Best Oil Stocks To Buy In 2022

Oil companies are extremely important for the global economy as the transportation sector and power sector both depend upon them. Oil prices have been rising since the start of 2021. This rise in demand is supported by recovering demand and capping supply from OPEC. Global oil demand will grow by 5.7 mb/d over the 2019-25 period at an average annual rate of 950 kb/d, as per the research by IEA. The future of the sector is challenging as the slowdown in oil demand growth alongside the continued build-up of refining capacity will intensify competition. Moreover, oil and gas producers are pressurized to embrace the energy transitions. Therefore, oil companies are looking to rise to the challenge by announcing ambitious targets to fight climate change

Image Source: Pexels

Investing in oil stocks offers great rewards in terms of high returns. But they are also the riskiest investment and highly volatile. The oil sector is currently valued at more than $2 trillion and it has more than 200,000 business operators working within this sector.

Benefits of Investing in Oil Stocks

- Return on Investment – Oil stocks are risky but they also offer lucrative returns on investment. Hence, they attract a lot of investors

- Tax Advantages – Income from oil stocks is tax-sheltered

- Diversification – Oil stocks offer an excellent mode of diversification in the portfolio. When the economy is down, oil stocks are usually up, hence it brings stability to an investor’s portfolio

Risks of Buying Oil Stocks

- Market Price Volatility – Oil stocks are highly volatile. Therefore, they are a risky investment if a huge part of the portfolio is invested.

- Geological Risks – Oil stocks backed by active drilling projects should be carefully studied for geological risks.

- Political Risk and Instability – A change in the political scenario and/or alteration in government policy can have a significant impact on projects related to oil exploration and drilling.

| Sr. | Company Name | Symbol | Market Cap | Share price (As of 22nd Dec 2021) |

| 1. | Exxon Mobil Corp. | XOM | $ 260 Billion | $ 60.99 |

| 2. | PetroChina Co. Ltd. | PTR | $ 133.2 Billion | $ 44 |

| 3. | Devon Energy | DVN | $ 28.6 Billion | $ 42.29 |

| 4. | Phillips 66 | PSX | $ 31.38 Billion | $ 71.62 |

| 5. | TotalEnergies SE | TTE | $132.4 Billion | $ 50.72 |

| 6. | ConocoPhillips | COP | $ 93.75 Billion | $ 71.08 |

| 7. | BP PLC | BP | $ 87.98 Billion | $ 26.77 |

| 8. | Pioneer Natural Resources Co. | PXD | $ 44.2 Billion | $ 181 |

Exxon Mobil Corp. (XOM)

ExxonMobil is one of the world’s largest publicly traded international oil and gas companies. It delivers an industry-leading position and improves earnings by strict cost control, strong operations, and working through recovering markets. Moreover, the company plans to improve its balance sheet through debt reduction. In the current post-pandemic era, when life has returned to normalcy, demand across all business lines has improved. In addition to it, ExxonMobil plans to reduce its carbon emissions to net-zero by 2050.

The key highlights from the recent quarterly earnings report of Exxon Mobil:

- Quarterly earnings were reported at $ 6.8 billion. From a loss of $680 million in 2020, the company’s earnings increased by $ 7.4 billion. This increase is due to improved demand and strong operations

- Cash flow from operating activities of $ 12.1 billion funded capital investments, debt reduction, and dividend

- Expected future annual capital investments of $20 billion to $ 25 billion; 4X increase in low-carbon spend

- Starting 2022, share repurchase program of up to $10 billion over 12 – 24 months

- On track to achieve 2025 emission-reduction plans by year-end

ExxonMobil is currently valued at $260 billion. Its share is trading at around $ 61. The company’s share has been rising since November-2020. The share kicked off the year 2021 at $ 41.22 and has grown by approx. 50% to date.

PetroChina Co. Ltd. (PTR)

PetroChina Company Limited is the largest oil and gas producer and distributor. It plays a very vital role in the oil and gas industry of China. PetroChina is amongst the biggest oil companies in the world and one of the biggest companies in China in terms of sales revenue. The company forms an optimal, efficient and integrated business chain from exploration and production of crude oil and natural gas in the upper stream to the refining, chemicals, pipelining, and marketing in the middle and down-stream, which greatly improves the operation efficiency, reduces costs and enhances the core competitiveness and overall anti-risk capability.

