Better Buy: AT&T (T), TMobile (TMUS), Or Verizon (VZ) Stock

Investors looking for a buying opportunity in stocks may be considering AT&T (T) and Verizon (VZ) stock because they both trade for under $40 per share. But price per share alone is hardly a good reason to buy a stock, even of a well-known wireless carrier.

TMobile (TMUS), meanwhile, is expected to see expansive growth but is trading around $152 per share.

Let’s see how AT&T, Verizon, and TMobile stocks compare and which may be the better buy at the moment.

Recent Performance

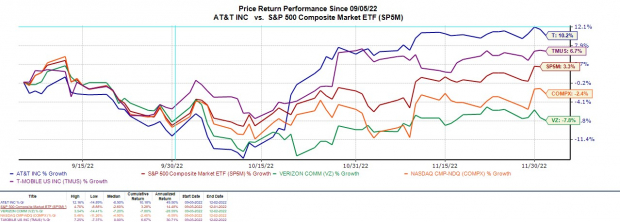

Over the last year, both AT&T and Verizon Stock have lagged behind the S&P 500, while TMobile has strongly outperformed the benchmark.

AT&T & VZ are down -19% and -26%, respectively YTD vs. the S&P 500’s -15%. On the other hand, TMUS is up an impressive +30%. TMUS has been the leader here, with AT&T and Verizon closer to the Nasdaq’s bearish performance.

(Click on image to enlarge)

Image Source: Zacks Investment Research

However, over the last three months, AT&T’s stock has an edge, up +10% vs. TMUS’s +7% and VZ’s -8%. AT&T’s recent momentum is mostly attributed to the company’s spinoff of Warner Bros. Discovery (WBD) and refocus on its core wireless business.

(Click on image to enlarge)

Image Source: Zacks Investment Research

Valuation

Turning to valuation, both AT&T and Verizon sport an “A” for Value in Zacks Style Scores system to top TMobile’s “C".

AT&T shares currently trade at 7.2X forward earnings, nicely below their decade-high of 15.3X. This is on par with VZ’s 7.3X. VZ also trades at a solid discount to its decade-high of 19.2X.

On the contrary, TMUS shares trade at a 74.3X forward earnings multiple, which is well below its decade-high of 755X.

(Click on image to enlarge)

Image Source: Zacks Investment Research

In terms of valuation from a price-to-earnings perspective, AT&T and Verizon stocks are more attractive vs. TMUS. Verizon appears to have a slight edge over AT&T as it trades further beneath its decade high.

Growth & Outlook

Pivoting to growth will help get a better indication of which stock is the better buy in addition to their current valuations.

Like the broader economy, most telecom companies are dealing with tougher operating conditions amid higher inflation.

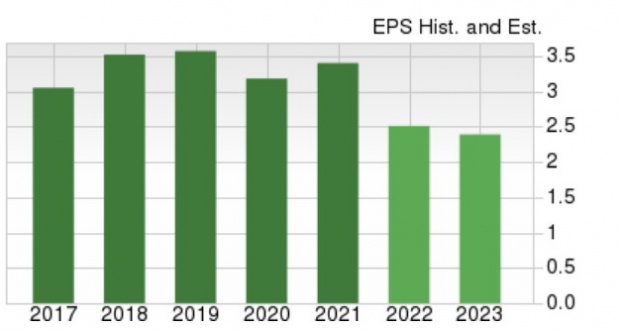

AT&T’s current fiscal year earnings and revenue are expected to decline -23% and -30%, respectively.

However, earnings estimate revisions for this year and FY23 have risen over the last 90 days. Fiscal 2022 earnings are now projected at $2.62 per share compared to $2.53 a share last quarter.

(Click on image to enlarge)

Image Source: Zacks Investment Research

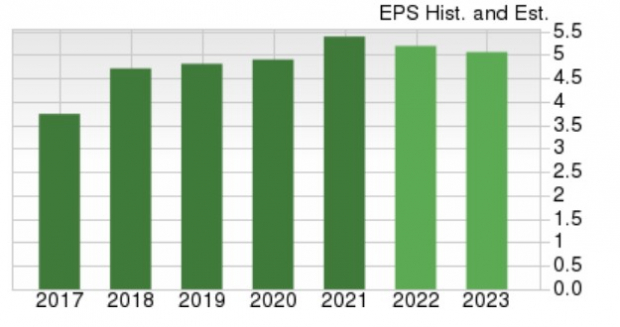

Taking a look at Verizon in the chart below, this year’s earnings are expected to decline -4% with sales up 2%.

Earnings estimates for fiscal 2022 and FY23 have slightly declined. FY22 earnings are now forecasted to be $5.19 per share compared to $5.20 last quarter.

(Click on image to enlarge)

Image Source: Zacks Investment Research

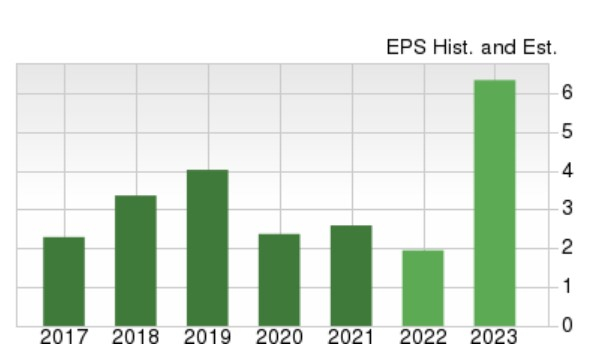

TMobile’s earnings are expected to drop -23% this year with sales virtually flat. Earnings estimate revisions have declined for FY22 but trended higher for FY23. EPS of $2.00 is now expected this year, down from $2.15 a share 90 days ago.

(Click on image to enlarge)

Image Source: Zacks Investment Research

TMUS earnings are expected to see substantial growth in FY23 as shown in the above chart. Fiscal 2023 EPS is expected to jump 233% to $6.66 per share and up from $6.33 a share last quarter.

Bottom Line

Despite TMobile’s impressive FY23 growth outlook, AT&T appears to have the edge over TMUS and VZ stock with T’s earnings estimate revisions trending up this year and in FY23. In correlation to climbing earnings revisions AT&T stock sports a Zacks Rank #2 (Buy), while TMobile and Verizon land a Zacks Rank #3 (Hold).

This gives the overall edge to AT&T as its stock trades more attractively than TMobile from a valuation standpoint. To that note, Verizon’s earnings estimate revisions have slightly declined despite its attractive valuation.

Even better, AT&T’s annual dividend yield at 5.78% is respectable compared to Verizon’s 6.81% because both are very high. Meanwhile, TMobile does not offer a dividend at the moment.

More By This Author:

5 Dividend-paying Multiline Insurers For A Stable Portfolio3 Companies That Recently Unveiled Fresh Repurchase Programs

Should Investors Consider These 3 Low-Beta Stocks?

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any specific ...

more