Best Stocks For Inflation In 2022

Inflation is the continuous increase in process of commonly used goods and services. It also indicates devaluing of money which reduces the purchasing power of money. It is a matter of concern for every person living. It affects the present and future, both of every household. Since the 2008 financial crisis, the global economic situation has been depreciating.

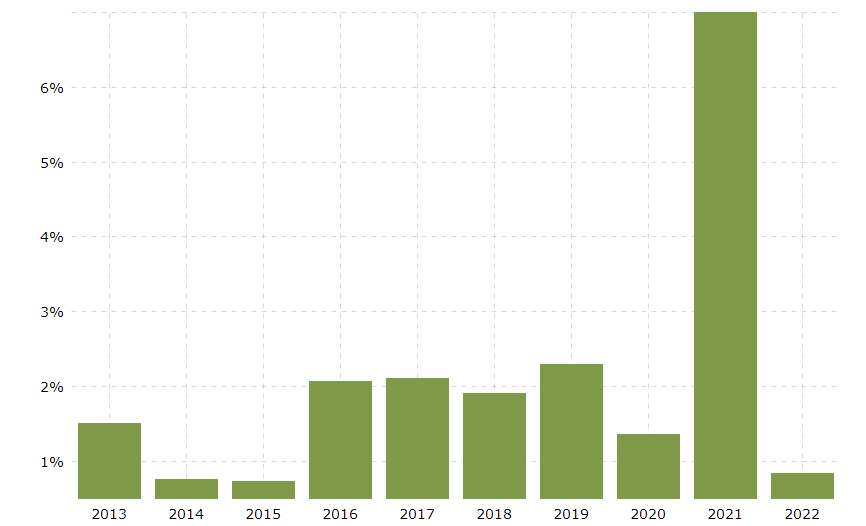

The below chart shows the annual rate of inflation in the United States as measured by the Consumer Price Index:

(Click on image to enlarge)

Source: macrotrends

Best Stocks for Inflation in 2022

- Apple (AAPL)

- Newmont Corporation (NEM)

- Wells Fargo (WFC)

- Chevron Corporation (CVX)

- Exxon Mobil Corp. (XOM)

- Aptiv PLC (APTV)

- Stanley Black & Decker Inc. (SWK)

- Rio Tinto (RIO)

- Riot Blockchain (RIOT)

- F5 Networks (FFIV)

Apple (AAPL)

Apple is one of the popular stocks because of its trillion-dollar market capitalization. Not only the stock, but Apple products have also become very common and are used in daily life. From mobile to wristwatches to laptops and computers Apple is everywhere in our daily lives.

What makes Apple an excellent stock investment for inflation is its solid business and dividend payouts. Moreover, Apple revenue generators such as App Store, App Pay, and Apple TV are not dependent on any product. These services generate a huge chunk of revenue that has no production costs.

During times of inflation, Apple has the competitive advantage of its powerful brand which increases its ability to adjust prices to inflation. Currently, the price of Apple stock is trading at $172.55. according to its recent dividend payment of $0.22 for the quarter, the dividend payout ratio is 14.57%. Also, its three-year dividend growth rate is 22.7%.

Apple recently announced quarterly results for the first quarter of 2022, ending December 25, 2021. The iPhone maker posted an all-time revenue record of $123.9 billion, representing a record increase of 11% year-over-year. Quarterly earnings per diluted share of $2.10.

Newmont Corporation (NEM)

Gold is one of the investors’ favorite picks during times of inflation as it acts as an effective hedge. Gold is also held by central banks instead of fiat money which indicates that it is also the best store of value. Investors can also invest in gold mining stocks instead of physical gold to protect their investment against inflation. Amongst gold mining stocks, Newmont Corporation is one of the best stocks to invest in.

Newmont is one of the largest gold mining companies with operating mines in Australia, North America, South America, and Africa. In the recent third-quarter report for 2021, the gold mining company reported solid performance. The company produced 1.45 million ounces of gold and 315,000 GEOs (Gold Equivalent Ounces) from co-products. The company was able to generate 735 million of free cash and declared an industry-leading dividend of $0.55/share for the quarter. The dividend payout ratio of the company is 86.96% and a three-year dividend growth rate is roughly 293%. The company also reported robust gold reserves of 94Moz and 65Moz in GEO reserves for the quarter.

Newmont Corporation has a market capitalization of over $51 billion. Its share is trading at $64.28. With gold prices expected to cross $2,000, Newmont is currently an excellent stock to invest in to hedge against inflation during the current year.

