Bear Of The Day: United States Cellular

United States Cellular (USM - Free Report) is the fourth largest full-service wireless carrier in the US. However, USM is being edged out by its larger rivals, who can out-compete with aggressive pricing for their service plans. Additionally, USM suffers from a high debt burden, downward trending earnings revisions, and stagnant market share in the industry.

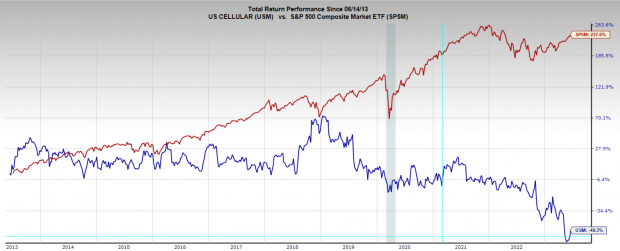

United States Cellular has been a poor-performing stock over the last decade, declining by -50% over that time. Unfortunately for USM, it doesn’t look like things are improving anytime soon, and thus the stock should be avoided by investors for now.

(Click on image to enlarge)

Image Source: Zacks Investment Research

Downgrades

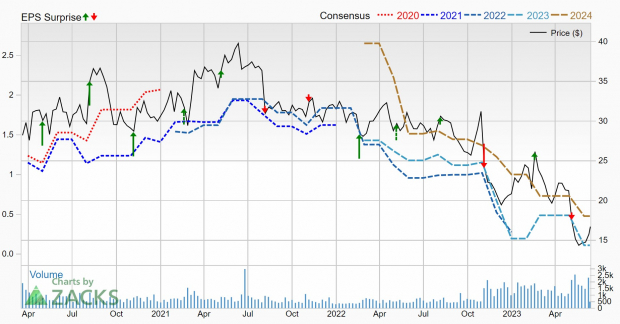

Earnings revisions have been trending consistently lower for the last year, reflected by USM’s Zacks Rank #5 (Strong Sell). Current quarter earnings have been revised lower by -52% and are expected to decline by -50% YoY. FY23 earnings have been downgraded by -78% and are projected to decline by -69% YoY.

Annual sales have been stagnant for the last 15 years, stuck at $4 billion. This isn’t expected to change as current quarter sales are projected to shrink by -2.6%, and FY23 sales are expected to decline by -2.7%.

(Click on image to enlarge)

Image Source: Zacks Investment Research

Valuation

United States Cellular is trading at a one-year forward sales multiple of 0.35x, which is a significant discount to the indsutry average of 1.5x, and below its 10-year median of 0.8x. Yet, there are few if any upside catalyst on the horizon to improve the outlook.

(Click on image to enlarge)

Image Source: Zacks Investment Research

Bottom Line

With declining sales, earnings, and market share, USM is clearly struggling. The cellular network industry is highly competitive, and even the larger incumbents have struggled in recent years.

Even after increasing investment into network advancement in an effort to improve efficiency through cost optimization, market penetration remains around 15%, and sales growth is sputtering. Additionally, with just $154 million in cash and $3.3 billion in debt, the mounting loan obligations are quickly limiting prospects.

Without the involvement of a brilliant activist investor, a major technological breakthrough, or business overhaul, USM is likely to continue to struggle and investors should steer clear of the stock.

More By This Author:

Oracle Q4 Earnings And Revenues Surpass EstimatesIPOs Quietly Lead This Market: 3 Top-Ranked Stocks To Consider

2 Airline Stocks That Could Fly Higher In June

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any specific ...

more