In its recent third-quarter report of 2021, PetroChina reported:

- Increase in revenue by 37.5% year-on-year

- Profit declined by approximately 44% year-on-year

- The number of Self-operated Gas stations at the end of Sept 30 2021 was 22,551

- The number of convenience stores at the end of Sept 30 2021 were 20,109

| Operating Data | Unit | For the Nine Months of 2021 | Year-on-year % change |

| Total crude oil output | Million barrels | 662.3 | -5.6 % |

| Marketable natural gas output | Billion cubic feet | 3,280.5 | 6.5 % |

| Oil and natural gas equivalent output | Million Barrels | 1,209.2 | -0.4 % |

| Processed crude oil | Million Barrels | 911.9 | 3.9 % |

| Gasoline, kerosene, and diesel output | Thousand Tons | 81,327 | 1.4 % |

PetroChina is currently valued at $ 139 billion. Its share is trading at $ 44.56. The stocks kicked off the year 2021 at $30.72. To date, it has risen by a whopping 45%.

Devon Energy (DVN)

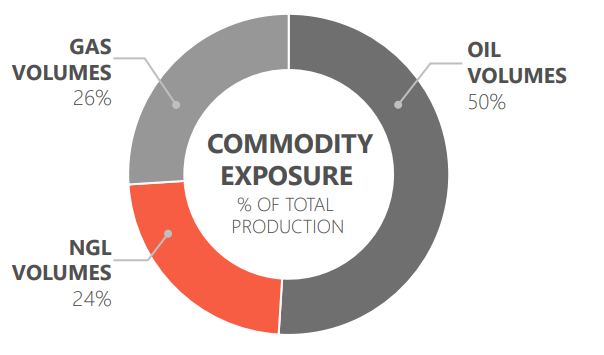

Devon Energy Corporation is a leading independent oil and natural gas exploration and production company. The nature of the company’s business is capital intensive. Therefore, they deliver sustainable and capital-efficient cash to maintain the company’s growth and shareholder’s return. Devon has a balanced exposure to oil and liquids-rich production. The following chart shows the production percentage by-product in the third quarter of 2021:

Devon Energy offers a market-leading dividend. Its dividend yield is 7 times higher than the S&P 500 dividend yield. It has been consistently paying dividends for the last 29 years. Moreover, the oil company is focused on growth and improvement. It has strong liquidity with cash holdings of $2.3 billion at the end of the third quarter. In addition to it, net debt improved by 16%.

The company is focused on the environmental friendly targets it has set for GHG Emissions, Methane Emissions,

Devon Energy has a market cap of $28.5. Its share is currently trading at $42.05. The share of Devon is on an upward streak since the start of 2021. From a price of $ 18.11, the share has appreciated by more than 100%.

Phillips 66 (PSX)

Phillips 66 is an energy manufacturing and logistics company. It operates through four segments: Midstream, Chemicals, Refining, and Marketing and Specialties (M&S). It has a total of 13 refineries in the United States and Europe that process crude oil and other feedstocks. The company is focused on operating excellence, optimization, safety, and increasing margins. The business has a global refining capacity of 2.2 million barrels of crude oil per day.

In its recent quarterly report:

- The company reported earnings of $402 million

- The company generated $2.2 billion of operating cash flow

- Phillips 66 delivered strong Midstream, Chemicals, and Marketing, and Specialties earnings

- There was a significant improvement in Refining realized margins

- The company paid off a $500 million term loan

- Also, the company recently increased the quarterly dividend to 92 cents per share

- Phillips 66 recently announced an agreement to acquire all publicly held units of Phillips 66 Partners

- The company also announced greenhouse gas emissions reduction targets

Phillips 66 is currently valued at $ 31.5 billion. Its share is currently valued at $ 71.9. the oil company’s share has seen multiple trenches and peaks in the last 2 years. After the March-2020 crash, the stock recovered a lot but again dipped to the lowest levels. The stock has recovered ever since.

TotalEnergies SE (TTE)

TotalEnergies SE is a France-based oil and gas company. It operates through four segments: Exploration and Production, Gas, Renewables & Power, Refining & Chemicals, and Marketing & Services. Exploration & Production encompasses the exploration and production activities.

