Bellicum Is Worth A Look With Multiple Catalysts On The Way In 2nd Half Of 2019

TM editors' note: This article discusses a penny stock and/or microcap. Such stocks are easily manipulated; do your own careful due diligence.

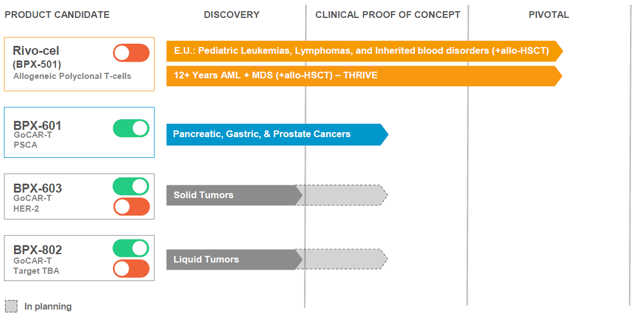

Bellicum Pharmaceuticals (BLCM) has many catalysts that are approaching in the 2nd half of 2019. It is a biotech that is built on using GoCAR-T technology as immunotherapy to treat patients with many different types of cancer. It also has rivo-cel which uses allogeneic polyclonal T-cells to improve outcomes in {C}Hematopoietic stem cell transplantation{C} ((HSCT)). Both of these aspects of the pipeline makes a strong case for the biotech. It is even taking it one step further by combining its CaspaCIDe switch and rimiducid switch to improve both safety and efficacy of its CAR-T therapies. This is known as the dual-switch GoCAR-T product. With a diverse array of immunotherapy products, multiple catalysts on the way in the 2nd half of 2019 and a currently completed cash raise I believe that there is massive upside potential that could take shape. That's why I believe it is a buy.

(Click on image to enlarge)

Rivo-cel is being used to treat pediatric patients with malignant or non-malignant blood disorders. That is these patients suffer from a range of blood disorders like: Leukemia, lymphoma, and other genetic blood disorders. Rivo-cel is a T-cell therapy that uses the biotech's CaspaCIDe safety switch to improve the outcome of a stem-cell transplant. Such transplants are known as Hematopoietic stem cell transplantation ((HSCT)). This involves the use of transplanting hematopoietic stem cells. The stem cells can normally be derived from bone marrow, peripheral blood, or umbilical cord blood. They can be autologous, allogeneic or syngeneic. Autologous means the patient's very own donor cells are used, while allogeneic means from a donor who is genetically similar but not an exact match. These pediatric patients with blood cancer take stem-cell transplants in hopes of curing their blood disorder. Such allogeneic transplants used now as standard of care ((SOC)) are good but have several drawbacks. Rivo-cel is intended to improve the outcome of an HSCT being done. This means faster recovery with immune cells in a person's body, lower rate of infection taking place and lower disease relapse-rates. Rimiducid is the switch of the CaspaCIDe safety switch system, it is incorporated to control the signaling of cells. In this case, rimiducid with rivo-cel combination is used to stop the morbidity or mortality that occurs in Graft-versus-host-disease ((GvHD)). GvHD is where after a transplant takes place, then the body views the new graft of cells as intruders. This causes the patient's own body to attack these cells that have been transplanted.

This is the lead product of the pipeline. It is the furthest along and has been greatly de-risked. The reason why I say de-risked is because Rivo-cel has already met the primary endpoint of a European registrational study. This is a phase 1/2 study using Rivo-cel to treat these pediatric patients with blood disorders. This study recruited patients with either malignant or non-malignant blood disorders who underwent a haploidentical stem cell transplant. The phase 1/2 study was known as the BP-004 trial. Before diving further into the data itself, it's important to understand that there was another separate comparator trial that was done. The comparator study had pediatric patients with malignant or non-malignant blood disorders that underwent a matched unrelated donor ((MUD)) HLA 10/10 transplant during the same time as the other study. The unrelated matched donor 10/10 means that there are aspects such as ethnicity and other measures that closely match the patient in question. The reason for the separation was to determine if the phase 1/2 study that used Rivo-cel could achieve non-inferiority over the use of the other type of transplant typically used. How was the primary endpoint established then in terms of non-inferiority? In essence, there was an endpoint used for each study. In the Rivo-cel phase 1/2 BP-004 study, Event Free Survival ((EFS)) at 180 days was 90.9% for Rivo-cel. This compares to the comparator study where EFS at 180 days ended up being 89.9%. As you can see, non-inferiority was established with Rivo-cel. Why is this data important? Bellicum has been able to find an unmet medical need in this space.

That's because Rivo-cel could be used for 20% to 25% of stem cell transplant patients who lack an HLA matched donor. HLA stands for Human leukocyte antigens and they are important proteins found on cells in the body. Your body uses these proteins to determine if HLA found matches your system. In other cases, HLA matched unrelated donors can take several months to find. A patient sometimes can't wait that long, well Rivo-cel can become this new option for patients. In either instance, it is important to have an alternative treatment like Rivo-cel. What makes this program even better is that there are several catalysts coming up. Not all catalysts will come immediately but there are several for investors to look forward to. The first of which is that full detailed data is still on its way. That is, Bellicum expects to show complete data from the phase 1/2 BP-004 study in the coming months at an upcoming medical meeting. The second catalyst, which is likely to occur in 2020, would be the MAA being filed with the EMA so that the biotech could receive European approval for Rivo-cel. This could put approval by late 2020 or early 2021. Lastly, there is another opportunity. Bellicum has made it clear that it wants to find a commercial partner for Europe, should Rivo-cel be approved. This is not guaranteed to happen, but considering the data to date I believe there is a good chance it can find a partner in the coming months.

