Best Undervalued Health Care Companies You Never Heard Of

Health care companies provide a variety of products and services in a growing industry. Here are three niche names to consider for your portfolio: HealthEquity, Progyny, and Amedisys.

Health care is a gigantic industry and global spending is expected to rise at a 3.9% compound annual growth rate by 2024. Focus is shifting from health care to health and well-being and resource allocation changes.

From an investor’s perspective, the healthcare sector gives exposure to innovative companies always in the search of better treatments and ones that constantly invest in research and development. Here are three health care stocks that look interesting: HealthEquity, Progyny, and Amedisys.

HealthEquity (HQY)

HealthEquity is an American company from Draper, Utah, offering cloud-based solutions to individuals to help them pay health care bills or to compare treatment prices and options, among others.

The company operates with a gross profit margin of 56.77%, higher than the sector median, and a Price/Book ratio of 2.84, lower by -17.04% than the sector median.

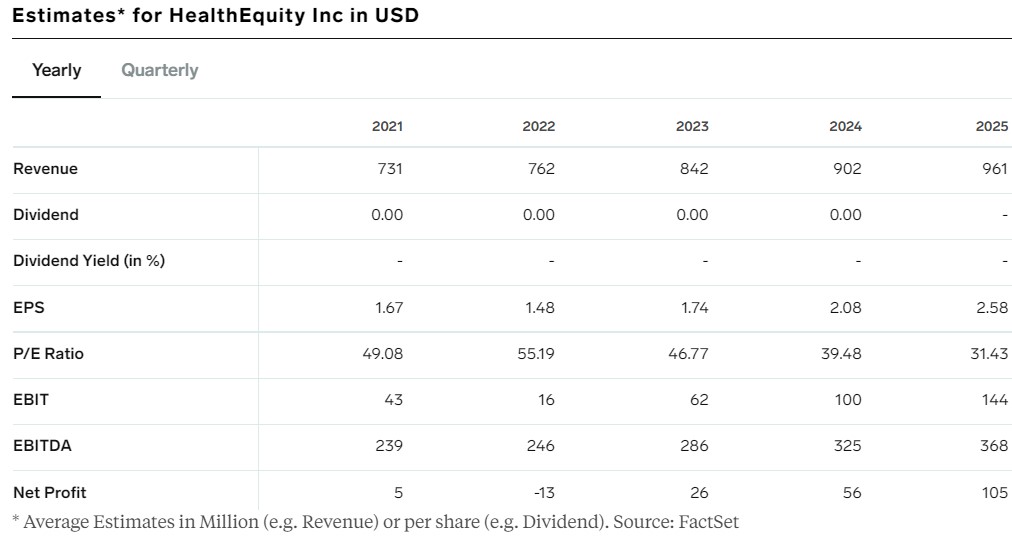

While the P/E ratio looks pretty elevated, it is forecast to decline significantly by 2025. The most interesting part, however, comes from the net profit, expected to increase more than twenty times over the same period.

(Click on image to enlarge)

Progyny (PGNY)

Progyny is an American company providing fertility solutions and treatments. Its EBIT over the past twelve month is higher than the sector median (8.4% vs. 2.32%) and out of the 17 analysts covering the company, 15 have buy ratings and 2 have neutral ones. No analyst has a sell recommendation and the price target for the goes as high as $81.

Amedisys (AMED)

Amedisys is an American health care company owning and operating more than 300 home health care centers. It also operates hospice and personal care centers across the United States and was founded in 1982.

In this case, the EBIT (Earnings Before Interest and Taxes) margin for the past twelve months is more than four times the sector median and the P/E ratio is more attractive.

Analysts are bullish on the Amedisys stock price too. Out of the 36 analysts covering the company, 26 have buy ratings while 9 have neutral ratings. Only one analyst has issued a sell rating and the highest price target for the company’s stock price is $340.

Disclaimer: None of the content in this article should be viewed as investment advice or a recommendation to buy or sell. Past performance/statistics may not necessarily reflect future ...

more