Bear Of The Day: Vulcan Materials

Vulcan Materials (VMC - Free Report) ) currently lands a Zacks Rank #5 (Strong Sell) with its Building Products-Concrete and Aggregates Industry in the bottom 20% of over 250 Zacks industries.

There could be more short-term weaknesses ahead for Vulcan stock as a supplier of construction aggregates and other construction materials such as concrete, asphalt mix, and calcium.

Subpar Q4 Report

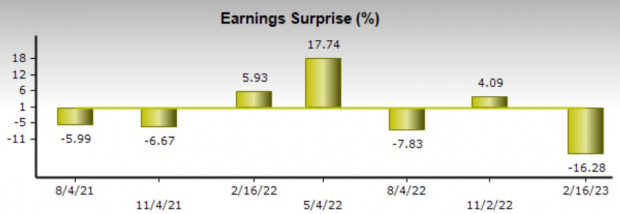

During its most recent fourth-quarter report on February 16, Vulcan stated it was impacted by abnormally wet and cold weather that disrupted construction activity and materials shipment in addition to softening in single-family residential demand.

Image Source: Zacks Investment Research

Disruption in construction activity led to Vulcan missing its Q4 earnings expectations by -16% at $1.08 per share compared to EPS estimates of $1.29. Vulcan also missed top-line estimates by -5%.

Shares of VMC have dropped roughly 9% since its Q4 report and the dip could continue with earnings estimates declining. Fiscal 2023 earnings estimates have now declined 12% over the last 90 days and FY24 EPS estimates have dropped 13%.

Image Source: Zacks Investment Research

Subpar Valuation

The declining earnings estimates have made Vulcan’s P/E valuation less attractive. Trading around $168 per share, Vulcan stock trades at 27.9X forward earnings.

While this is well below its extreme decade-long highs and a slight discount to the median of 31.6X, shares of VMC trade much higher than the industry average of 11.5X and above the S&P 500’s 18.3X.

Furthermore, the company’s EV/EBITDA of 15.9X is noticeably higher than its industry average of 7.6X with many analysts seeing the optimum level at less than 10X.

(Click on image to enlarge)

Image Source: Zacks Investment Research

Bottom Line

With Vulcan’s business industry weakening at the moment, justification for paying a premium for VMC shares is fading. To that point, investors may want to be cautious of Vulcan stock right now as the decline after its Q4 report could continue.

More By This Author:

Lululemon Q4 Earnings: Taking A Look At Key Metrics Versus Estimates3 Large-Cap Growth Mutual Funds Worth Betting On

Walgreens Boots Q2 Earnings Top Estimates, Margins Down

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any specific ...

more