Best Agriculture Stocks To Buy In 2022

The agriculture industry is one of the largest influencers of the global economy, employing more than one billion people globally. Some of the leading agriculture companies generate up to $ 50-$ 115 billion in annual revenue.

Within the agriculture sector, many new subcategories are emerging which are expected to see rapid growth in the coming year due to emerging trends that are likely to shape the sector for the foreseeable future.

One of the biggest examples of new sub-sectors within the agriculture sector is because increased adoption of new technologies. This is giving rise to:

- Global smart farming market – It is expected to achieve 2.88 billion USD growth by 2025

- Global agriculture AI market – It is expected to achieve 458 million USD growth by 2025

- Global automated pest control system market – It is expected to achieve 100 million USD growth by 2025

The agricultural industry has been affected by the COVID-19 pandemic. Along with it, climate change impacts, increased disease risks, and increased labor costs, many companies are facing extreme financial stress, with a slower-than-expected recovery period. But the overall sector has made an impressive recovery as commodity prices have soared in several categories.

Agribusiness is a huge business and spreads across a wide array of industries. Agriculture companies require huge setups for operations. As a result, a handful of companies rule the overall market. Therefore, these companies offer excellent opportunities for investors. Investors can choose among companies providing agricultural products and services such as fertilizers, pesticides, seeds, processing, and livestock.

Best Agriculture Stocks to Buy in 2022

Here is a list of the 10 Best Agriculture stocks for 2022:

| Sr. | Company Name | Symbol | Price (As of 4th October 2022) | Market Cap | Dividend Yield | Major Markets |

| 1 | Deere & Company | DE | $ 360.29 | $ 108.75 billion | 1.31 % | Equipment for crop production |

| 2 | Archer-Daniels-Midland | ADM | $ 85.7 | $ 48.48 billion | 1.99 % | Plant-based proteins, processing, industrial biotech |

| 3 | Nutrien | NTR | $ 88.19 | $ 45.29 billion | 2.18 % | Fertilizers, digital agriculture, retail |

| 4 | Corteva Agriscience | CTVA | $ 61.76 | $ 42.75 billion | 1.05 % | Pesticides, biologicals, digital agriculture |

| 5 | Tyson Foods | TSN | $ 67.46 | $ 23.96 billion | 2.73 % | Meat production, plant-based proteins |

| 6 | CF Industries | CF | $ 105.06 | $ 20.37 billion | 1.6 % | energy nitrogen and hydrogen products, including fertilizers |

| 7 | FMC Corp | FMC | $ 112.44 | $ 14.06 billion | 1.94 % | Pesticides, biologicals |

| 8 | Bunge Limited | BG | $ 88.13 | $ 13.32 billion | 2.96 % | Processing, industrial biotech |

| 9 | ScottsMiracle-Gro | SMG | $ 45.92 | $ 2.4 billion | 6.04 % | Fertilizers, lawn care, hydroponics |

| 10 | China Green Agriculture | CGA | $ 6.11 | $ 81 Million | NA | Fertilizers and agricultural products. |

Deere & Company

Deere & Company is a manufacturer of agricultural, construction, and forestry machinery. It operates through three segments:

- Agriculture and Turf

- Construction and Forestry

- Financial Services.

Deere and Co offer a portfolio of more than 25 brands offering innovative solutions for customers in a variety of production systems. A few popular names are:

- Wirtgen

- Hagie

- PLA

- Mazzotti

- Kreisel

- Monosem

- Blue River Technology

In the recent third-quarter report, the company reported:

- Net Sales were reported at $ 14.1 billion, as compared to $ 11.5 billion, in the previous year’s same quarter

- Net Income was reported at $ 1.89 billion, as compared to $ 1.67 billion during the last year’s same period

- Earnings per share were reported at $ 6.16, as compared to $ 6.16 during the last year’s same period

Deere and Co have a market cap of $ 108.75 billion. Its share is trading at a price of $ 360.29.

