Beat The Market With These 5 “Stock Cannibals”

In 2016, renowned value investor Monish Pabrai developed a simple concept called “Uber Cannibals.” He suggested that buying a five-stock portfolio of companies that were buying back large amounts of their own stock, that were cheap based on undefined valuation multiples, and that fit his definition of quality, would outperform the market.

I have discussed many times the fact that I love buybacks almost as much as I love dividends, so the buyback argument that rages about whether they are good or bad has always amused me. It’s easy:

- Buybacks at reasonable valuations, with cash flow generated by the business, are good.

- Buybacks at excessively high valuations, or with borrowed money, are usually bad.

- Buying back shares of an outstanding business is a fantastic strategy.

- Buying back shares of a bad business is probably not a great idea. I used the idea of owning a small, concentrated portfolio of cannibal stocks (companies that buy back their own shares) and added my own features. And the results were outstanding.

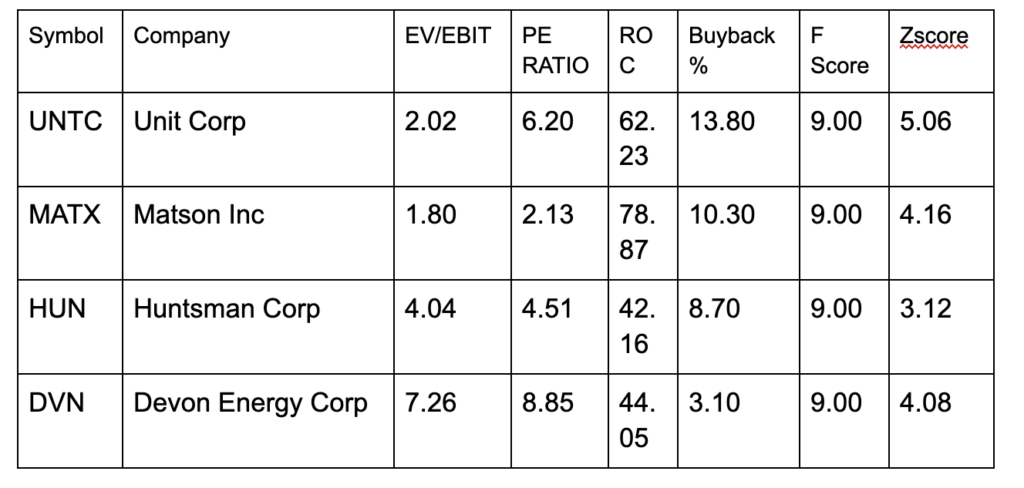

I limit the universe to companies earning high returns on capital, boasting excellent fundamentals, and with little chance of facing significant financial risk in the next few years.

I measure fundamental quality using the Piotroski F-Score. Since Joseph Piotroski developed the nine-point model—which measures profitability, liquidity, and efficiency—in 2002, I have found it to be an excellent tool for finding outstanding companies.

To identify companies with no chance of significant financial risk, I have always used the Altman Z-score. The formula has been adjusted a few times, but I have always found it to be one of the best ways to find companies with fortress-quality financials.

I then back-tested 5- and 10-stock portfolios against the broader market. A quick and dirty test shows that this portfolio beat the market handily since January 2016. I selected the top 5 and then the top 10 companies with the highest Z-scores.

The 5-stock portfolio had a total return of 148.44%, compared to just 94.72% to the S&P 500. The 10-stock portfolio also outperformed the index with a total return of 135.38%. That’s a pretty solid excess return over the S&P 500 during a period with returns above the historical averages.

When I run the screens today, I find that energy is the dominant theme. I am not surprised; thanks to decades of poorly thought-out energy policies, we have a fundamental supply-demand imbalance in fossil fuels.

We all want to get to 100% renewable energy and widespread electric vehicle usage. It would be foolish not to want that outcome. However, it is going to be a lot more complicated, be a lot more expensive, and take a lot longer to achieve than politicians and activists may have you believe.

