Beware The Mega-Cap Smackdown

There’s a big shift happening in the market right now… One that could cause some big problems for your investments if you’re caught leaning the wrong way.

Many of the mega-cap tech stocks are rolling over. And this weakness has the potential to spread!

Let’s look at a few of the most important names and talk about investment alternatives that could help protect your wealth this September.

Ominous Mega-Cap Breakdowns

Three marquee names are in the process of rolling over. And given their collective weight in the broad market indices, the breakdowns could cause pain across other areas of the market as well.

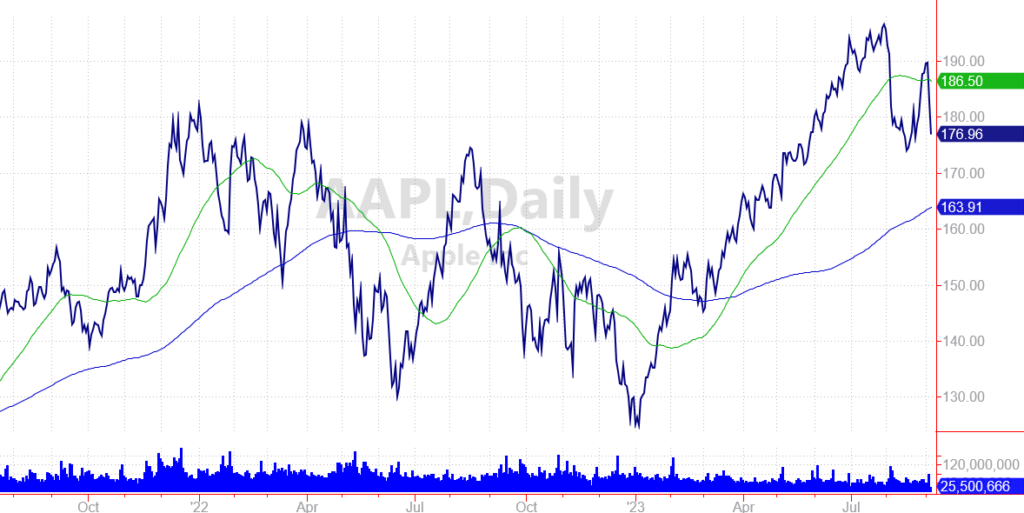

Shares of Apple Inc. (AAPL) moved sharply lower over the last two days. Investors are worried about China’s retaliatory ban on iPhones in government buildings.

Since China is an important market for AAPL, any government pressure could continue to weigh on shares.

(Click on image to enlarge)

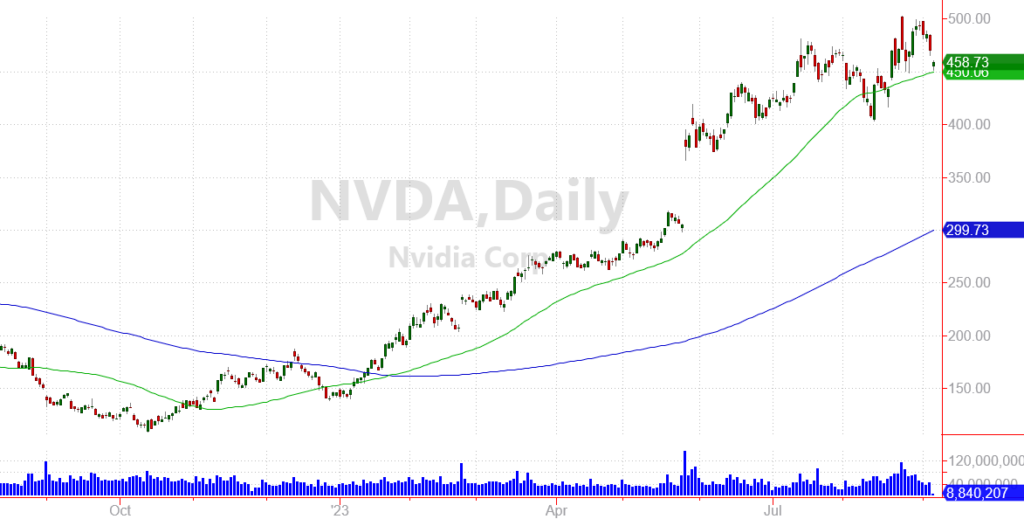

Next, shares of AI chip maker Nvidia Corp. (NVDA) are extremely vulnerable.