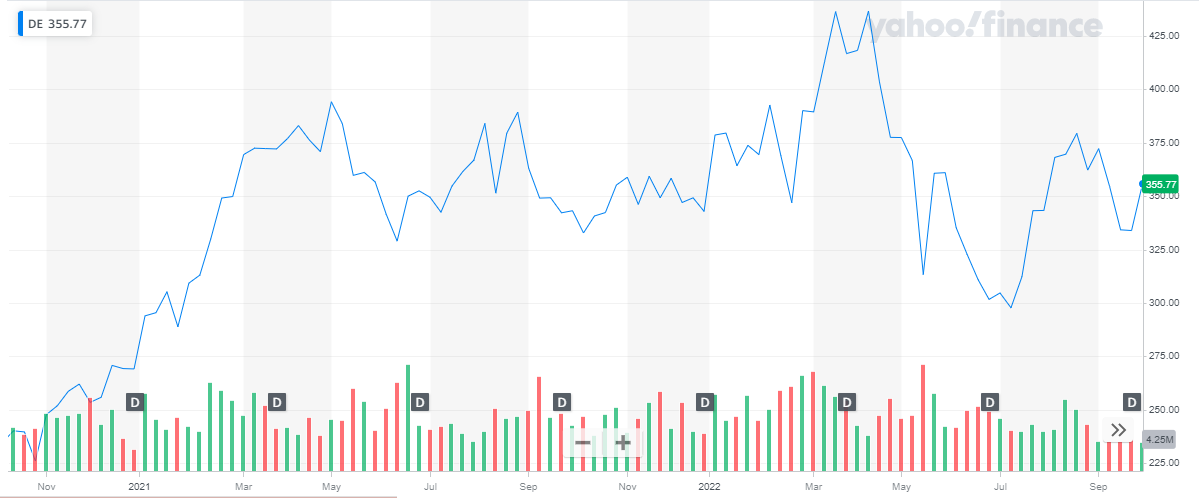

During 2021 the stock continued to climb high. From $ 269.05 the stock rose up to $ 394.22. For the remaining half of the year, the company maintained its share price, while exhibiting volatile behavior. The share concluded the year at a price of $ 342.89, representing a 27.5 % appreciation during the year.

In 2022, the stock has been seen following a head and shoulders pattern. From a price of $ 342.89, the stock rose up to $ 436.45 and then declined to $ 297.7 and last closed at $ 355.77. Overall, the stock appreciated by 3.75 %.

Archer-Daniels-Midland

Archer-Daniels-Midland is a premier global human and animal nutrition company. The company operates through three segments:

- Ag Services and Oilseeds

- Carbohydrate Solutions

- Nutrition.

It procures, stores, cleans and transports agricultural raw materials, such as oilseeds, corn, wheat, milo, oats, and barley. The company also engages in agricultural commodity and feed product import, export, and distribution; and structured trade finance activities. Investing in value stocks is a long-term investment.

In the second quarter report for the year 2022, the company reported:

- Revenues were reported at $ 27.3 billion

- Net earnings and adjusted earnings of about $ 1.2 billion

- Earnings per Share of $ 2.18

Archer-Daniels-Midland has a market cap of $ 48.07 billion. Its shares are trading at a price of $ 85.75

During 2021, the stock of the company started climbing slowly and steadily. From a price of $ 50.41, the stock closed the year at $ 67.59, representing a 34 % appreciation during the year.

In 2022, the stock started off at $ 67.59 and climbed as high as $ 96.91. After that, the stock dipped and dropped to the low of $ 72 and last closed at $ 85.75. Overall, the stock appreciated by 27 % to date.

Nutrien

Nutrien is the world’s largest provider of crop inputs and services, playing a critical role in helping growers sustainably increase food production. They produce and distribute approximately 27 million tonnes of potash, nitrogen, and phosphate products worldwide. With this capability and its leading agriculture retail network, the company is well-positioned to supply the needs of its customers.

Nutrien recently reported its second-quarter results for the year 2022:

- Total Revenue was reported at $ 14.5 billion, as compared to $ 9.8 billion in the previous year’s same period

- Net earnings were reported at $ 3.6 billion, as compared to $ 1.1 billion in the previous year’s same period

- Net earnings per share were reported at $ 6.51

Nutrien has a market cap of $ 46.42 billion. Its share is trading at a price of $ 85.48.

During 2021, the stock of the company started climbing slowly and steadily. From a price of $ 48.16, the stock closed the year at $ 75.2, representing a 56 % appreciation during the year. Investors are now looking for the finest solar energy stocks to invest in.

