Best Energy Stocks To Buy As Oil Rallies: PSX, CVX, And COP

Oil trades above $80 again, and energy stocks follow higher. Here are three stocks to buy as oil rallies: Phillips 66, Chevron Corporation, and ConocoPhillips

The new trading year barely started, but the oil price already recovered most of its recent correction. Fears of the omicron variant impacting the economy receded, and investors piled back in risk-on trades.

Oil failed above $85 last year, but the recent rally threatens to make a new higher high. As such, energy stocks are “on fire,” with oil stocks already posting double-digit gains. Moreover, valuations look attractive, and they pay hefty dividends.

Here are three energy stocks to buy amid rising oil prices: Phillips 66 (NYSE: PSX), Chevron Corporation (NYSE: CVX), and ConocoPhillips (NYSE: COP).

Phillips 66

Phillips 66 is a crude oil producer and marketer from Houston, Texas. It employs close to 10,000 people, and it was founded in 1917.

The stock price is up +2.53% today alone and +15.73% YTD. Besides the stock’s performance, the company pays a quarterly dividend with a forward dividend yield of 4.39%. Moreover, the dividend payout ratio is 86.66%, and the five-year dividend growth rate is 8.12%.

Phillips 66 grew its YoY revenue at a rate higher than the sector median by 68.57%, and at the current market price, the company reached a market capitalization of $35.92 billion.

Chevron Corporation

Chevron is based in San Ramon, California, and was founded in 1879. It is involved in petroleum operations and is one of the largest oil companies in the world.

The stock price is up +2.21% today alone and +37.36% in the last twelve months. On top of that, Chevron pays a quarterly dividend with a forward dividend yield of 4.28%. Furthermore, it has one of the longest dividend growth histories – 34 years.

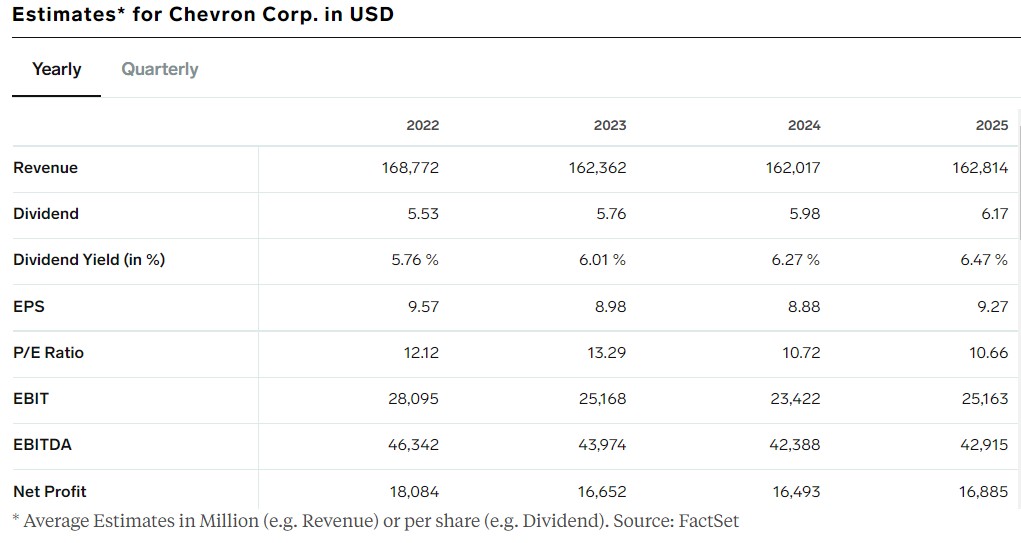

Chevron operates with a gross profit margin higher than the sector median by 13.08% and the P/E ratio for 2022 is forecasted at 12.12.

(Click on image to enlarge)

ConocoPhillips

ConocoPhillips is another company from Houston, Texas, producing and marketing crude oil. Its stock price is close to record-high levels after bouncing strongly from the pandemic lows – just like the crude oil price did.

(Click on image to enlarge)

While the dividend yield is not that high when compared to the other two companies presented earlier (only 2.27%), ConocoPhillips operates with a much higher gross profit margin – higher by 22.19% than the sector median.

The stock price is up +12.26% YTD and +81.28% in the last year.

Disclaimer: None of the content in this article should be viewed as investment advice or a recommendation to buy or sell. Past performance/statistics may not necessarily reflect future ...

more