Rivo-cel is the lead product and since it has met the endpoint in the European Registration study, it is good in that territory. It has also been de-risked. However, what I like about Bellicum is that it has shown positive preliminary data in its phase 1/2 study using BPX-601 to treat patients with pancreatic cancer. Pancreatic cancer is a quite devastating type of cancer. That's because it is typically not found until it has reached the metastatic stage. That's because no symptoms show up until the cancer has already spread to other organs in the body. The pancreas lies behind the lower part of the stomach. It is a very important organ in the human body. That's because it secretes enzymes that aid in digestion and hormones which help to regulate the metabolism of sugars. Most important of all is that once someone is diagnosed with it, they have poor prognosis. In essence, the 5-year survival rate for a person who has pancreatic cancer is 9%. To date, you will see other types of cancers seeing an improvement in survival rates. Unfortunately, for pancreatic cancer the 5-year survival rate has remained this low for many years. The global pancreatic cancer market is expected to reach $13 billion by 2023. This is where Bellicum's GoCAR-T product, known as BPX-601, comes into play. The biotech is exploring this treatment in hopes of improving survival rates for these patients. In order to treat pancreatic cancer, the biotech is incorporates its proprietary iMC activation switch. What is this iMC activation switch and why is it important? Current T-cells have unpredictable efficacy, and that's because they can't be controlled properly. On the other hand, with the iMC activation switch of GoCAR-T BPX-601 the CAR-T cells released are only activated on targeted antigens expressed on the surface of cancer cells and used along with rimiducid. In essence, regular CAR-T technology doesn't have a large therapeutic window. Its effects only last a few days or weeks. On the other hand, GoCAR-T products like BPX-601 offer a more controlled treatment option which is better suited to target and kill tumor cells. The iMC activation switch helps:

- Improve T-cell proliferation (T-cells increasing in numbers rapidly)

- control the micro-tumor environment for T-cells to have a better shot attacking the tumor

- Increase immune activity seen in the patient to help build more T-cell activity

This all sounds good, but its activity has already shown to be good in preliminary data released. The mechanism of action has been proven. As of April 23, 2019, cut off time, there were about 18 patients treated with BPX-601. As you may be aware, CAR-T trials require lymphodepletion prior to treatment with a product. This was broken down into two types of lymphodepletion.

- 13 patients were given BPX-601 following Cy lymphodepletion

- 5 patients were given BPX-601 following Flu/cy lymphodepletion

About 4 patients didn't receive rimiducid and then 14 received a single dose of rimiducid one week after patients were given BPX-601. Of the 13 patient that were available for efficacy, 8 of them or 62% had obtained stable disease. Then about 3 patients had tumor shrinkage ranging from 10% to 24%. I will state that this is early clinical data. However, you have to remember this is metastatic pancreatic cancer. It is not customary to ever see even 1 complete response or partial response. For that matter, it is uncommon to achieve proper disease stabilization. Then, you have to also view it one other way. This is the fact that only 1 dose was used and there was no dose-limiting toxicity. What does this mean? This means that more doses can be used in upcoming cohorts to improve the efficacy observed in the initial preliminary results released. That's exactly what the biotech chose to do. It decided to do repeat dosing of rimiducid in order to reactivate the iMC switch over time. by reincorporating rimiducid with multiple doses it could expand the therapeutic window to increase CAR-T activity. Remember above when I said that CAR-T wasn't able to properly target solid tumors? That's because these therapies lack the long-term window to be effective in solid tumors. By doing weekly repeat doses of rimiducid it could keep reactivating CAR-T cells over and over again to enhance efficacy and create a longer period of a durable response. This could end up helping improve the T-cell activity against tumors and possibly improve the duration of response (T-cells lasting longer and not dying off like other CAR-T technology). This is where a catalyst opportunity comes in. Results from this repeat rimiducid dosing is expected to be released late 2019 or early 2020. That is the timeline for the moment, although in the coming months look for another possible update on this catalyst. The thing about BPX-601 is that it targets solid tumors that express prostate stem cell antigen (PSCA). Why is that a good thing? That's because there are quite a few solid tumors that express PSCA. These are: Prostate cancer, gastric and of course as highlighted above pancreatic cancer. About 60% of pancreatic cancer tumors express PSCA, therefore this offers a large market opportunity. Then Prostate and gastric cancers at the top express PSCA by 90% and 89% respectively.