Wells Fargo (WFC)

Wells Fargo is one of the USA’s largest middle-market banking providers with more than 130 offices around the country. One of its biggest strengths is its vast network of local banks and ATMs. Also, its mobile app is one of the highest-rated bank apps.

In the recent fourth-quarter result of 2021, the bank reported revenue of $20.9 billion a 13% year-on-year increase, and a Net Income of $5.8 billion. The bank declared a dividend of $0.25 in its recent quarter. The bank has a dividend payout ratio of 20% and a negative 63% dividend growth rate. Due to tough times, the bank has been forced to reduce debt but being a leading bank, the prospects of future growth are higher.

The bank’s credit quality has substantially improved during the fiscal year 2021 owing to improved credit extensions. The bank reported a remarkable decline in provision for credit losses. The bank’s market valuation is currently at $225.9 billion. Its share is trading at $58.14. the share price is on an upward streak since the start of the year and has appreciated by 60% during the year 2021 and it continues to climb.

Chevron Corporation (CVX)

Chevron is a huge multinational energy company. Its diversified operations within the energy sector give it an excellent advantage of benefitting from growth within every segment of the energy sector. From exploration to production, chemical and refining, and marketing, Chevron has expanded its operation within all. This makes it an excellent stock for investment as investors get exposure to a well-integrated energy stock. Also, the long-paying dividend history is what makes it the best stock to invest in for inflation in 2022. There has been a lot of focus on the long-term investment stocks.

Chevron has a record of a strong balance sheet and good financial performance (excluding the year 2020). In the recent financial report, the company reported record-high free cash flow. As a result, the company was able to pay a higher dividend, a disciplined capital growth program, and a significant debt paydown with a year-end net debt ratio comfortably below 20%.

For the fourth quarter of 2021, Chevron reported earnings of $5,055. The company announced a dividend of $1.42 for the quarter. The dividend payout ratio of the company is 65.87% and it has 18.5% three-year dividend growth. A good financial year led to a ROCE of roughly 10% and a 4% increase in dividend payment.

Exxon Mobil Corp. (XOM)

ExxonMobil, one of the world’s largest publicly traded energy providers and chemical manufacturers, develops and applies next-generation technologies. Semi conductor stocks are one of the best investment opportunities.

Exxon has a market capitalization of over $337.7 billion. Its share is trading at $78.28. the stock has been on an upward trend throughout the year 2021. During the year, the stock appreciated by 50% and it is still on the rise.

Recently, the company published its full-year earnings report, where the company reported full-year earnings of $23 billion. Moreover, $48 billion of cash flow was generated, which is the highest in the past 10 years. Also, Exxon managed to reduce its debt holdings by paying off $10 million in debt.

For the recent quarter, the company paid a dividend of $0.88. the company is not good in its dividend payout ratio, which is reported at a negative 253%. And the dividend growth rate has been a meager 8% for the past 3-years combined.

Since the oil prices are on the rise, we can expect more positive growth drivers for the company. Therefore, during the current inflation period, Exxon Mobil is a great buy.

Aptiv PLC (APTV)

Aptiv is a global technology leader, spread around 44 different countries with 124 manufacturing facilities and 12 major technical centers worldwide. The company is in a good position to leverage the growth in trends in electrification, connectivity, and autonomy within the automotive sector. Also, the company continues to invest in advanced technology and collaborations to take full benefit of the opportunities available in the automotive sector. For Aptiv, expansion through acquisition has been the key growth factor. Investing in oil stocks offers great rewards in terms of high returns.

Aptiv, in its recent fourth-quarter report for the year 2021 reported revenue of $4.1 billion and EPS of $0.56. revenue has declined by 4% and EPS has reduced from $1.13 in the same period last year. The reported operating cash flow was at $669, which also declined by 16% from the same period last year.

Aptiv has a market capitalization of over $38 billion. Its share is trading at $142. The share of the technology company has been on rising since the year 2020. In the year 2021, the stock has appreciated by 26% and the stock continues to grow further.

For the future, Aptiv plans to invest to support customer production which will eventually translate into revenue outperformance.

Stanley Black & Decker Inc. (SWK)

Stanley Black & Decker is a world-leading provider of tools and storage, commercial electronic security, and engineered fastening systems since 1843. The company is a leading global diversified company based on revenue. It is number one in tools and storage, number 2 in security services, and a global leader in engineered fastenings.

