Best Stocks To Buy Next Week Ahead Of Their Quarterly Earnings Release

It will be a busy week ahead for investors monitoring the Micron Technology (MU), Cintas (CTAS), and General Mills (GIS) stock prices. The three companies report their quarterly earnings, and investors are mostly bullish. The market expects EPS of $2.11, $2.64, and $1.05, respectively.

Micron Technology

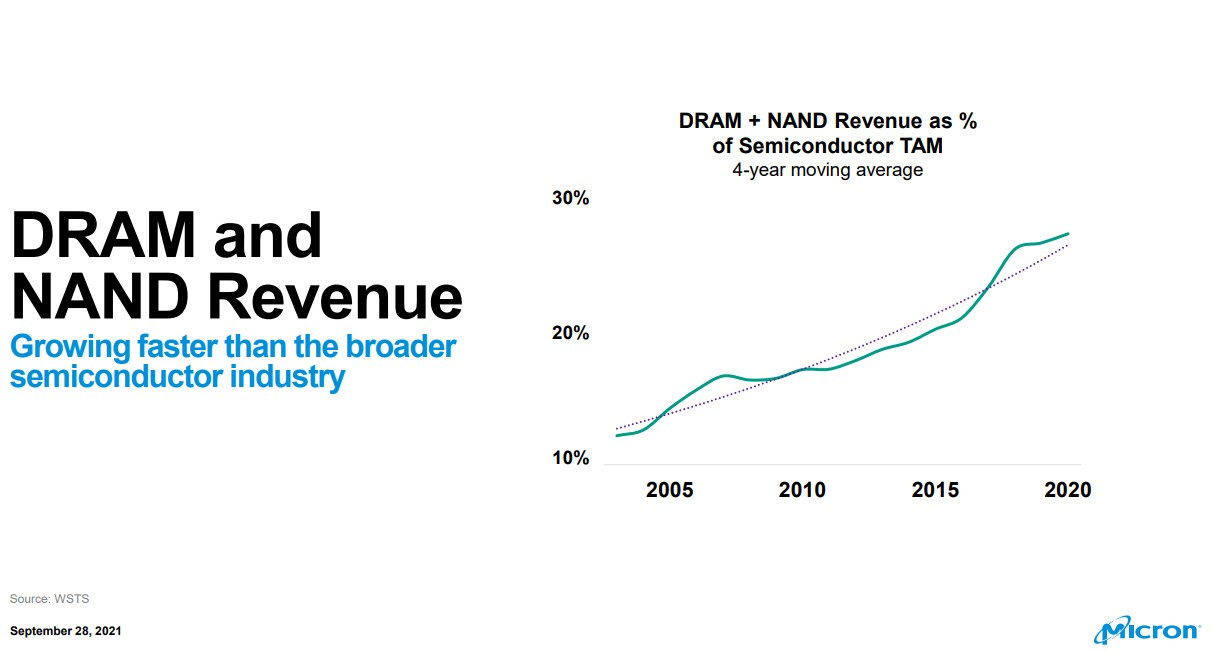

Micron is an American IT company based in Boise, Idaho. It employs over 40,000 people, and it is one of the biggest players in the semiconductors industry. It manufactures and sells memory storage products, such as DRAM or dynamic random-access memory, and it reports its quarterly earnings next Monday, Dec. 20.

Micron’s stock price is up a little over 10% this year, and the company pays a dividend. Investors expect EPS of $2.11 on the quarter, and the company has beaten the market’s expectations in the last four consecutive quarters.

Cintas

Cintas is an American company providing corporate identity uniforms. As a Fortune 500 company, it serves over 1 million businesses by providing services and products that enhance the image and, ultimately, the brand. It provides safety compliance training, first aid and safety products, restroom supplies, and uniforms.

The company is scheduled to release its Q2 FY2021 results on Dec. 22 at 10:00 AM ET. Market participants expect EPS of $2.64, in line with the EPS reported last year in the same quarter. As for the annual revenue, the estimate for the fiscal period ending May 2022 is $7.65 billion, expected to increase to $8.18 billion.

In the last five years, Cintas' stock price has been up +24.06% YTD.

General Mills

General Mills is an American company operating in the packaged foods and meats industry. Based in Minneapolis, Minnesota, it employs 35,000 people, and it will report its earnings for Q2 FY2022 next week, on Dec. 21, at 08:00 MA CST.

The company operates with a gross profit margin of 35.28%, higher than the sector median by 2.05%, and the stock price trades at an attractive P/E Non-GAAP (TTM) ratio of 17.90, which is lower than the 19.86 sector median.

General Mills’ stock price has been up +15.05% YTD, and the company pays a hefty dividend, judging by the 3.02% dividend yield. Moreover, the payout ratio is 53.87%.

Disclaimer: None of the content in this article should be viewed as investment advice or a recommendation to buy or sell. Past performance/statistics may not necessarily reflect future ...

more