Best Stocks To Buy Next Week Ahead Of The Quarterly Earnings Call

Rivian (RIVN), Accenture (ACN), and Micron Technology (MU) will report their quarterly earnings in the next seven days. What do analysts say, and how did their stock price perform this year?

December holidays are due in a couple of weeks, but some companies are still scheduled to release their quarterly earnings. These three companies will report their earnings in the next seven days, and investors will scrutinize their financial performance.

Rivian

Rivian Automotive is an American manufacturer of electric vehicles. More precisely, it makes pick-up trucks and SUVs, and it employs over 6,000 people.

It made headlines a little over a month ago when it became a publicly listed company. On Nov. 10, the company listed its shares in a highly-anticipated IPO, with over 150 million shares having been sold at $68.

At the opening on the Nasdaq, the stock price traded above $100, and it went as high as $170, before coming down to the recent price of $114.66. Investors piled up to buy Rivian shares and to be part of the transition to green transportation.

The fact that the company is losing money does not seem to bother investors. The EPS estimate for 2021 is -$19.07, expected to improve to -$5.05 in 2022. Rivian reports its quarterly earnings on Dec. 16.

Accenture

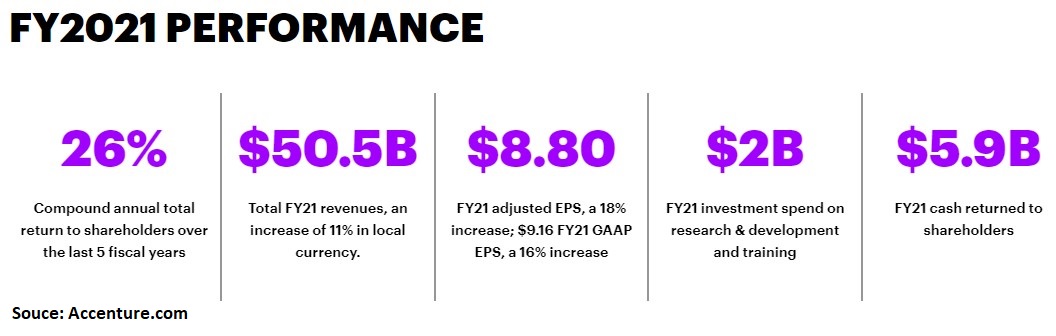

Accenture reports its quarterly earnings this upcoming week as well. It closed the FY2021 with more than $50 billion in revenues, and more than 10% of it was cash returned to shareholders.

Moreover, the company invested $2 billion in research & development, and the compound annual total return to shareholders over the last five fiscal years is 26%. Accenture’s stock price is up +45.26% year-to-date. The stock closed Friday at $379.44.

Micron Technology

Micron Technology is an American IT company from Boise, Idaho. It employs over 40,000 people and sells memory and storage products.

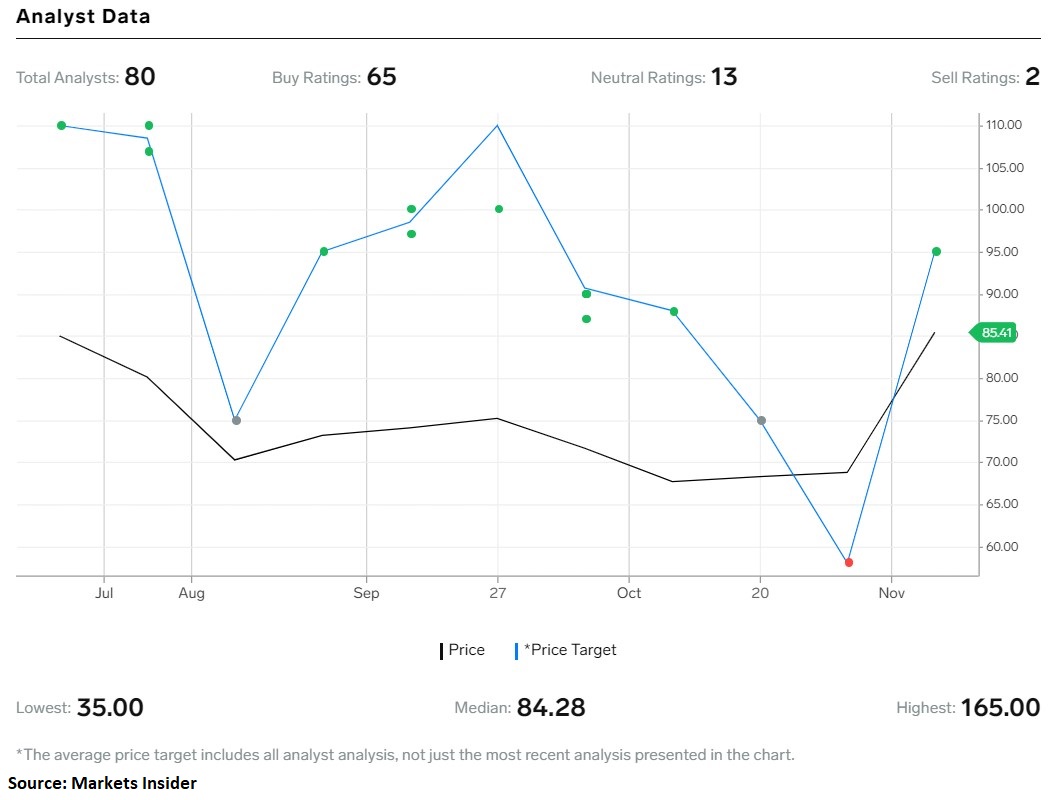

The company reports its quarterly earnings on Dec. 20, and the consensus is that the EPS will reach $2.11 on the quarter. The stock price is up +13.78% this year, and most analysts are bullish. The stock closed Friday at $85.54.

Out of the 80 analysts that cover the stock price, 65 have issued buy ratings, and 13 have neutral ratings. Moreover, only 2 analysts have sell ratings, and the highest price target for the stock price is $165.

Disclaimer: None of the content in this article should be viewed as investment advice or a recommendation to buy or sell. Past performance/statistics may not necessarily reflect future ...

more