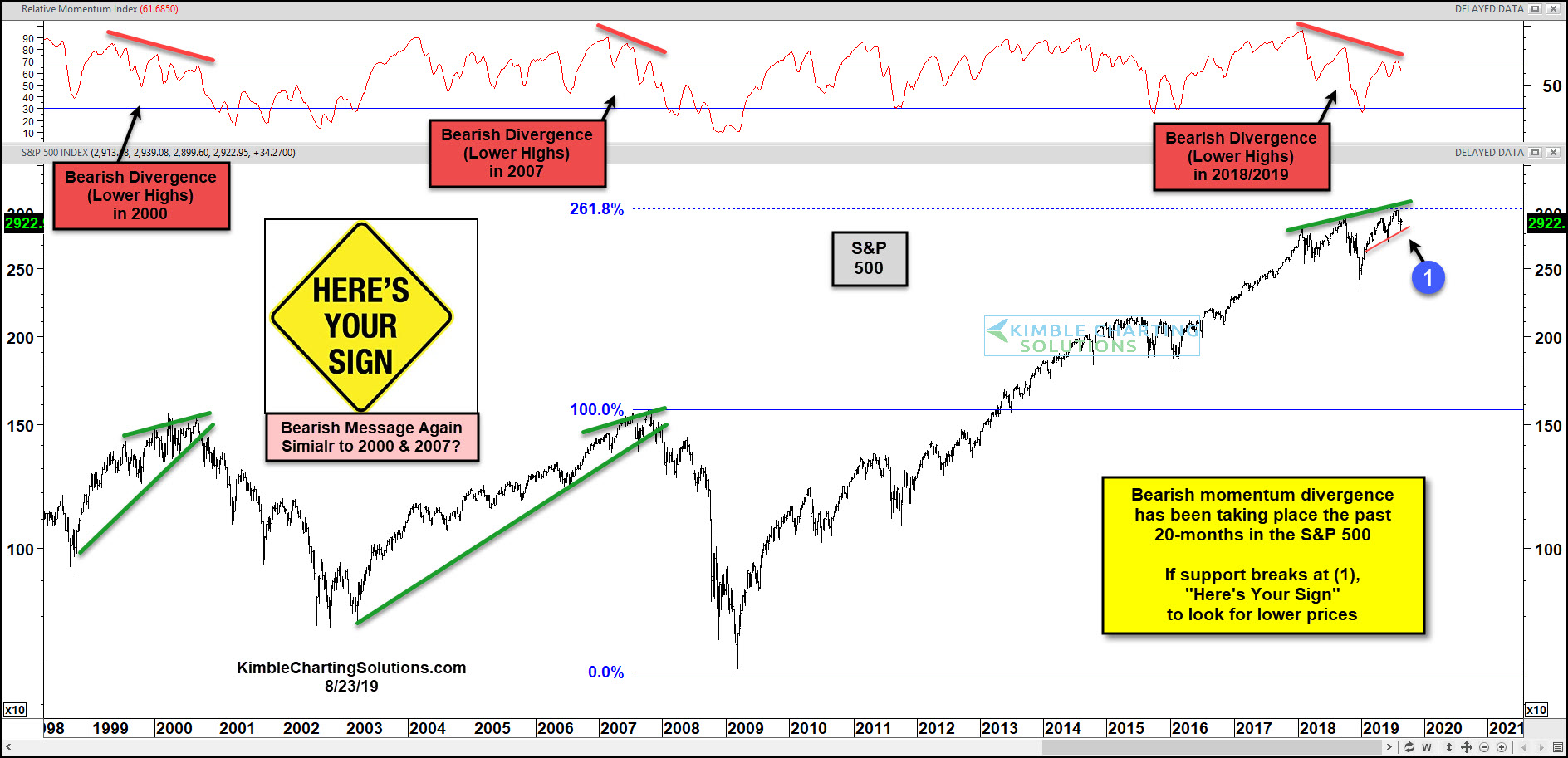

Bearish Divergences Similar To 2000 & 2007 In Play Again

(Click on image to enlarge)

Does history at important junctures ever repeat itself exactly? Nope

Do look-alike patterns take place at important price points? Yup

This chart looks at the S&P 500 over the past 20-years.

In 2000 and 2007 bearish momentum divergences took place months ahead of the actual peak in stocks.

Currently, momentum has created a bearish divergence to the S&P 500 for the past 20-months, as the seems to have stopped on a dime at its 261% Fibonacci extension level of the 2007 highs/2009 lows.

Joe Friday Just The Fact Ma’am; A negative sign for the S&P 500 with the divergence in play, would take place if support breaks at (1).

Disclosure: Sign up for Chris's Kimble Charting Solutions' email alerts--click here.

Even if one doesn't care a blessed penny what the essenpee did 20 years ago, there are enough people that do, and set their little bots to that tune. self-fulfilling herdspeak.

Ouch!