Benchmarks Muted As Investor Digest Slew Of Earnings Reports

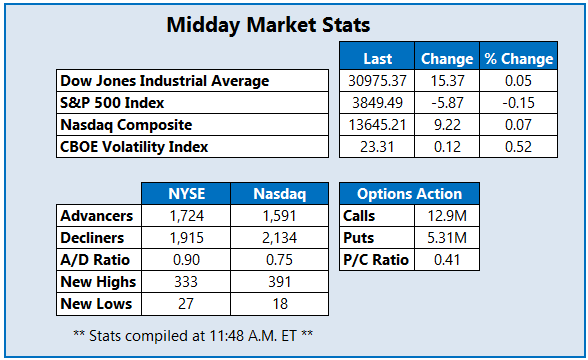

Stocks are hovering around breakeven at midday, as investors digest a slew of earnings reports and prepare for many more over the next few days. General Electric (GE) and Johnson & Johnson (JNJ) are stealing the show today, as both equities surge following better-than-expected quarterly reports. The Dow Jones Industrial Average (DJI) was last seen sitting just below breakeven, while the Nasdaq Composite (IXIC) and S&P 500 Index (SPX) are also flat. It has been an upbeat earnings season so far, with over 70% of companies that reported earnings beating Wall Street's expectations, according to Bank of America. Investor anxiety surrounding Covid-19 remains high, however, after Minnesota officials reported the first case of a virus strain found in Brazil in the U.S.

One stock seeing notable options activity today is General Electric Company (NYSE: GE), last seen up 5.8% to trade at $11.63, after the energy giant posted a fourth-quarter revenue beat, despite missing Wall Street's earnings estimates. So far, 475,000 calls have already crossed the tape, which is five times the average intraday amount, compared to 67,000 puts. Most popular is the weekly 1/29 11.50-strike call, followed by the 12-strike call in the same series. The security has been climbing up the charts since October with support from the 40-day moving average, and earlier hit an 11-month high of $12.23. Over the past nine months, GE has added no less than 71%.

Near the top of the New York Stock Exchange (NYSE) today is Venator Materials PLC (NYSE: VNTR), up 15% at $5.13 at last check, after earlier hitting a two-year high of $5.24. The positive price action came after the security received a price-target hike from Jefferies to $5 from $2. Today's pop helped VNTR topple overhead pressure at the $4.80 mark, which had been keeping a tight lid on the security over the last few weeks. Shares have been tearing up the charts since November, though, led higher by several bull gaps as well as the 20-day moving average, which contained the stock's latest pullback. In the last nine months alone, VNTR has added an impressive 320.3%.

Near the bottom of the NYSE today is Blue Apron Holdings, Inc. (NYSE: APRN), last seen down 10% to trade at $8.70, though a reason for the bear gap was not immediately clear. While the security experienced a volatility halt during yesterday's session, shares surged to break through resistance at the $8 mark, which has been in place since August. The security has seen a significant amount of volatility over the past year as well, surging to a March 19, two-year high of $28.84 just weeks after tumbling down to a March 9, all-time low of $2.01. Year-over-year, though, APRN remains up 108.6%.