In 2022, the stock started off at $ 75.2 and climbed as high as $ 112. After that, the stock dipped and dropped to the low of $ 73.25 and last closed at $ 85.48. Overall, the stock appreciated by 35 % to date.

Corteva Inc.

Corteva, Inc. is a publicly traded, global pure-play agriculture company that combines industry-leading innovation, high-touch customer engagement, and operational execution to profitably deliver solutions for the world’s most pressing agriculture challenges. Corteva generates advantaged market preference through its unique distribution strategy, together with its balanced and globally diverse mix of seed, crop protection, and digital products and services. With some of the most recognized brands in agriculture and a technology pipeline well-positioned to drive growth, the Company is committed to maximizing productivity for farmers, while working with stakeholders throughout the food system as it fulfills its promise to enrich the lives of those who produce and those who consume, ensuring progress for generations to come.

Corteva reported second-quarter results for the year 2022:

- Net Sales were reported at $ 6.25 billion, representing an 11 % increase on a year-on-year basis

- Net Income was reported at $ 969 million, representing a 0.1 % decline from the previous year same period

- Earnings per share were reported at $ 1.37

Corteva Inc. has a market cap of $ 42.25 billion. Its share is trading at a price of $ 60.89.

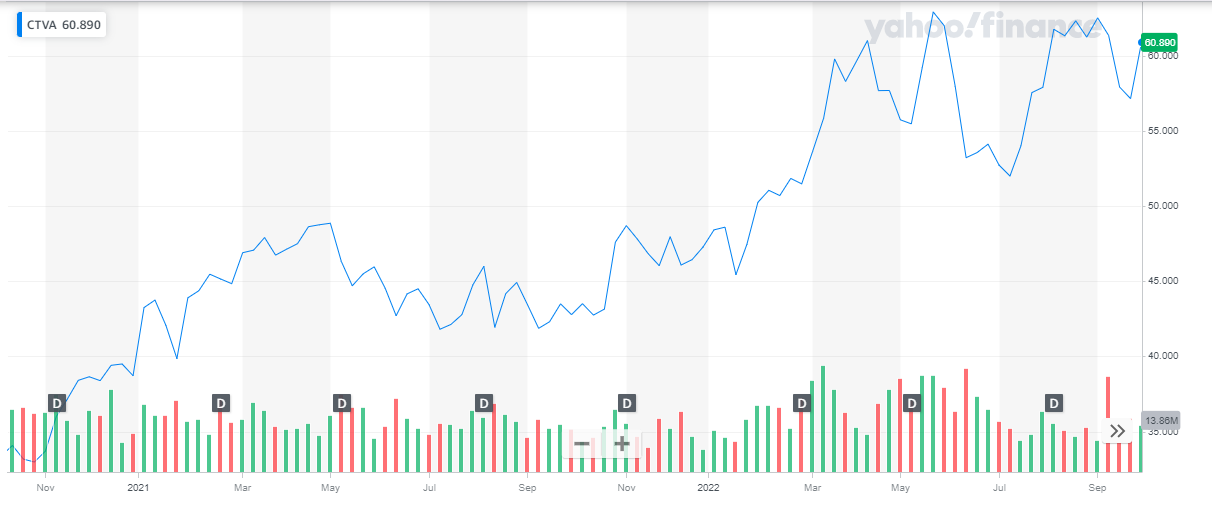

In 2021, the stock started at $ 38.72 and continued an upward streak throughout the year, with a few dips. The stock closed the year at $ 47.28, representing a 22 % appreciation.

In 2022, the stock spiked high from $ 47.28 to $ 62.9 and then dipped to $ 52. The stock last closed at $ 60.89, representing a 29 % appreciation to date.

Tyson Foods

Tyson Foods, Inc is one of the world’s largest food companies and a recognized leader in protein. Founded in 1935, the company has been led by the same family. Under four generations of family leadership, the Company has a broad portfolio of products and brands which include:

- Tyson

- Jimmy Dean

- Hillshire Farm

- Ball Park

- Wright

- Aidells

- Ibp

Tyson Foods innovates continually to make protein more sustainable, tailor food for everywhere it’s available, and raise the world’s expectations for how much good food can do.

