Best Dividend Stocks To Buy At The Start Of February

During the COVID-19 pandemic, investors favored growth stocks. Are dividend stocks back in favor? Here are three dividend stocks to buy as the new month starts – PepsiCo, AbbVie, and Otis Worldwide Corporation.

The COVID-19 pandemic brought a rally in most equity markets due to unprecedented fiscal and monetary stimulus. Investors mainly focused on growth stocks, which surged.

Is 2022 the year when dividend stocks are back in a big way?

Sure enough, dividend payments are expected to increase by 6% in 2022 compared to the previous year. Investors typically focus on stocks with a high dividend yield, but the secret is to find a balanced yield that does not hide financial troubles.

When companies increase their dividends, it is a sign of confidence in the business and its ability to generate future cash flow. As such, here are three dividend stocks to buy as the new month starts: PepsiCo, AbbVie, and Otis Worldwide Corporation.

PepsiCo

PepsiCo (Nasdaq: PEP) is a food and beverage company operating globally and having a brand with worldwide recognition. It employs close to 300,000 people, and its YoY revenue growth exceeds the sector median – 11.85% vs. 8.96 sector median.

Pepsi’s stock price is up +27.06% in the last twelve months, and the company pays a quarterly dividend. One of the most impressive things about Pepsi is that it increased the annual dividend for the past 49 years. Moreover, the forward dividend yield is 2.48%, and the payout ratio is 67.77%.

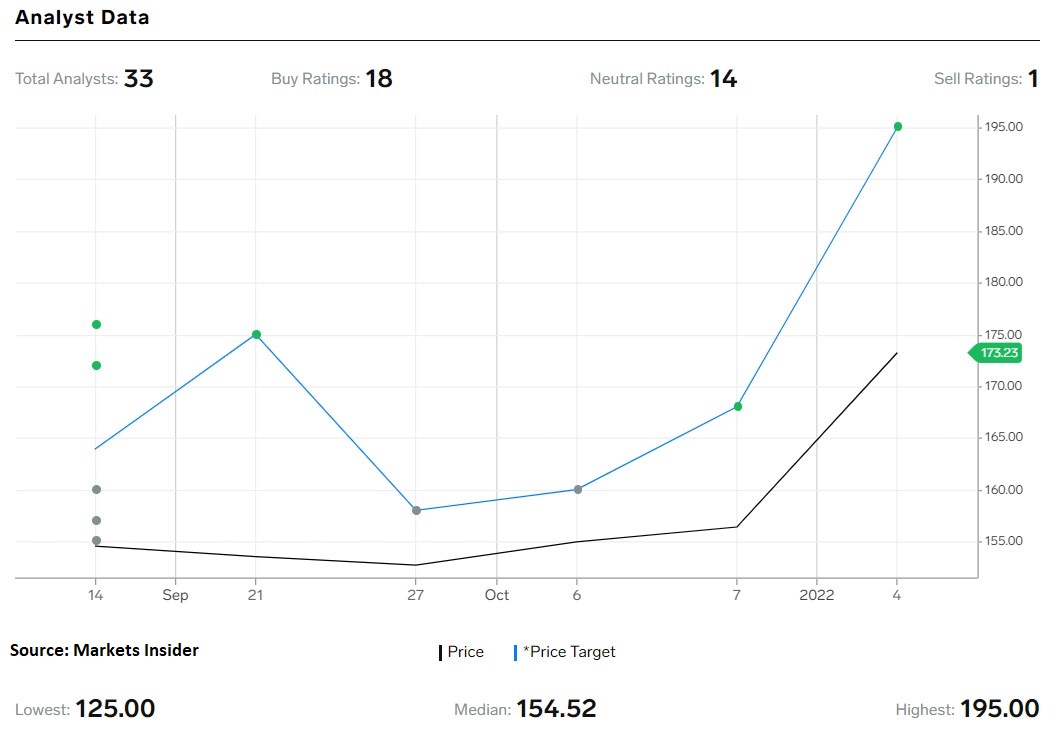

Most analysts have issued buy ratings for Pepsi's stock. Out of the 33 analysts covering the stock, only 1 has issued a sell rating.

(Click on image to enlarge)

AbbVie Inc.

AbbVie (NYSE: ABBV) is one of the largest companies operating in the health care sector. Based in North Chicago, Illinois, it employs 50,000 people, and its YoY revenue growth exceeds the sector median by 101.56%.

Moreover, AbbVie’s forward dividend yield is 4.12%, while the dividend payout ratio is 42.24%. At the current stock market price, the company is valued at $243.83 billion and has an enterprise value of $312.34 billion.

Otis Worldwide Corporation

OTIS is an American company manufacturing escalators and elevators. With international operations, it has a forward dividend yield of 1.12% and it has an EBIT Margin for the past twelve months higher than the sector median by 59.31%.

(Click on image to enlarge)

Otis’ stock price gained +32.14% in the last twelve months, and at the current market price, the company is valued at $35.16 billion.