In the third-quarter report, TotalEnergies reported:

- Net Income was reported at $4.8 billion, an increase of 38% year on year. The reason for this increase was TotalEnergies’s multi-energy model and its leading position in the LNG market

- Total Cash flow (DACF) was reported at $8.4 billion, a 25% year-on-year increase

Total Energies has a market capitalization of $ 133.4 billion. Its share is currently trading at $51.08. The stock of TotalEnergies has seen multiple peaks and drops. It is on a bullish run since March-2020 but has also exhibited volatility. The stock kicked off the year 2021 at a price of $ 41.91. And now it has appreciated by roughly 22%.

ConocoPhillips (COP)

ConocoPhillips is the world’s largest independent E&P company based on production and proved reserves. It markets crude oil, natural gas, natural gas liquids, liquefied natural gas, and bitumen to customers around the world. The company targets medium and large businesses privately owned and/or state-owned with operations within the energy, utility, and petroleum industries

ConocoPhillips provides oil and gas to several high-profile companies, including British multinational oil and gas company BG Group, China’s state-controlled PetroChina, and Malaysia’s government-owned Petroleum Nasional. The company has a customer base spanning 14 countries.

In the recent quarterly report, ConocoPhillips reported:

- Earnings of $2.4 billion, as compared to a loss of $ 0.5 billion last year in the same quarter

- Increase in the quarterly dividend by 7% to 46 cents per share.

- Combined cash, cash equivalents, and restricted cash was reported at $10.2 billion

- As part of a commitment to ESG excellence, the company announced a reduction in targets from a 2016 baseline to 40-50% on net equity and gross operated basis by 2030, from the previous target of 35-45% on only a gross operated basis

The company has a market valuation of around $94 billion. Its share is currently trading at $71.19. The stock of ConocoPhillips is on a bullish run since the start of the current year. The share kicked off the year 2021 at $40. Since then, it has grown by a whopping 78%. By using the stock signals, you can avoid hours of technical analysis to understand the market.

BP p.l.c. (BP)

BP p.l.c is an oil and petrochemicals company. The Company explores and produces oil and natural gas. It also refines, markets, and supplies petroleum products, generates solar energy and manufactures and markets chemicals. BP’s chemicals include terephthalic acid, acetic acid, acrylonitrile, ethylene, and polyethylene. The company is moving towards low carbon emissions and plans to net zero emissions by 2050.

In the third-quarter report, the company reported:

- Underlying replacement cost profit of $ 3.3 billion

- Declared a dividend of 5.46 cents per share

- Operating cash flow of $6 billion

- Capital expenditure was $2.9 billion

BP has a market capitalization of over $89 billion. Its share is trading at $26.97. The share is on an upward streak at a slow pace. Since the pandemic market crash, the stock has not recovered back to its pre-pandemic price.

Pioneer Natural Resources Co. (PXD)

Pioneer Natural Resources Company is a top-tier independent n oil and gas exploration and production company that explores for, develops, and produces oil, natural gas liquids (NGLs), and gas. It sells homogeneous oil, NGL, and gas units. Pioneer has all proved reserves, production, and resource potential in low-risk, predictable basins in the United States.

Pioneer is focusing on ESG leadership therefore the company is doing ESG-based investing with an emphasis on climate change and sustainable investments. Pioneer has set a target for net-zero emission by 2050.

In the third-quarter report, Pioneer reported:

- Oil production of 389 MBOPD

- BOE Production of 676 MBOEPD

- Net Income of $1 billion

- Free cash flow of $ 1.1 billion

- Variable dividend of $3.02 announced, to be paid in Dec-2021

- The company has strengthened its emissions intensity reduction goal

Pioneer is a $44 billion company. Its share is currently trading at $ 180. The share of Pioneer is on a bullish run since the start of the year. From January till date it has appreciated by 58%.

Conclusion

Oil is one of the riskier yet most profit-generating sectors. Careful scrutinizing of the company will lead to smart investment decisions by investors. The above list has been created after detailed research on the company’s stock performance and operational capacity along with their commitment towards the transition in the energy sector.

Disclaimer: Futures, options, and over the counter foreign exchange products may involve substantial risk and may not be suitable for all investors. Leverage can work against you as well as for ...

more