Bear Of The Day: Vera Bradley, Inc. (VRA)

Fashion and style are often fickle, with notable exceptions. Vera Bradley, Inc. (VRA) and its collection of quilted bags and backpacks remain popular overall, with the company projected to pull in roughly $550 million dollars in revenue this year.

Unfortunately, Vera Bradley’s sales have been up and down over the years, and VRA shares have yet to find their footing on Wall Street.

Photo by Sean Benesh on Unsplash

VRA’s Struggles

Vera Bradley is famous for its women’s handbags, luggage, home accessories, and more. The company initially rose to prominence and has since maintained its business through its relatively unique patterns that are often extremely colorful. Vera Bradley’s quilted offerings also stood out and were rather instantly recognizable.

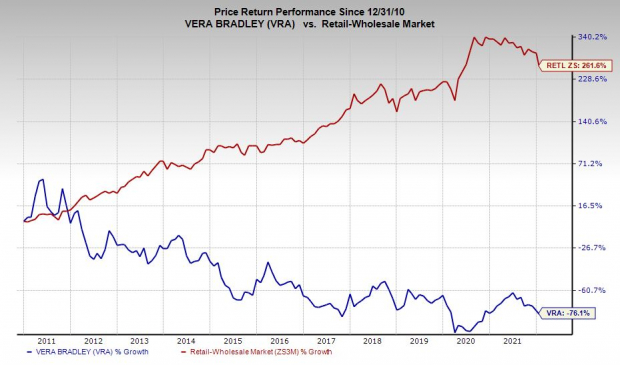

(Click on image to enlarge)

Image Source: Zacks Investment Research

Vera Bradley has expanded its offerings. But it has found it exceedingly difficult to sustain being cool and trendy in the world of fast-fashion and a seemingly endless array of e-commerce brands.

VRA shares surged following the company’s 2010 IPO. Vera Bradley stock has fallen rather steadily since then, and it hasn’t sniffed even its IPO price since 2012. This makes more sense considering that Vera Bradley’s sales dropped on a YoY basis for six years running, until it finally bounced back in its fiscal 2020.

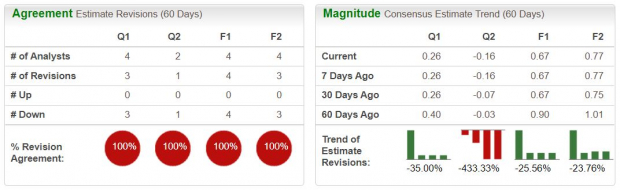

Image Source: Zacks Investment Research

Bottom Line

Zacks estimates call for VRA to post sales growth both this year and next, along with solid adjusted earnings expansion. Despite the positives, Vera Bradley is being negatively impacted by supply chain setbacks and rising costs, as is much of the economy. This has seen its FY22 (current year) and FY23 consensus earnings estimates tumble by 26% and 24%, respectively since its last report.

Vera Bradley’s downward earnings revisions activity helps it grab a Zacks Rank #5 (Strong Sell) at the moment. VRA has also fallen way short of our EPS estimates in three out of the last four quarters.

Vera Bradley could bounce back and some investors might be tempted by its low stock price (under $8 per share). However, it’s likely best to stay away from VRA, especially amid the current market selloff.

Disclaimer: Neither Zacks Investment Research, Inc. nor its Information Providers can guarantee the accuracy, completeness, timeliness, or correct sequencing of any of the Information on the Web ...

more