The company announced blowout earnings in August and shares gapped higher on the news. But investors are taking a “buy the rumor, sell the news” approach to this stock and NVDA has traded lower following the announcement.

Any break of the 50-day average (green line in the chart below) could lead to a major selloff for this stock. I wouldn’t be at all surprised to see NVDA fall to the $300 level — which would represent a 34% drop from today’s levels. (Sobering!)

(Click on image to enlarge)

Full disclosure, I have a bearish position on NVDA which will benefit from any further drop in the stock.

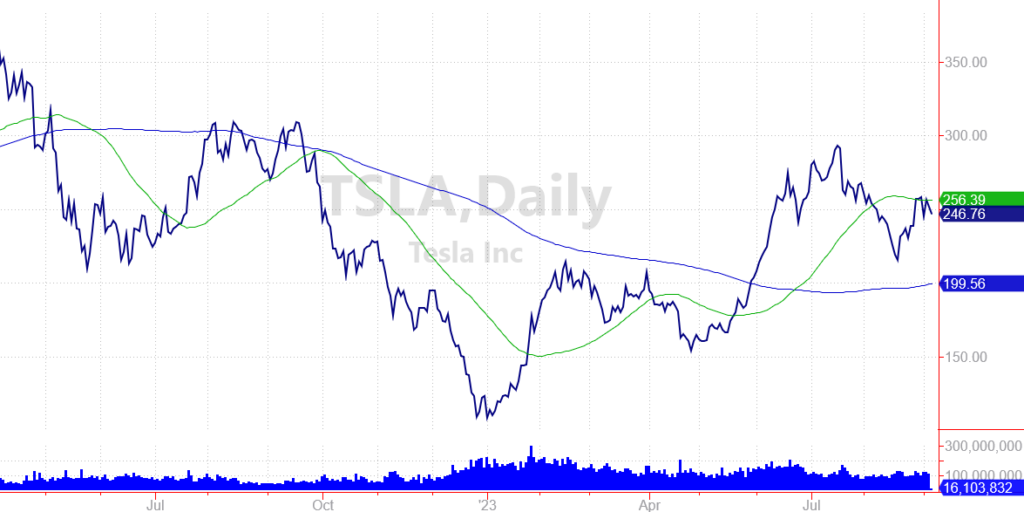

Finally, we have the popular electric vehicle maker Tesla Inc. (TSLA).

Shares turned lower in July as the company began cutting prices on vehicles to stay competitive with other vehicles on the market. Given TSLA’s premium valuation, the stock could have a long way to fall before attracting new buy orders from fundamental investors.

(Click on image to enlarge)

My Speculative Trading Program currently holds put contracts for TSLA which will benefit from the stock trading lower. Members can view all open & closed positions. They also receive real-time email and optional text alerts every time a position is opened or closed.

It’s a Stock Picker’s Market

Despite the ominous action for a few key mega-cap stocks, I’m still optimistic about our profit opportunities this year.

Specific stocks in the energy, healthcare and industrial sectors are holding up very well. And companies that grow profits are trading higher even as the broad market levels out.

In markets like this, stock pickers have an advantage over index investors.

That’s because large-cap stocks tend to hold the broad market back. But many individual stocks still perform very well.

If you do the research and find those outliers, you can generate positive returns even when the broad market is stagnant.

Plus, there are plenty of ways to place bearish bets on some of these vulnerable mega-cap stocks to profit from lower prices to come.

It’s important to stay nimble, to be aware of which areas are strong (and which areas are weak), and to take action if any of your positions start to break down.

More By This Author:

How To Play The Instacart IPOIt’s A Bull Market — So Sit On Your Hands

Will “Threads” Keep META Trading Higher?