Tyson Foods recently reported its third quarter 2022 report:

- Total Sales Revenue was reported at $ 13.5 billion, as compared to $ 12.5 billion during the previous year, the same period

- Net Income was reported at $ 753 million. The company reported equal net income for the previous year same period

- Earnings per share were reported at $ 2.07

Tyson foods have a market cap of $ 23.6 billion. Its share is trading at a price of $ 65.52.

The stock of the company has been on a bullish run since the start of 2021. From a price of $ 64.44, the stock closed the year at a price of $ 87.16. Overall, the stock appreciated by 35 % during the year.

In 2022, the stock continued its bullish run and peaked at $ 97.99. After that, the stock reversed its course and started its downward journey. The stock last closed at $ 65.52, representing a 25 % decline to date.

CF Industries

CF Industries is a leading global manufacturer of hydrogen and nitrogen products for clean energy, emissions abatement, fertilizer, and other industrial applications. The company owns manufacturing complexes in the United States, Canada, and the United Kingdom, which are among the most cost-advantaged, efficient, and flexible in the world, and unparalleled storage, transportation, and distribution network in North America. They have a total of 3,000 employees working for them which focus on safe and reliable operations, environmental stewardship, and disciplined capital and corporate management, driving company strategy to leverage and sustainably grow the world’s most advantaged hydrogen and nitrogen platform to serve customers, creating long-term shareholder value.

CF Industries reported second-quarter results for the year 2022:

- Net sales were reported at $ 3.4 billion, as compared to $ 1.6 billion during the previous year’s same period

- Net earnings were reported at $ 1.17 billion, as compared to $ 246 million during the previous year’s same period

- Earnings per share were reported at $ 5.58 per diluted share

CF Industries has a market cap of $ 21.1 billion. Its shares are trading at a price of $ 105.73.

The share of CF industries has been following a bullish trend since 2021. It started off at $ 38.71 and closed the year at $ 70.78, representing an 83 % appreciation during the year.

During 2022, the stock continued its bullish journey with a few dips along the way. From a price of $ 70.78 the stock rose up to $ 118.35 and last closed at $ 105.73. To date, the stock appreciated by approx. 50 % in 2022

FMC Corp

FMC Corporation, an agricultural sciences company, provides crop protection, plant health, and professional pest and turf management products. It develops, markets, and sells crop protection chemicals that include insecticides, herbicides, and fungicides; and biologicals, crop nutrition, and seed treatment products, which are used in agriculture to enhance crop yield and quality by controlling a range of insects, weeds, and diseases, as well as in non-agricultural markets for pest control. The company markets its products through its own sales organization and through alliance partners, independent distributors, and sales representatives. It operates in North America, Latin America, Europe, the Middle East, Africa, and Asia.

FMC Corp recently reported its second quarter report:

- Revenue was reported at $ 1.45 billion, an increase of 17 % from the second quarter of 2021

- Net income was reported at $ 131 million, a decline of 35 % from the second quarter of 2021

- Earnings per share were reported at $ 1.06

FMC Corp has a market cap of $ 14 billion. Its share is trading at a price of $ 111.03.

The stock of FMC has been very volatile in the past two years. The stock started the year 2021 with a price of $ 114.93 and after multiple dips and peaks dropped to a low of $ 87.77. The stock closed off the year 2021 at $ 109.89 representing a 4 % decline throughout the year.

In 2022, the stock spiked high and went from $ 109.89 to $ 138.4. It last closed at $ 110.93. The stock has maintained its price level as compared to the start of the year.

Bunge Limited

Bunge Ltd. operates as a holding company, which engages in the supply and transportation of agricultural commodities. It operates through the following segments:

- Agribusiness – The Agribusiness segment involves the purchase, storage, transportation, processing, and sale of agricultural commodities and commodity products

- Edible Oil Products – The Edible Oil Products segment includes the production and sale of vegetable oils, shortenings, margarine, and mayonnaise.

- Milling Products – The Milling Products segment consists of the production and sale of wheat flours, bakery mixes, corn-based products, and rice

- Sugar and Bioenergy- The Sugar and Bioenergy segment comprises the manufacture and marketing of sugar and ethanol derived from sugarcane, as well as energy derived from the sugar and ethanol production process.

- Fertilizer – The Fertilizer segment focuses on producing, blending, and distributing fertilizer products for the agricultural industry.