The company recently published its full-year results for the year 2021. Revenue was reported at $15.6 billion which grew by 20%, owing to robust customer demand. And EPS was reported at $9.61, which increased by a whopping 30%. The company declared a dividend of $0.79 for the fourth quarter. Its dividend payout is reported at 28.14% and 3-year annual dividend growth of 15.5%.

The company has a market capitalization of over $26 billion and its share is trading at $163.49. The share of the company has been on an upward streak since the year 2020. During the year 2021, the stock has appreciated by 14% and there are no roadblocks to the steady growth of the stock price. Investing in value stocks is a long-term investment.

The year 2021 was marked by a series of strategic transactions focused on the core business of the company. This also included strengthening the position of the company in the industry and establishing its name as a global leader in the $25 billion outdoor power equipment market. The potential future growth and the continuously growing stock price make it an ideal investment during the current inflation times.

Rio Tinto (RIO)

Rio Tinto is a leading global mining group that focuses on finding, mining, and processing mineral resources. It operates in about 35 countries – in mines, smelters, and refineries, as well as in sales offices, data centers, research, and development labs.

In addition to sustained production levels, the mining company announced plans to invest $108 million to investigate the feasibility of an underground mine below the existing open pit at Kennecott. Rio Tinto paid a $3.76 dividend for the first half of 2021. In addition to it, the company also declared a special dividend of $1.85 per share for the same period. The company has a three-year dividend growth of 122.45%.

The company has a market valuation of $124.7 billion. Its share is trading at $76.66. the share price journey has been volatile in the past 18 months. The stock price peaked at $93 and then dropped to $60 before rising to the current trading level. The cybersecurity stocks have become a high-growth sector and is attracting a lot of investor attention.

Rio Tinto was amongst the highest paying dividend stock on the FTSE 100 index this year. All the more reasons to invest in this stock are to protect your portfolio against inflation.

Riot Blockchain (RIOT)

Riot Blockchain, Inc. is a Bitcoin mining company, supporting the Bitcoin blockchain through rapidly expanding large-scale mining in the United States. Previously involved with the biotech industry, the company’s focus shifted after the founder made his first investment in the cryptocurrency Coinsquare in 2018. Since then, RIOT’s biggest investments have been in a cryptocurrency exchange, a blockchain auditing service, and a telecom smart contract service. Additionally, RIOT has made a massive investment in Bitcoin mining hardware. Moreover, the company is determined to expand its operations by increasing its Bitcoin mining hash rate and infrastructure capacity. Crypto Signal Providers can help you in selecting the best ones for your portfolio.

In the recent third-quarter report for the year 2021, the bitcoin mining company reported revenue of $64.8 million for the quarter. The revenue increased by more than 2,500% within one year. Also, Bitcoin mining increased by almost 500%, totally at 1,292 Bitcoin. The company is still in its infancy and is currently not generating profits. It reported a net loss of $15.2 million for the quarter

Riot Blockchain has a market capitalization of around $2 billion. Its shares are trading at a price of $17.76. the stock has been pretty volatile since the start of 2021. The stock price shot up to $71.3 from a price of $20, in Feb-2021 after dropping back to previous trading price levels.

The boost in cryptocurrency and the exponential growth within this sector make RIOT blockchain an excellent investment for inflation for 2022.

F5 Networks (FFIV)

F5 specializes in application services and application delivery networking. F5 technologies focus on the delivery, security, performance, and availability of web applications. As well as the availability of servers, cloud resources, data storage devices, and other networking components.

In the recent annual report for 2021, the company reported revenues of $2.5 billion, a 12% increase from last year. Net Income was reported at $331 million and earnings per share were $5.46. Get to know some of best blue-chip stocks to invest in now.

F5 is a $12.2 billion-dollar company. Its share is trading at $200.65. The stock price has been on the rise since the last quarter of 2020. In the year 2021 alone, the stock appreciated by 39% from a price of $175.94 to $244.71.

F5 network transited from hardware to cloud-based software at an appropriate time. With the growth in cloud-based software, there are huge opportunities for the company in near future. Hence it is an excellent stock to invest in to hedge against inflation during the current year.

Conclusion

The above companies have been shortlisted based n the growth in their operations and how likely the companies can combat the rising inflation problems. Since not every company can manage its expenses and continue to grow, the above-mentioned few companies are a great investment for 2020 to guard your portfolio against inflation.

Disclaimer: Futures, options, and over the counter foreign exchange products may involve substantial risk and may not be suitable for all investors. Leverage can work against you as well as for ...

more