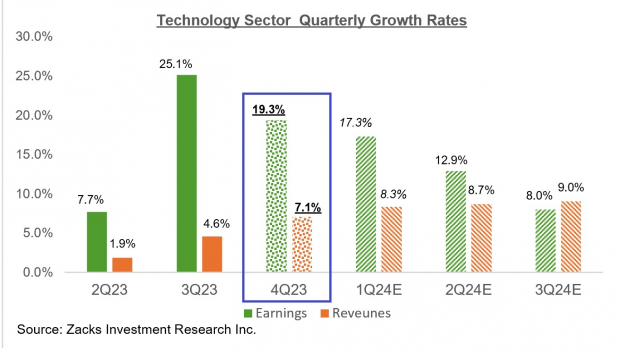

Beyond these mega-cap players, total Q4 earnings for the Technology sector as a whole are expected to be up +19.3% from the same period last year on +7.1% higher revenues.

The chart below shows the sector’s Q4 earnings and revenue growth expectations in the context of where growth has been in recent quarters and what is expected in the coming four periods.

Image Source: Zacks Investment Research

As was the case with the ‘Big 7 Tech Players’, the Tech sector as a whole has been dealing with the pulled-forward revenues and earnings during Covid over the last many quarters. In fact, earnings growth for the Zacks Tech sector turned positive only in 2023 Q2 after remaining in negative territory during the four quarters prior to that.

This big-picture view of the ‘Big 7 players’ and the overall sector shows that the worst of the growth challenge has moved into the rearview mirror.

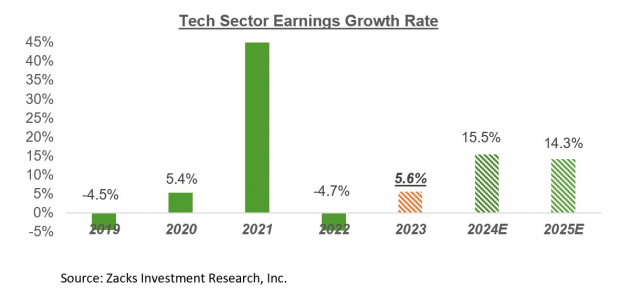

You can see this clearly in the chart below.

Image Source: Zacks Investment Research

You can see in the chart below that the sector is on track in 2023 to exceed the profitability level of 2021, with significant gains expected this year and next.

Image Source: Zacks Investment Research

The Earnings Big Picture

The chart below shows the earnings and revenue growth rates actually achieved in the preceding four quarters and current earnings and revenue growth expectations for the S&P 500 index for 2023 Q4 and the following three quarters.

Image Source: Zacks Investment Research

As you can see here, 2023 Q4 earnings are expected to be up +1.1% on +2.4% higher revenues. This follows the +3.8% earnings growth reading we saw in the preceding period (2023 Q3) and three back-to-back quarters of declining earnings prior to that.

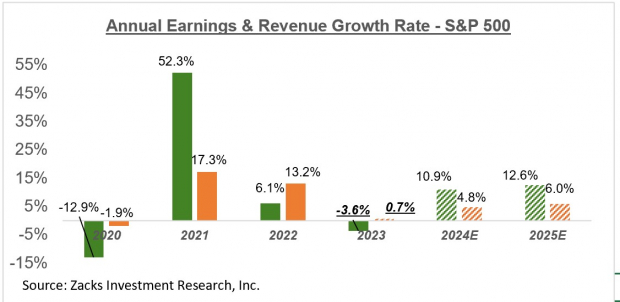

The chart below shows the earnings picture on an annual basis.

Image Source: Zacks Investment Research

Q4 Earnings Season Scorecard

Including all the results that came out through Friday, January 26th, we now have Q4 results from 124 S&P 500 members or 24.8% of the index’s total membership.

We have over 300 companies on deck to report results this week, including 106 S&P 500 members. In addition to the aforementioned mega-tech players, this week’s line-up includes a who’s who of the index, including Boeing, Pfizer, International Paper, Starbucks, Exxon, Chevron, and many others.

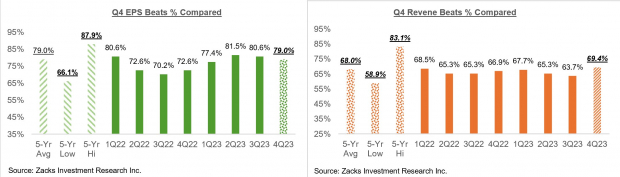

Total Q4 earnings for the 124 index members that have reported already are down -0.4% from the same period last year on +3.4% higher revenues, with 79% beating EPS estimates and 69.4% beating revenue estimates.

The comparison charts below put the Q4 earnings and revenue growth rates in a historical context.

Image Source: Zacks Investment Research

The comparison charts below put the Q4 EPS and revenue beats percentages in a historical context.

Image Source: Zacks Investment Research

More By This Author:

Breaking Down The Q4 Earnings Season Scorecard

Q4 Earnings Results Reflect Stability

Q4 Earnings Season Kicks Off Positively

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any specific ...

more