Bunge Limited recently reported its second quarter report of 2022:

- Net Sales were reported at $ 17.9 billion as compared to $ 15.4 billion in the prior year

- Net Income was reported at $ 206 million as compared to $ 306 million in the prior year

- Earnings per share were reported at $ 1.34 as compared to $ 2.37 in the prior year

Bunge Limited has a market cap of $ 13 billion. Its share is trading at a price of $ 85.75.

The share has been on a bullish run throughout 2021 and the major part of 2022. It started the year 2021 at a price of $ 65.58 and closed off at $ 93.36. Overall, the stock appreciated by 42 % during the year.

The stock continued its bullish journey in 2022 till it peaked at $ 123.95. After that, the stock reversed its course and started its downward journey. The stock last closed at $ 85.86, representing a 31 % appreciation to date.

ScottsMiracle-Gro

Scotts Miracle-Gro Co. engages in the manufacture, marketing, and distribution of systems and accessories for hydroponic gardening. It operates through the following segments:

- U.S. Consumer – The U.S. Consumer segment consists of consumer lawn and garden business

- Hawthorne – The Hawthorn segment includes indoor, urban, and hydroponic gardening businesses.

- Other – The Other segment refers to the consumer lawn and garden business in geographies other than the U.S. and product sales to commercial nurseries, greenhouses, and other professional customers.

Scotts Miracle Go recently reported its third quarter report for the year 2022:

- Sales were reported at $ 1.19 billion, a 26 % decline from the previous year same period

- Net Loss was reported at $ 443.9 billion

- Earnings per loss were reported at $ 8.01 per share,

Scotts Miracle Go has a market cap of $ 2.27 billion. Its share is trading at a price of $ 41.09.

The stock of the company has been on a bearish run for the past two years. From a price of $ 199.14, the stock declined up to $ 161 in the year 2021. Overall, the stock declined up to 20 % during the year.

In 2022, the stock started at $ 161 and last closed at $ 40.87, representing a whopping 75 % decline to date.

China Green Agriculture

China Green Agriculture, Inc. (Green Nevada) is engaged in the research, development, production, and sale of various types of fertilizers and agricultural products in the People’s Republic of China through its wholly-owned Chinese subsidiaries:

- Shaanxi Tech Team Jinong Humic Acid Product Co., Ltd. (Jinong),

- Xi’an Jintai Agriculture Technology Development Company (Jintai),

- Xi’an Hu County Yuxing Agriculture Technology Development Co., Ltd. (Yuxing),

- Beijing Gufeng Chemical Products Co., Ltd. (Gufeng)

- Beijing Tianjuyuan Fertilizer Co., Ltd. (Tianjuyuan).

The Company has four segments:

- Fertilizer products (Jinong)

- Fertilizer products (Gufeng and Tianjuyuan)

- Agricultural products (Jintai)

- Research and development (Yuxing).

Through Jintai, it develops and produces agricultural products, such as fruits, vegetables, flowers, and colored seedlings.

China Green Agriculture reported its quarterly report for the year 2022:

- Sales were reported at $ 61 million, as compared to $ 67 million in the previous year’s same quarter

- Net loss was reported at $ 38 million, as compared to a net loss of $ 14.8 million in the previous year’s same quarter

- Net loss per share was reported at $ 4.49 per share

China Green Agriculture has a market cap of $ 81 million. Its share is trading at a price of $ 6.08.

The stock started in the year 2021 at $ 3.6. It climbed high to $ 15.49 before dipping back again. The stock closed the year at $ 9.5, representing a 1.6-fold increase during the year.

In 2022, the stock followed a downward pattern. From $ 9.5 the stock last closed at $ 6.11, representing a 36 % decline to date

Conclusion

The agricultural sector is huge. While there are many big names in the industry, a cautious approach towards investing in always advised. The above list has been crafted after careful selection of the company’s current profitability and expected future success. The above-listed companies are amongst the best agriculture stocks to buy, in 2022.

More By This Author:

Elliott Wave View: Alphabet Likely See Further Downside

Natural Gas Incomplete Bearish Sequences Calling The Decline

Elliott Wave View: Dips in Dow Futures Might Find Support

Disclaimer: Futures, options, and over the counter foreign exchange products may involve substantial risk and may not be suitable for all investors. Leverage can work against you as well as for ...

more