Quite correctly, energy companies have decided not to accelerate production as prices have risen. This has pushed their returns on capital higher and generated enormous stacks of cash. They are using that cash to pay dividends to shareholders and buy back enormous amounts of stock.

The energy companies in the top 5 include Unit Corporation (UNTC)—an Oklahoma-based company that engages in the exploration and production of oil and natural gas and which also owns energy infrastructure, including pipelines—and Devon Energy (DVN), another oil and gas exploration and production company.

CI Industries (CF), the third company in the top 5, manufactures and sells hydrogen and nitrogen products for energy, fertilizer, emissions reduction, and other industrial activities. There is a growing fertilizer shortage around the world, which has helped CF Industries grow its earnings and improve its financial condition dramatically.

Huntsman Corporation (HUN) is in the chemicals business. It would probably be easier to determine which industries do not buy chemicals from Huntsman, as it makes a wide range of products with an incredibly diverse list of potential uses.

Rounding out the top 5 is Matson (MATX), a marine shipping company that serves Hawaii, Alaska, Guam, and other island economies in Micronesia. Other routes cover China to Long Beach, California, various islands in the South Pacific, as well as Okinawa, Japan.

Although we did not use any valuation parameters in our high-quality cannibal screen, all five companies trade with single-digit price-to-earnings ratios. And four of the five pay cash dividends in addition to buying back shares. The highest-yielding stock is Devon Energy, with a yield of 6.82%.

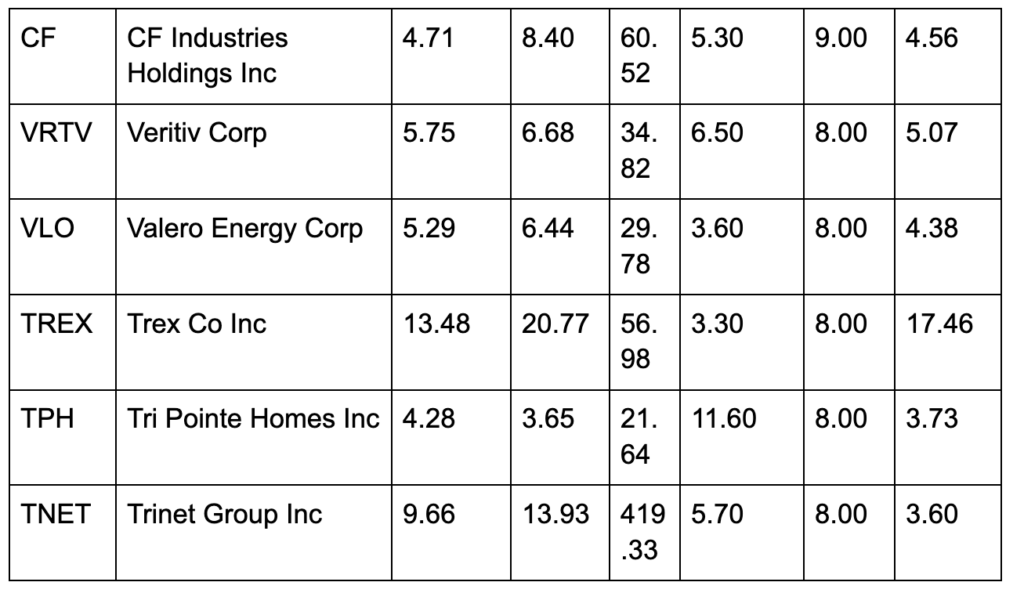

When we expanded to the 10-stock portfolio, we added more energy, as well as a packaging company, a staffing company, a building products company, and a home builder. The building-related companies should see strong tailwinds due to the acute housing shortage in the United States.

Here are the top 10 high-quality cannibal companies that showed up in my screen on Sept. 8, 2022:

More By This Author:

The Best Stock For The Return Of GeopoliticsHere’s Where To Find Big Dividends From The Coal Boom

These Three Bank Stocks Are Unbelievably Good Deals Right Now

Disclosure: The information contained in this article is neither an offer nor a recommendation to buy or sell any security, options on equities, or cryptocurrency. Investors Alley Corp. and its ...

more