To keep its programs and technology advancing, Bellicum has introduced other CAR-T products to its pipeline. These are next-generation dual-switch GoCAR-T products. This makes use of the CaspaCIDe to reduce toxicities associated with such treatments and then the iMC activation switch to possibly increase efficacy. The first clinical product is known as BPX-603, which is being used to target solid tumors that express human epidermal growth factor receptor 2 antigen or HER2. This is important because Bellicum holds the potential to achieve a sharp improvement in this particular type of solid tumors. That's because other CAR-T therapies to date have not been able to achieve proper efficacy and also have problems with massive amounts of toxicity. The ability for BPX-603 to use iMC activation switch and CaspaCIDe to achieve a good outcome for these patients should be highly welcomed. An IND for this product is expected any day now in 2019. This will allow the biotech to begin a phase 1 study to treat patients with solid tumors. Besides going after other solid tumors with a dual switch GoCAR-T product, Bellicum looking to go after hematological malignancies (blood cancers). The product being used for such indications is known as BPX-802. This is a potential IND that could be filed either in late 2019 or 2020. This would allow the company to begin a phase 1 study for hematological malignancies.

According to the 10-Q SEC Filing, Bellicum Pharmaceuticals had cash, restricted cash and investments totaling $60.6 million as of June 30, 2019. It believes that this cash would only be enough to fund its operations until the end of 2019. Being that this would not be enough cash it had to find a way to obtain more. It chose to enact an offering to raise enough cash to fund its pipeline. It was able to get a public offering completed, along with a private placement with certain institutional investors. It closed a $57.5 million public offering of preferred stock and warrants, along with a receipt of $12.1 million option fee related to a private placement of up to $70 million of preferred stock and warrants. The thing is that the CEO could have only raised a small amount to last for only 1 more year, but chose to go bigger. I believe going bigger was a smarter move. That's because it now has enough cash to properly negotiate a better deal for a potential commercial partner of rivo-cel. Also, it has enough cash now to last through many milestones which could possibly boost the stock price. I believe the most confident piece of news is that Baker Brothers bought a lot of shares of Bellicum. Specifically, they bought a 5.8% stake in the biotech. They also did buy awhile back a long time ago at a higher price. However, as I highlighted above since then lots of progress has been done in terms of Rivo-cel meeting the primary endpoint and BPX-601 showing good preliminary data in pancreatic cancer with single dosing.

Bellicum is a highly undervalued biotech. Especially, when you consider that it has two types of technology that can be utilized to potentially alter how CAR-T therapies are produced. The current limitations with CAR-T is that they can only be focused on targeting blood cancers because they are not as effective in treating solid tumors. By using rimiducid and CaspaCIDe, The biotech can improve the efficacy and safety of CAR-T treatments respectively. Having said that there are still some risks to keep in mind. The first risk is that while rivo-cel has been able to achieve the primary endpoint in pediatric blood disorder patients, there is no guarantee it will secure European approval. But based on the clinical data and non-inferiority I believe it has a good shot at receiving regulatory approval. The other risk is the upcoming clinical data for BPX-601 in pancreatic cancer. The expectation is that repeat dosing of rimiducid should improve clinical outcomes for these pancreatic cancer patients. However, there is no guarantee that repeat dosing of rimiducid would achieve better stable disease. On the flip side, if repeat dosing of rimiducid improves durable response for an extended period it would be a major finding in CAR-T therapies against solid tumors. The final risk to be aware of is that the biotech trades with a low market cap of $53 million, which means it is susceptible to massive price swings in either direction. In addition, the liquidity remains low as the average trading volume is 805,000. Still, I believe that it is highly undervalued based on a couple of key items. The first is that rivo-cel in the European pediatric market could possibly produce sales between $500 million to $700 million. This is important because rivo-cel has already achieved its primary endpoint in the European registrational study. In addition, there is the THRIVE phase 2/3 study that is exploring the very same indication in an adult & adolescent population. There is an opportunity to expand the label for this indication and go after another $3 to $4 billion market. This is why I believe Bellicum is highly undervalued to where it is trading at now. This is not even including the GoCAR-T programs which are in place. I believe that Bellicum, flush with a good amount of cash after its recent rise, is a solid buy.

Disclosure: I am/we are long Bellicum Pharmaceuticals

Based on history, any catalyst will lead to new lows. $BLCM

That's because before the recent influx of cash investors were worried about dilution or cash raise. They knew that cash was low and they were going to need more cash. So any catalyst of course would have cause new lows. However, now with Baker Brothers and financing completed they have cash slightly past 2021. They are good on cash now. I don't believe any positive catalyst will have a negative reaction. Also, it depends. If Bellicum finds a partner for instance for Europe on rivo-cel with upfront cash and milestone payments it will trade higher. But thanks for your opinion.

How likely is finidng a partner for $BLCM?

That's hard to say because it depends on negotiations. But Rivo-cel in Europe in pediatric setting can garner $500 million to $700 million in revenue. On top of the phase 2/3 THRIVE study which is ongoing right now, once data for that is revealed if it is successful with primary endpoint that adult population would add the potential for $3 to $4 billion in revenue. So on that basis I would say a very good chance. Having said that it's hard to say when it will come. Because big deals take about 3 to 6 months to negotiate. So without knowing when they started talks it's hard to say exactly.

Thanks for answering, Terry.

Good answer, Terry.