Best Year For Tech Stocks Since 2003, Uptrend Looks Intact

The Nasdaq, dominated by technology, is set for its strongest year since 2003, with a remarkable climb of over 40%. This exceptional performance is attributed to the surge in artificial intelligence interest and a resurgence in mega-cap tech stocks.

The three major indexes are also all to notch their ninth straight winning weeks. That underscores the market’s late 2023 rally, rebounding off a negative third quarter. The year was good for investors to test their patience. Much unfolds in between, but when the day concludes, you can reflect and take pride in being an investor.

Stocks are now in the middle of a period dubbed the “Santa Claus rally,” which refers to the last five trading days of an ending year and the first two of a new one. The S&P 500 has risen about 1.3% over this timeframe on average, per data going back to 1950 from the Stock Trader’s Almanac.

Adding to the positive developments, the U.S. dollar is experiencing its lengthiest decline since October, contributing to its challenging quarter. A weaker dollar lowers costs for repaying debts in dollars for foreign entities, potentially boosting global trade. It also means higher profits for U.S. companies with significant international operations. These factors collectively bode well for the stock market.

Amazon: Top one in the AI field (AMZN)

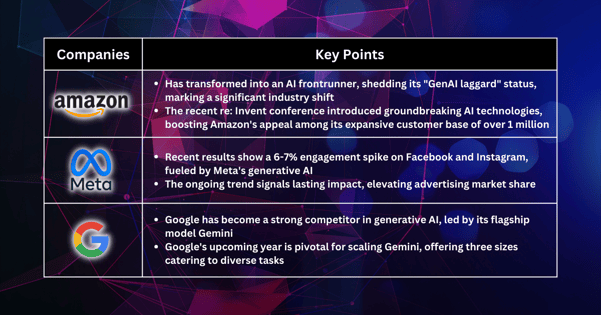

Amazon is a leading choice in the AI field, shedding its label as a "GenAI laggard."

The recent re: Invent conference marked a significant leap in AI-related innovations, introducing breakthroughs like Amazon Web Services' Neuron platform, the cloud-based machine-learning platform Amazon SageMaker, and Amazon Bedrock, which provides foundation models from Amazon and prominent AI startups via an API.

Additional momentum for the company comes from its generative AI-powered assistant, Amazon Q, and Amazon Connect, an omnichannel cloud contact center. These collective advancements are poised to garner substantial adoption among Amazon Web Services' expansive base of over 1 million customers.

Meta: Failed in Meta, but gaining momentum in AI (META)

Harnessing the power of generative AI to drive Meta-owned Facebook and Instagram forward, recent outcomes showcase a significant 6% to 7% surge in engagement on both social media platforms.

We view this as an ongoing positive trend over several years rather than a one-time occurrence, impacting various platform interfaces and contributing to continuous long-term growth and increased advertising market share.

These suggest that this AI technology has the potential to revolutionize messaging and reshape the user experience within the apps. Meta's stock price has surged by almost 200% this year.

Google: Catching up (GOOGL)

Other strongly positioned contenders in the race to embrace and monetize generative AI include Google.

While Google still has more to prove, next year is an opportunity for the tech giant to scale its AI model, Gemini. Gemini 1.0, the company’s first version, offers three different sizes, ranging from Ultra for highly complex tasks to Nano for mobile devices. Ultra could help attract developers and new cloud customers.

More By This Author:

Inflation Report Fuels Speculation Of Earlier Fed Cuts, Equities Display Signs Of FatigueBe Mindful Of Potential Sell-Off As Market Is Too Expensive Now

Tech Stocks Surge As Fed Signals Three Rate Cuts In 2024

Disclaimer: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. ...

more